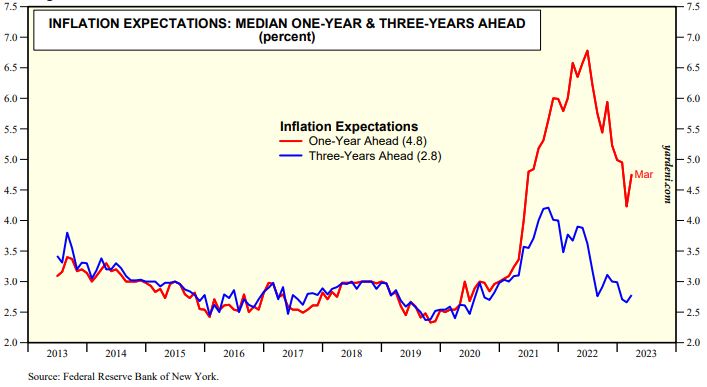

The S&P 500 fell slightly today despite the better-than-expected March CPI data this morning. Inflation continues to moderate. The headline CPI inflation rate fell from 6.0% y/y in February to 5.0% in March. However, the core rate edged up from 5.5% to 5.6%, but slowing rent inflation is likely to cool this rate in coming months. On Monday, the Federal Reserve Bank of NY reported that inflationary expectations edged up slightly in March, but remain well below last years peak (chart).

Today's release of the March 21-22 FOMC minutes showed that the Fed's staff is now forecasting a mild economic downturn soon because of the banking crisis: "Given their assessment of the potential economic effects of the recent banking-sector developments, the staff’s projection at the time of the March meeting included a mild recession starting later this year, with a recovery over the subsequent two years."

Leer la noticia completa

Regístrese ahora para leer la historia completa y acceder a todas las publicaciones de pago.

Suscríbase a