The industry analysts who cover the S&P 500 companies are starting to lower their earnings estimates for 2022 and 2023. Consider the following:

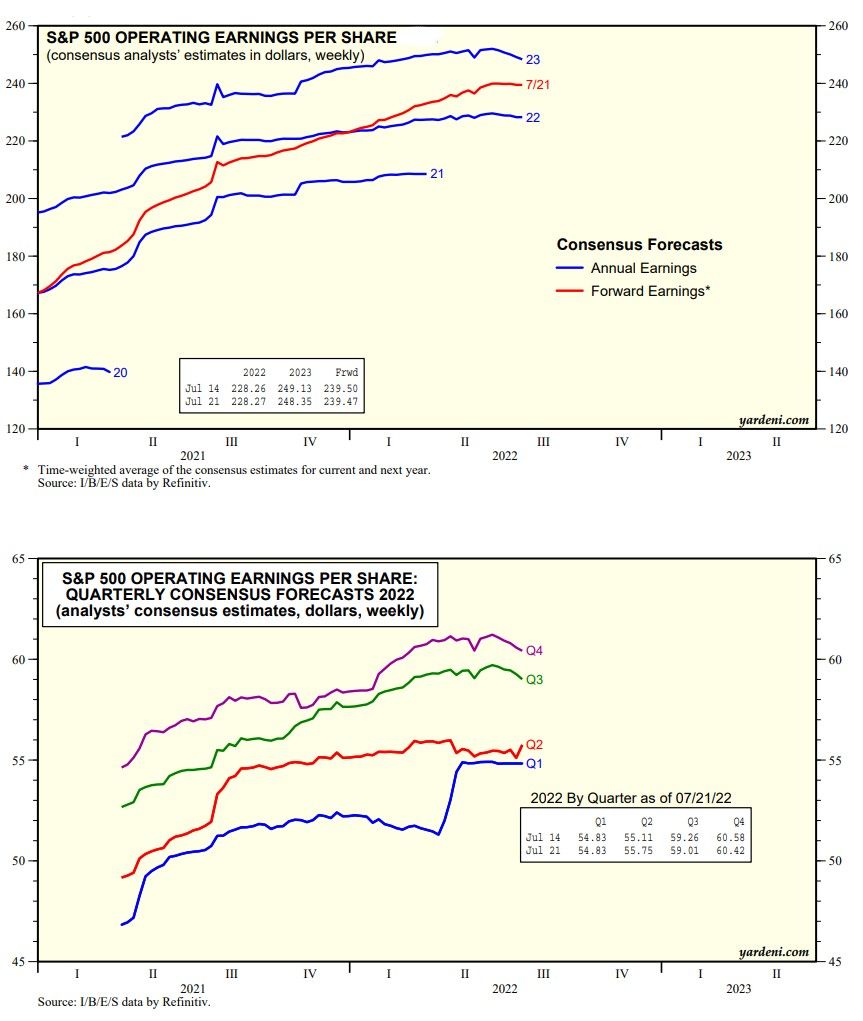

(1) They haven't cut their estimates by much, so far, but enough to flatten S&P 500 forward earnings after it rose to a record high four weeks ago. (Forward earnings is the time-weighted average of analysts' consensus earnings estimates for the current year and the coming year.)

(2) Forward earnings should remain flat around $240 per share through the end of this year as it converges toward 2023's estimate, which we expect will fall from $248 currently to $240 by the end of this year. In this soft-landing scenario, the S&P 500 would move mostly sideways over the rest of this year, assuming that the forward P/E bottomed at 15.3 on June 16.

(3) Of course, in a hard-landing scenario, the bear market would resume, knocking the S&P 500 below its June 16 low as both forward earnings and the forward P/E head lower.

(4) So far, the Q2 earnings reporting season has been mostly as expected by the analysts, though they are shaving their Q3 and Q4 estimates.