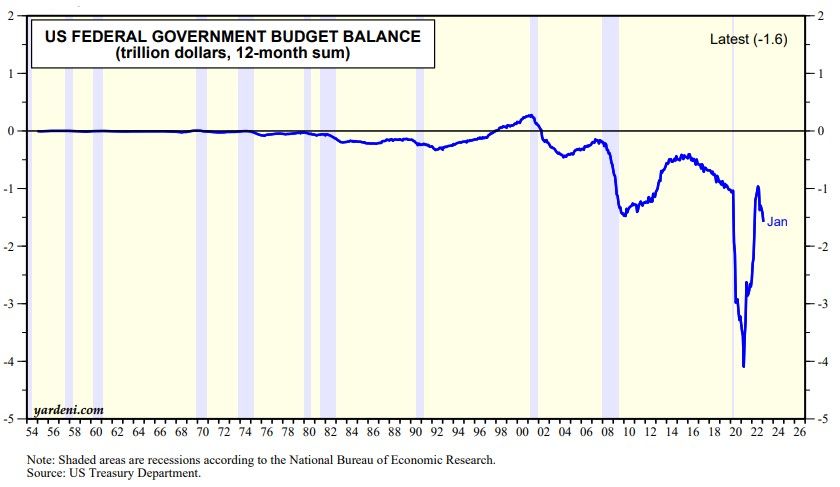

Over the past 12 months through January, the federal budget deficit totaled "only" $1.6 trillion. That's down from over $4.0 trillion during the pandemic, but it has been widening again in recent months (chart).

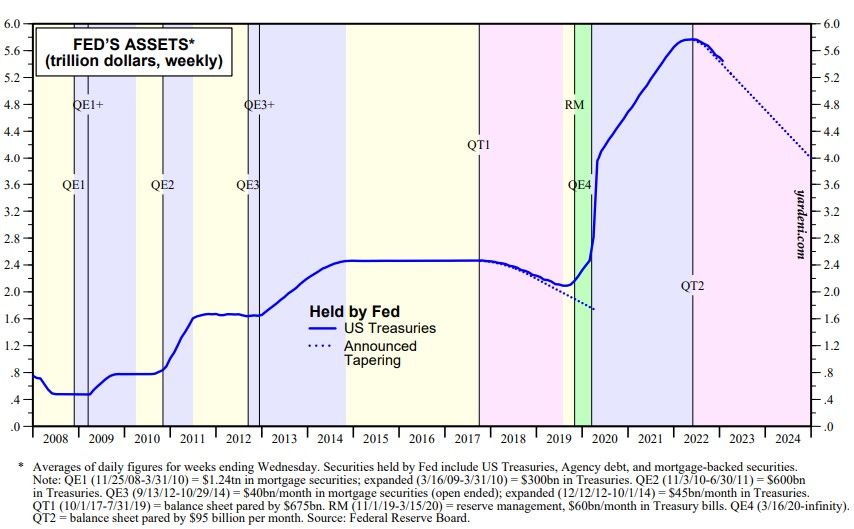

The bond market rarely reacts to the Treasury's monthly deficit release. That's remarkable considering that the Fed stopped buying and rolling over maturing Treasury securities last summer (chart). The Treasury bond market seems to be driven more by inflation and how the Fed is likely to respond to it than by supply and demand.

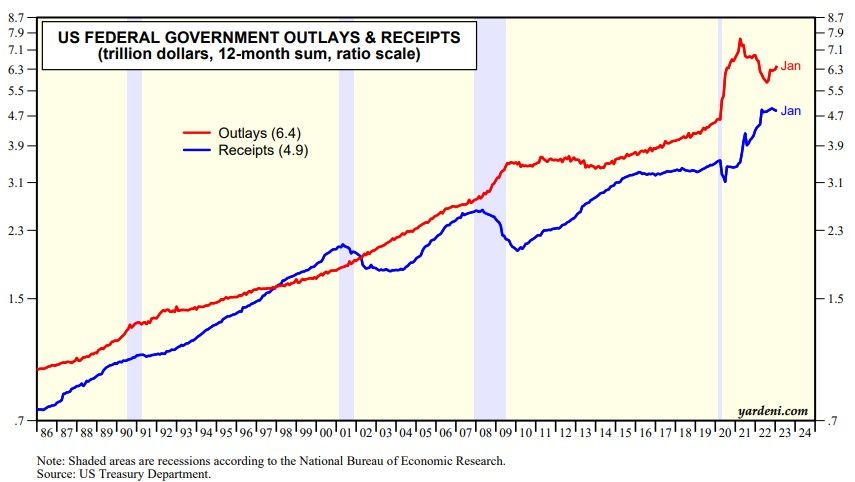

Government outlays have been rising again, totaling $6.4 trillion over the past 12 months. Receipts have stalled around $4.9 trillion over the past year (chart). That's consistent with a soft landing rather than a hard landing (so far).

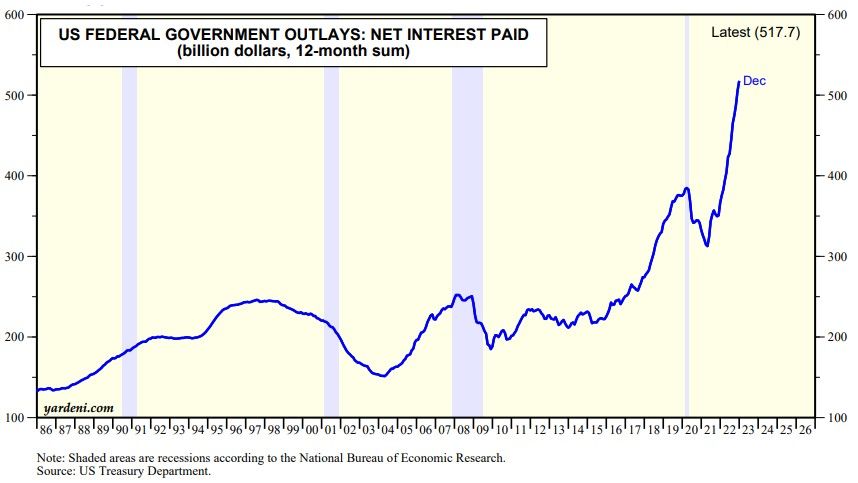

Net interest paid by the federal government rose to a record $517.7 billion over the past 12 months (chart). That equates to about a 2.1% average interest rate on $24.6 trillion of publicly held debt. Net interest paid is going higher reflecting more debt and higher interest rates.

What about the political battle over the debt ceiling? It is likely to be resolved just in time to avoid a default. In a default scenario, stock and bond prices would tank for a few days forcing the politicians to do a deal.