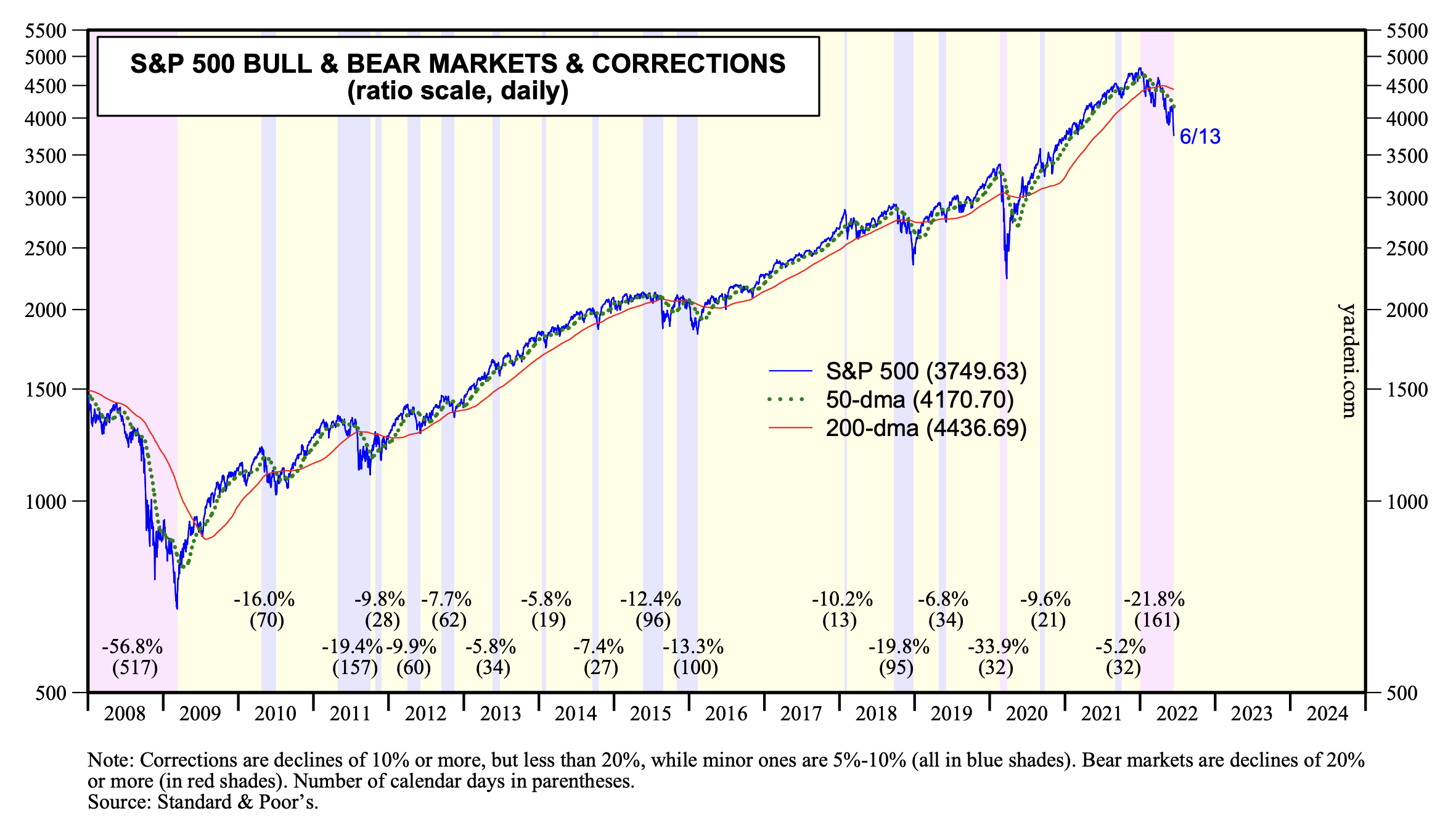

On Monday, the latest S&P 500 correction morphed into a bear market when the index closed down more than 20.0%—specifically 21.8%—below its record-high close on January 3, 2022.

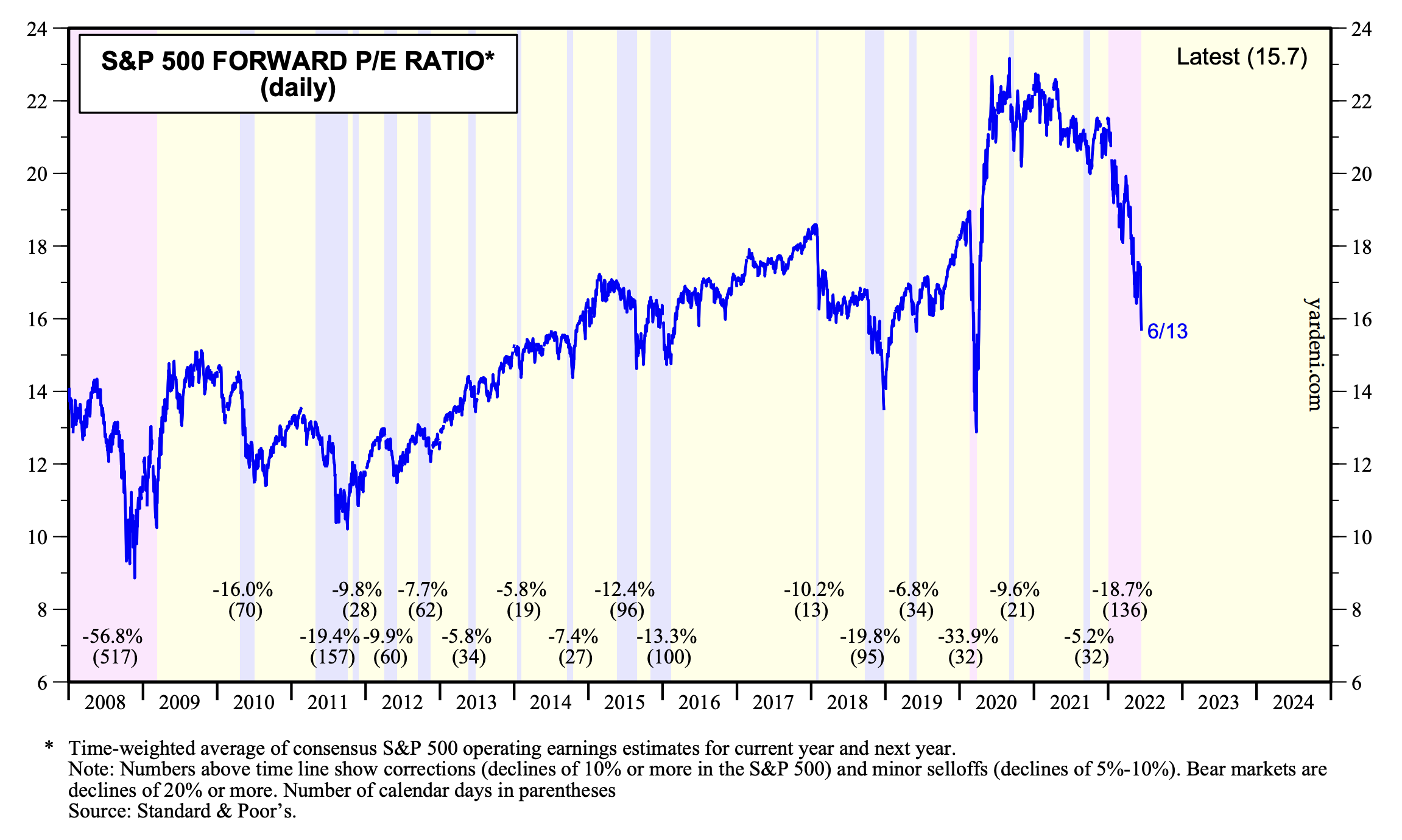

Over this period, the S&P 500 forward P/E plunged 26.6% from 21.4 to 15.7 even as forward earnings (i.e., the time-weighted average of analysts’ earnings estimates for 2022 and 2023) continued rising to new record highs. Investors lost confidence in those projections as they fretted that persistent inflation would force the Fed to raise interest rates to levels that might cause a recession, which would depress earnings. Persistent inflation meant that the Fed Put was kaput, and there is no upside in fighting the Fed when it is fighting inflation.

As a result, here is where the S&P 500 currently stands:

(1) The index is now down 11.9% on a year-over-year basis and is unchanged from its level on January 2, 2021. In effect, investors have given back all their gains made since the start of last year.

(2) The index now is priced at 15.5% below its 200-day moving average.

(3) If the index were to fall to its pre-pandemic high of 3386.15 on February 19, 2020, that would take the S&P 500 down a total of 29.4% from its January 3 record high.

(4) Dropping to the lockdown recession low of 2237.40 on March 23, 2020 would take the index down 53.4% from its record high.

(5) Assuming that the S&P 500’s forward earnings per share remains at $239.28 (as of the June 9 week), here are the imputed price levels of the S&P 500 at various forward P/Es: 2871 (P/E of 12), 3111 (13), 3350 (14), 3589 (15), 3828 (16), 4068 (17), and 4307 (18).