American consumers are doing what they do best: They are consuming goods and services. Their consumption of services has been especially strong. So the demand for workers by several major services industries has been particularly strong. In turn, robust employment gains have boosted consumers’ purchasing power and spending.

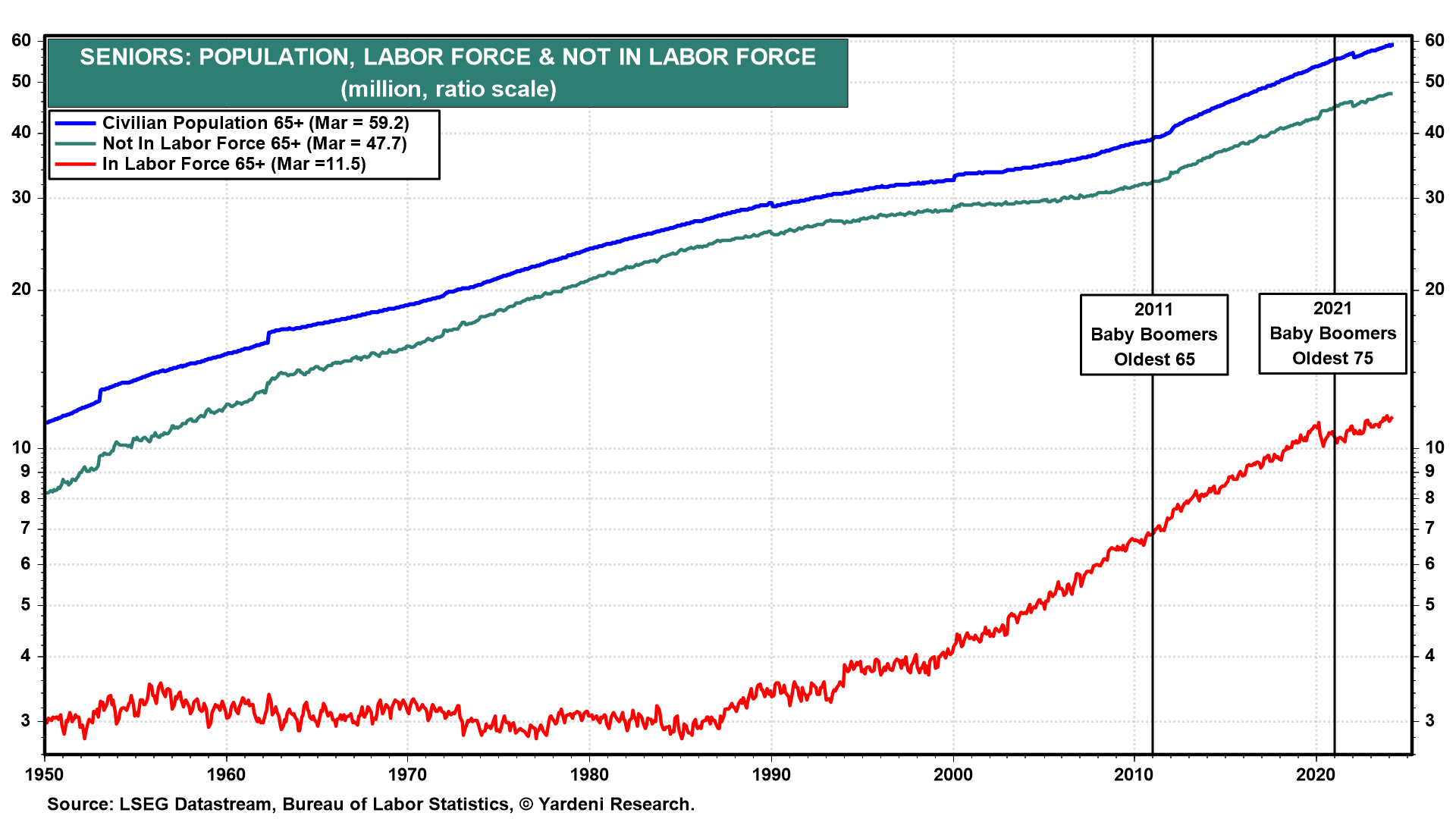

We have attributed some of these developments to the retiring Baby Boomer generation. This cohort is the richest generation of senior citizens in the history of the United States. The oldest of them turned 65 years old during 2011 (chart). Since the start of that year through March of this year, the population and labor force of seniors (65 years old and older) increased 20.0 million and 15.2 million. The number not in the labor force rose 4.8 million over that period to a record 47.7 million.

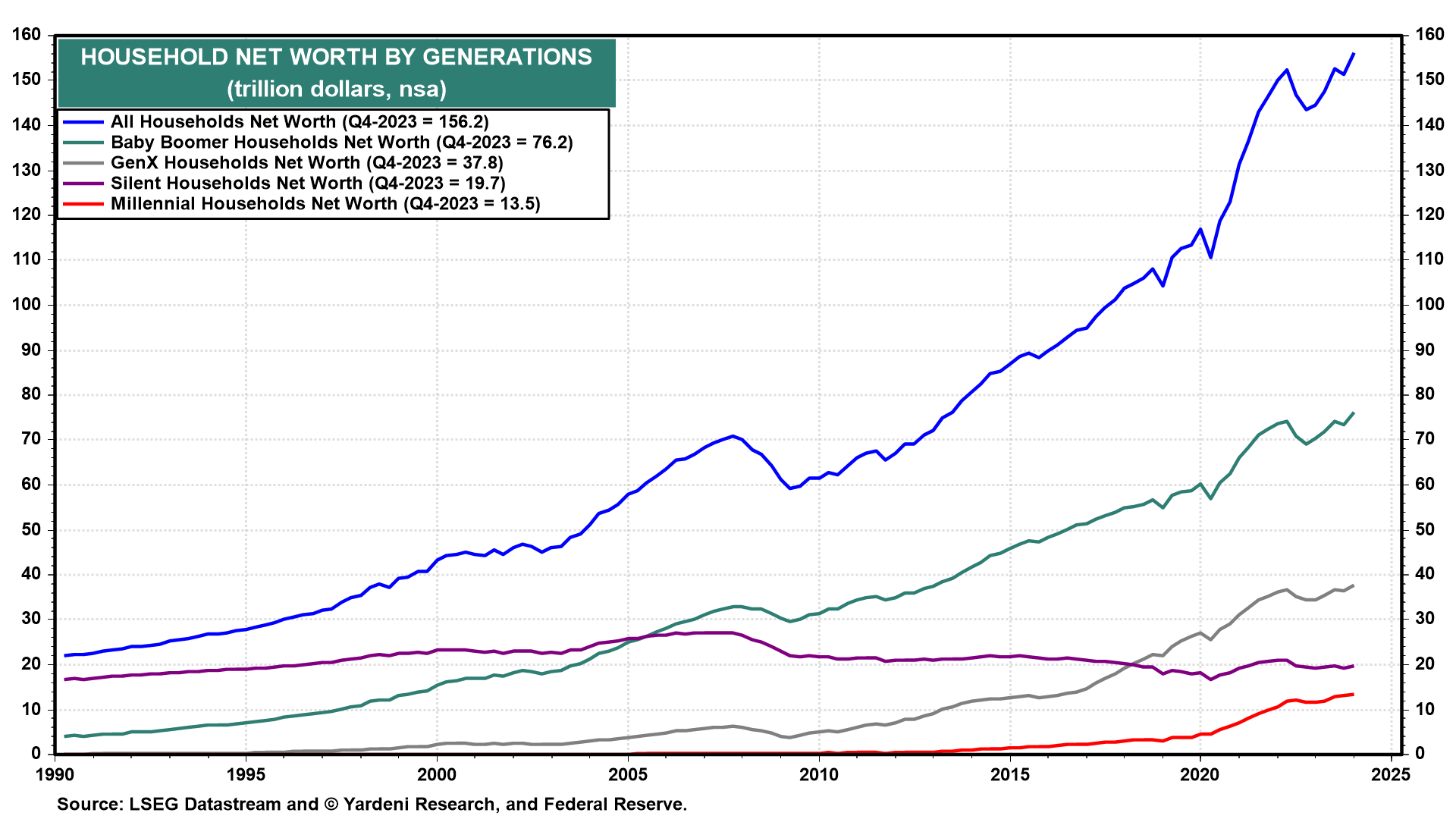

That’s a lot of seniors who are no longer working. Presumably, most of them are retired and are no longer saving but rather spending their retirement savings and/or the income it generates. As we’ve noted previously, total household net worth rose to a record $156.2 trillion at the end of last year, with Baby Boomers holding a record $76.2 trillion (chart).

Thanks to all the retired and retiring seniors, spending on air transportation, hotels & motels, food, and health care services all have been soaring to new or near record highs. That’s because seniors are traveling more, dining out more, and visiting their health care providers more. As a result, payroll employment in all these industries continues to rise to record highs.

This helps to explain the resilience of the economy and why there hasn't been a consumer-led recession over the past two years, as was widely feared.

The Baby Boomers watched a lot of Star Trek during the 1960s. They certainly took to heart Spock’s mantra “Live long and prosper.” He should have finished the thought with “Then retire and spend it all before your expiration date.”