In our opinion, price inflation is turning out to be transitory after all. Wage inflation is more persistent, but moderating. Rent inflation is stickier, but also moderating. Today's CPI report for September mostly confirms our assessment.

Fed officials will undoubtedly stress that at 3.7% y/y and 4.1%, the headline and core CPI inflation rates remain too high above their 2.0% inflation target. However, some of them have already acknowledged that the federal funds rate (FFR) at 5.25% may be restrictive enough, especially given the recent jump in the bond yield. So today's CPI doesn't change our view that the current FFR is the terminal rate for the latest monetary policy tightening cycle.

Let's have a closer look at today's CPI report:

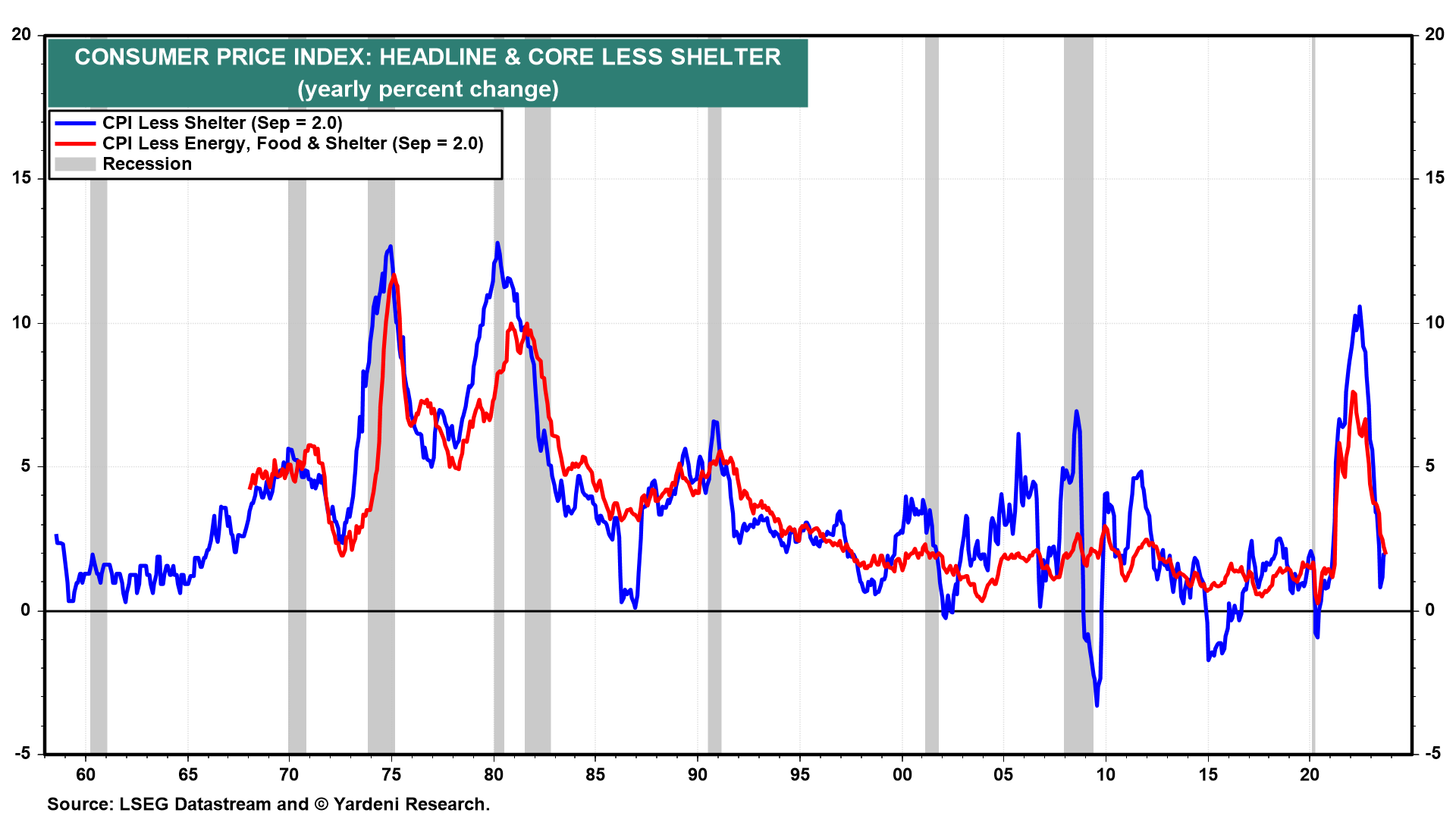

(1) The really good news is that the headline and core CPI inflation rates excluding shelter rose just 2.0% each during September (chart). These two measures of inflation have already scored bullseyes on the Fed's 2.0% target! Price inflation has turned out to be remarkably transitory according to them. That's because pandemic-related supply chain disruptions caused prices to spike higher for a while until the bottlenecks were ameliorated.

Leer la noticia completa

Regístrese ahora para leer la historia completa y acceder a todas las publicaciones de pago.

Suscríbase a