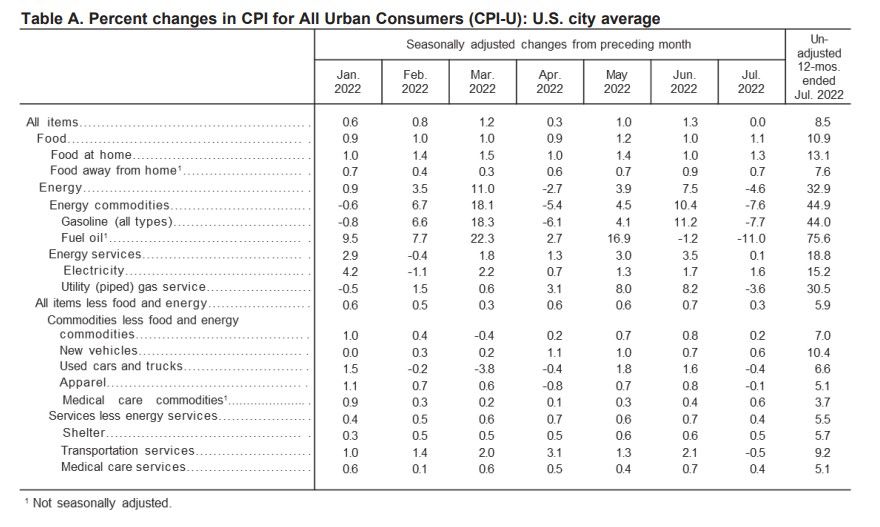

July's headline and core CPI inflation rates were lower than expected at 0.0% and 0.3% (table below). The y/y rates were down to 8.5% and 5.9% below recent peaks of 9.1% (in June) and 6.5% in March). That's consistent with our view that inflation is peaking, but remains too high. So we expect that the Fed will hike the federal funds rate again by 75bps in September and pause for the rest of this year.

Nevertheless, it was good news for stock and bond investors. The purchasing power of consumers during July certainly got a boost from the flat CPI.

Contributing most to the decline in the inflation rate was the energy index, which fell 4.6% over the month as the indexes for gasoline (-7.7%) and natural gas (-3.6) declined, while the index for electricity (1.6) increased. (This morning crude oil prices continue to fall on expectations of a US-Iran nuclear deal.)

The bad news is that the food index continued to rise, increasing 1.1% over the month as the food at home index rose 1.3%.

The indexes for shelter, medical care, motor vehicle insurance, household furnishings and operations, new vehicles, and recreation were among those that increased over the month. There were some indexes that declined in July, including those for airline fares, used cars and trucks, communication, and apparel.