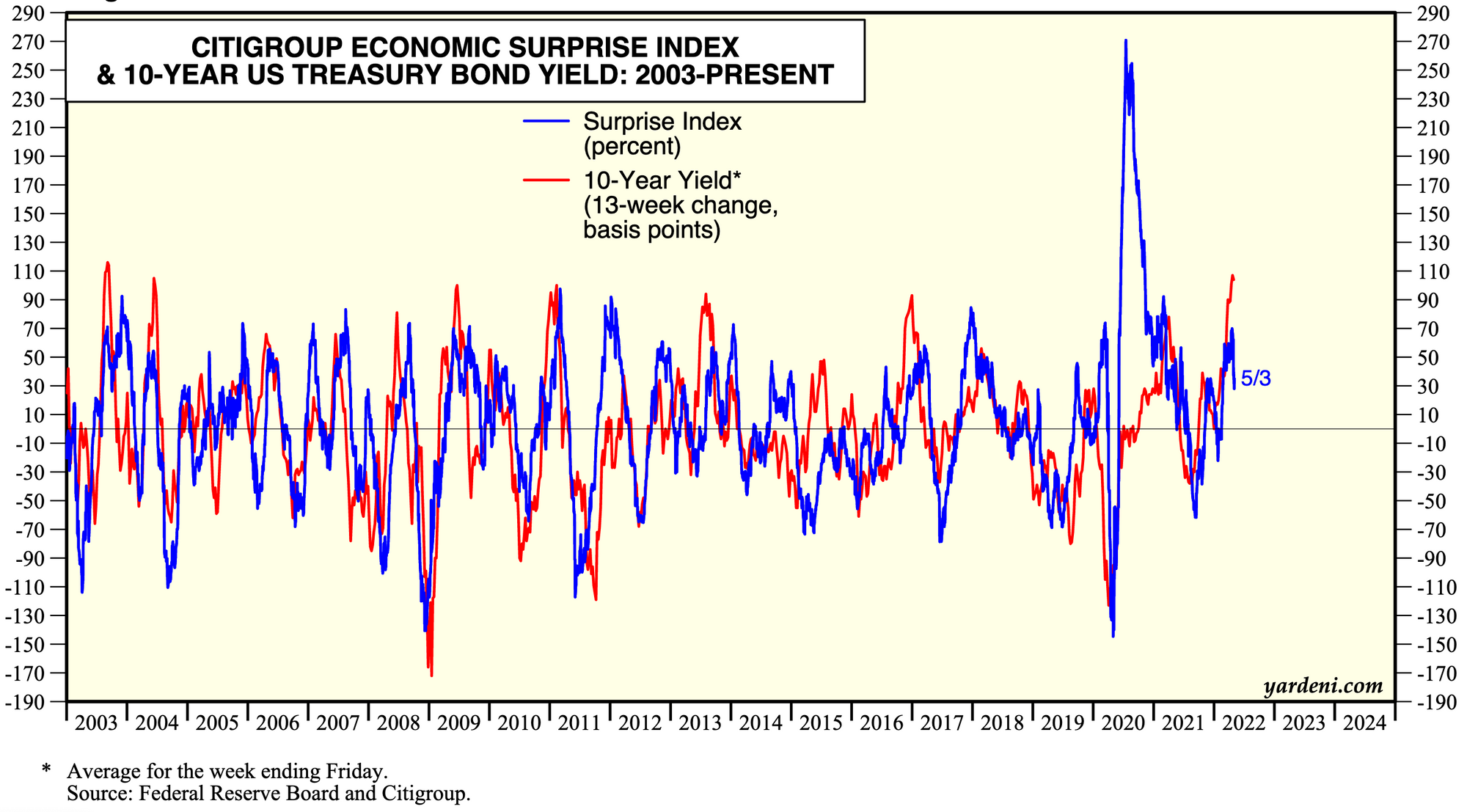

We are keeping an eye on the Citibank Economic Surprise Index (ESI), which is highly correlated with the 13-week change in the 10-year US Treasury bond yield. The ESI measures the degree to which economic data are either beating or missing expectations.

The recent weakness in the ESI suggests that the worst of the bond selloff may be over. Let’s see how the bond market responds to tomorrow’s FOMC statement, which will be followed by Fed Chair Jerome Powell’s press conference. If the yield can remain around 3.00%, it might take some pressure off the stock market, which might have had a significant bullish reversal day on Monday.

The litany of bearishness about stocks and bonds in recent days has triggered our contrary instincts.