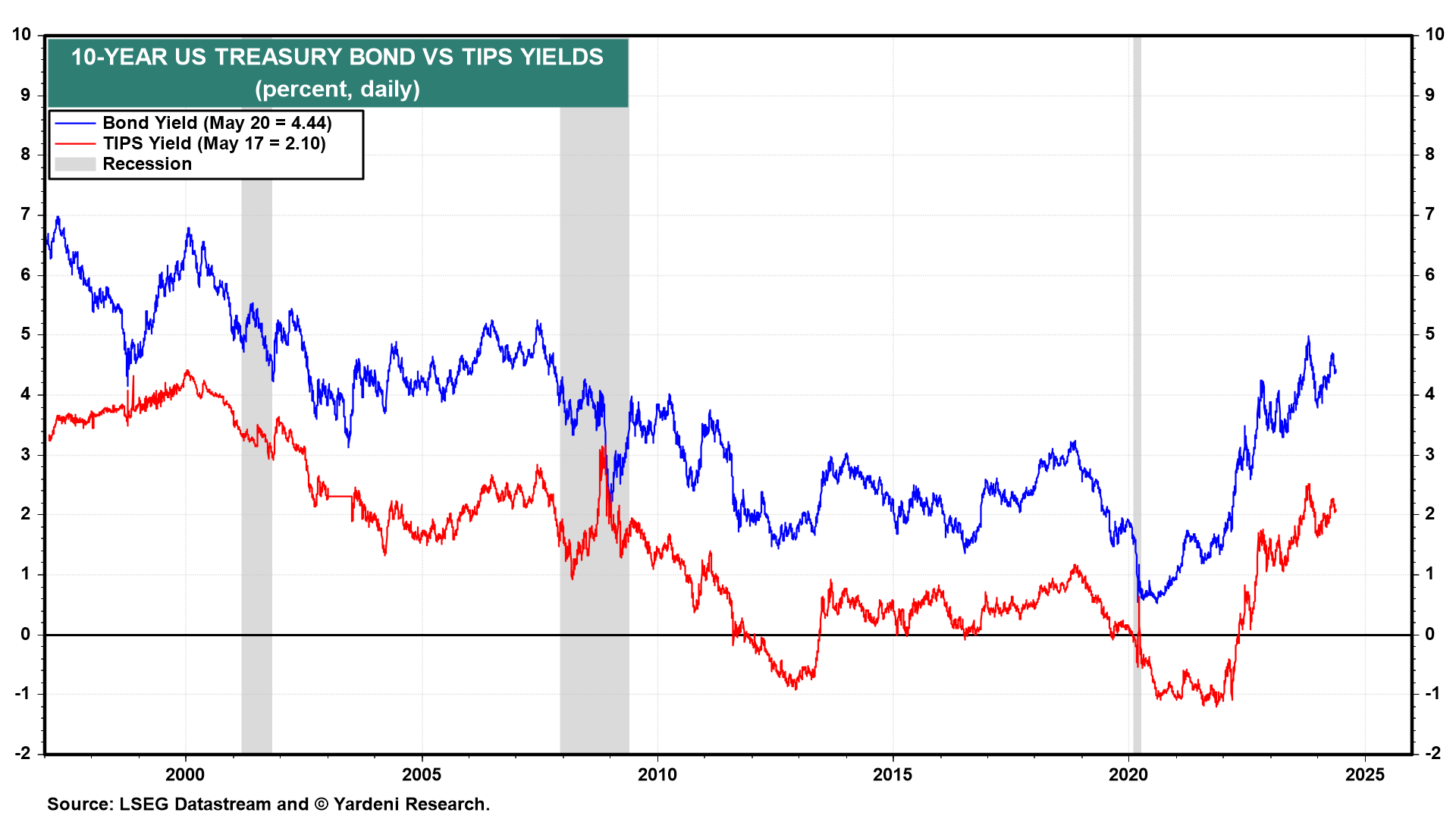

We expect that the 10-year US Treasury bond yield will remain rangebound between 4.00% and 5.00% for the foreseeable future. We expect to see it more often below 4.50% (the mid-point of the range) than above it. This is consistent with our view that interest rates have normalized: They are back to where they were prior to the "Great Abnormal" period from the Great Financial Crisis (GFC) through the Great Virus Crisis (chart).

The 10-year nominal bond yield is equal to the 10-year TIPS yield plus the spread between the two yields, which is a widely used market-based proxy for expected inflation over the next 10 years. We expect that the TIPS yield will continue to hover around 2.00%-2.50% for a while as it did before the GFC.

We expect that the inflation proxy will continue to hover between 2.00% and 2.50% (chart). We observe that this variable is highly correlated with the price of a barrel of Brent crude oil. Barring a geopolitical crisis causing oil prices to soar, there seems to be ample supply of oil to meet global demand for now.

Leer la noticia completa

Regístrese ahora para leer la historia completa y acceder a todas las publicaciones de pago.

Suscríbase a