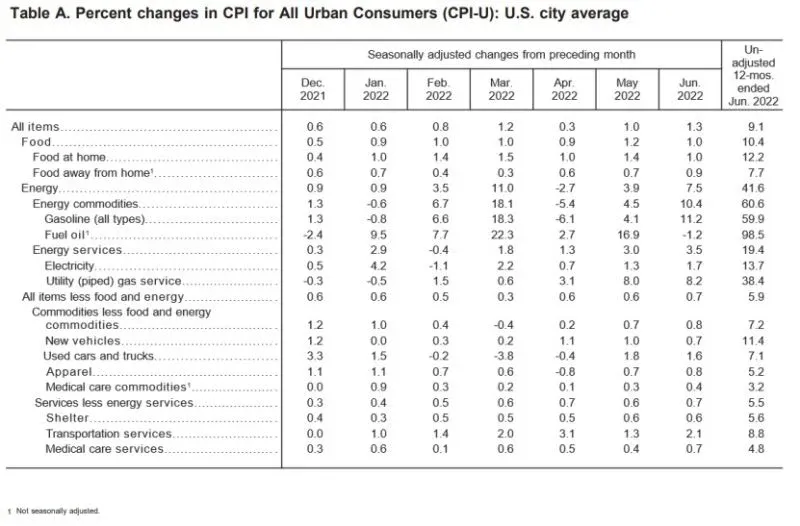

The bottom line on June's headline CPI release is that it was higher than expected and showed few signs of peaking. The 9.1% y/y jump beat expectations of an 8.8% increase and exceeded May's 8.6%, though the core rate edged down from 6.5% in March to 5.9% in June.

Moreover, June's inflation was broader-based than widely anticipated:

(1) The CPI for nondurable goods rose 16.2% y/y. Food rose 10.4%, led by a 12.2% increase in food at home. Energy rose 41.6%, with big jumps in fuel oil (98.5%), gasoline (59.9%), piped gas (38.4%), and electricity (13.7%).

(2) The CPI for durable goods rose 8.4%. That's down from 11.4% during May, continuing to moderate since earlier this year but remaining high. New and used car prices rose 11.4% and 7.1%. Household furnishings and supplies rose 10.2%, with furniture and bedding up 13.1% and major appliances up 7.5%.

(3) The CPI for services rose 6.2%, up from 5.7% in May. Rent of shelter (which has a 32% weight in the CPI) rose 5.6%, up from 5.5% in May. Medical care services rose 4.8%, up from 4.0%. Transportation services increased 8.8%. Among the few price declines during June was airline fares, but it was still up 34.1% y/y.

(4) In July’s CPI, food and energy inflation should moderate given the recent sharp declines in food and energy commodity prices. There should also be more convincing signs that durable goods inflation has peaked. Rent inflation will remain troublesome.