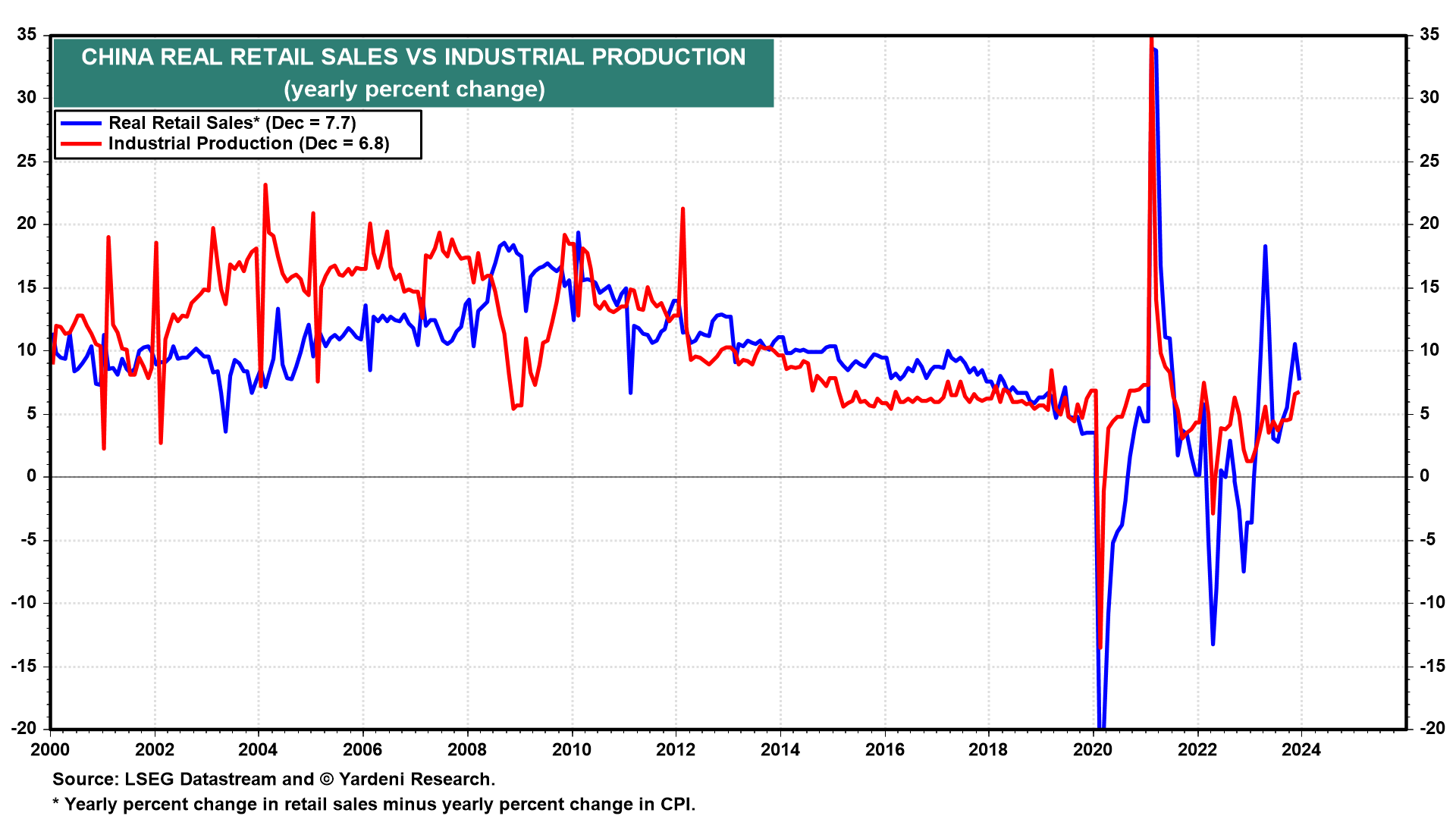

China might be in a recession or going into one. That’s a controversial statement since real GDP rose 5.2% y/y during Q4-2023, according to the official data from the National Bureau of Statistics of China (NBS). The NBS also reported that industrial production rose 6.8% y/y in December and that inflation-adjusted retail sales increased 7.7% last month (chart). Those are not recession readings.

China’s recession is hiding in plain sight. It is the result of a major negative wealth effect on consumers caused by plunging real estate and stock prices. It’s hard to get accurate data on the former because the property market has turned very illiquid over the past couple of years as property developers have faced severe liquidity and solvency challenges. In an illiquid market, one can only guess the correct value of an asset.

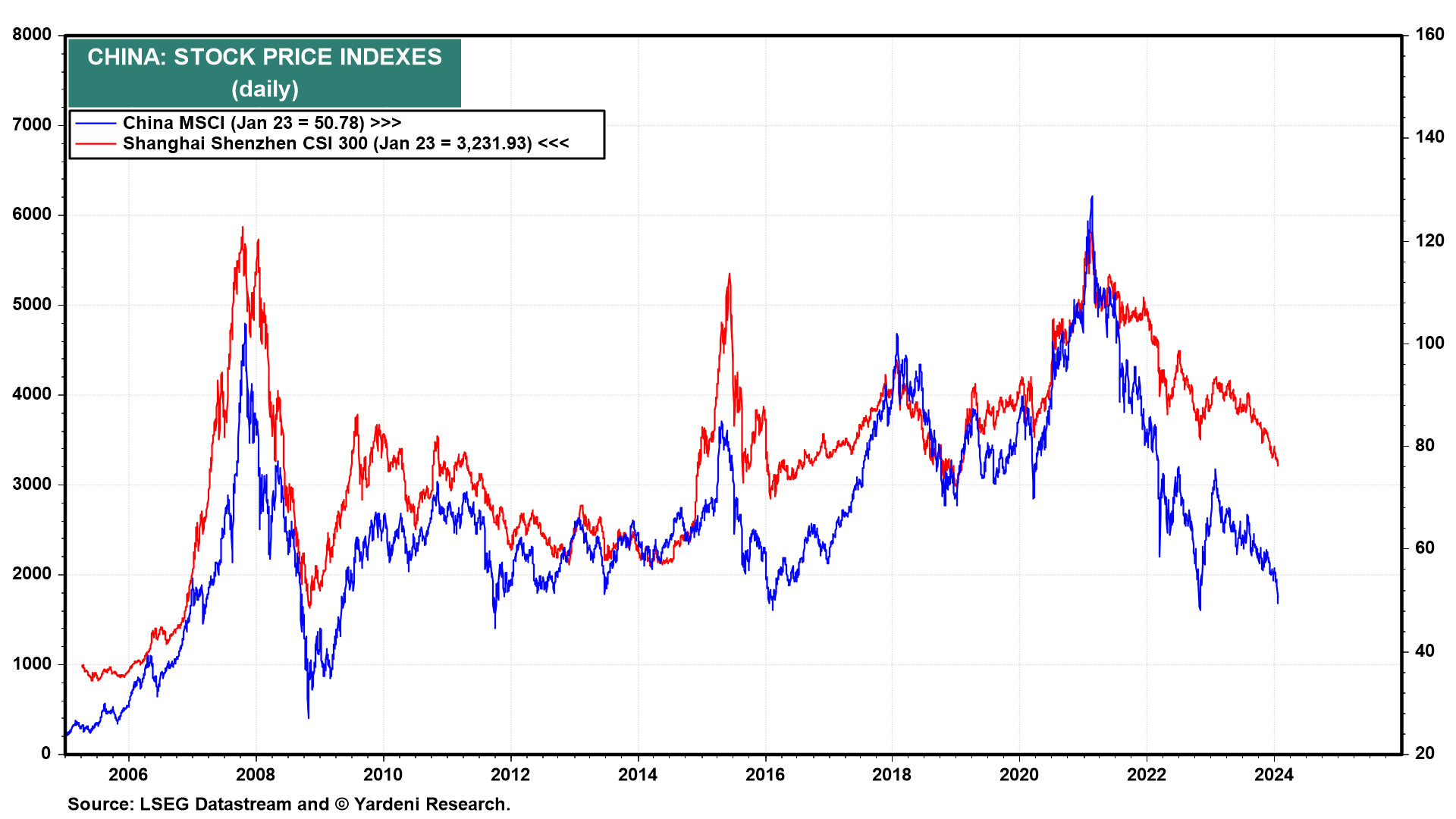

On the other hand, stock prices are publicly available. We can clearly see a bear market that is usually associated with the bursting of speculative bubbles and recessions. For starters, the Shenzhen Real Estate stock price index is down a whopping 58% since July 9, 2020 (chart).

The China MSCI stock price index has plunged 62% since February 17, 2021 (chart).

How bad is it? More than $6 trillion has been wiped out from the market value of Chinese and Hong Kong stocks since the 2021 peak, a January 23 Bloomberg article reports. Furthermore: “Policymakers are seeking to mobilize about 2 trillion yuan ($278 billion), mainly from the offshore accounts of Chinese state-owned enterprises, as part of a stabilization fund to buy shares onshore through the Hong Kong exchange link, said the people, asking not to be identified discussing a private matter.”

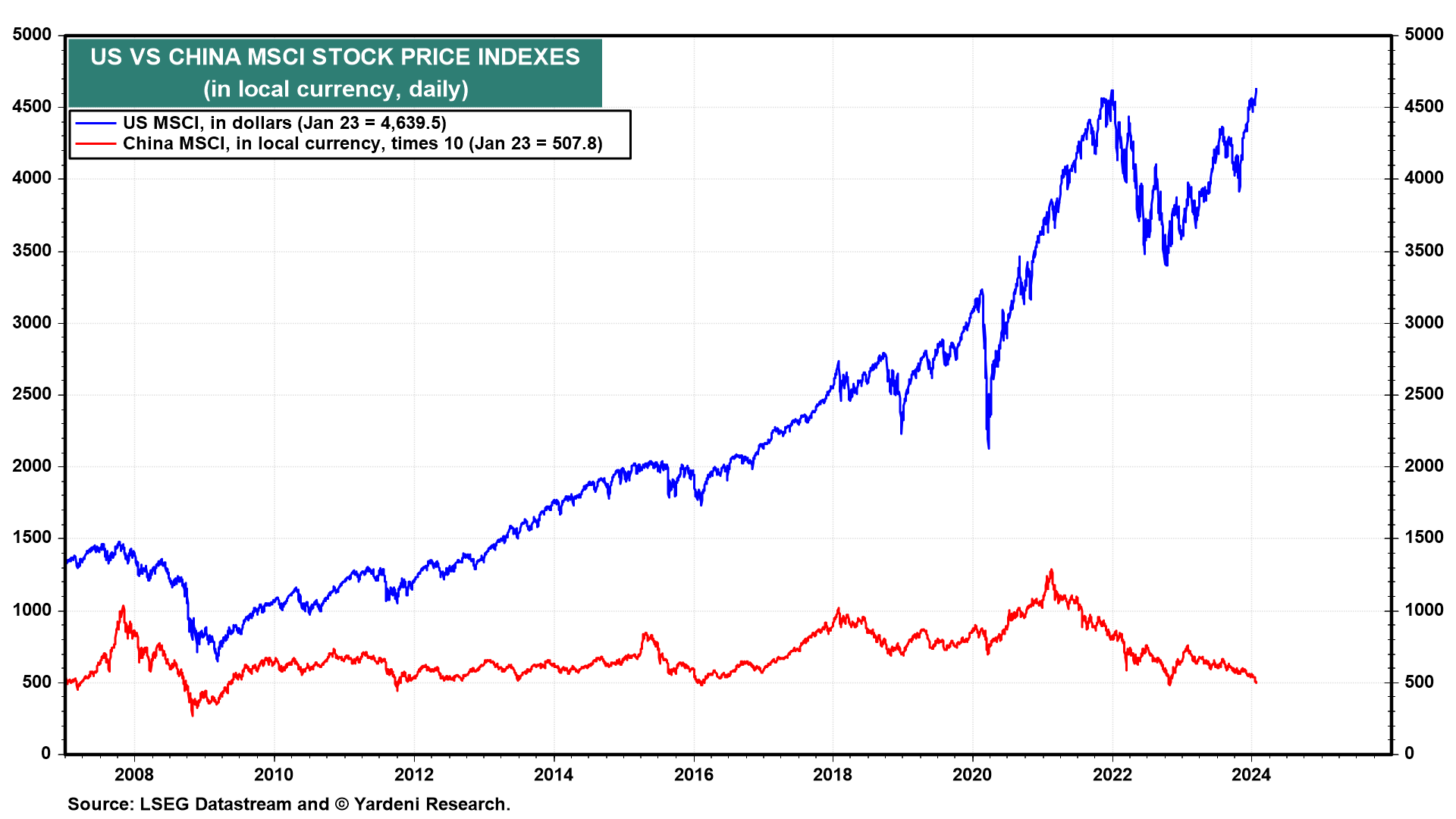

By the way, since the Great Financial Crisis in 2008, the China MSCI stock price index has been essentially flat, while the US MSCI stock price index has more than quadrupled (chart).

You'll find these automatically updating charts in the Global Economy section of Our Charts.