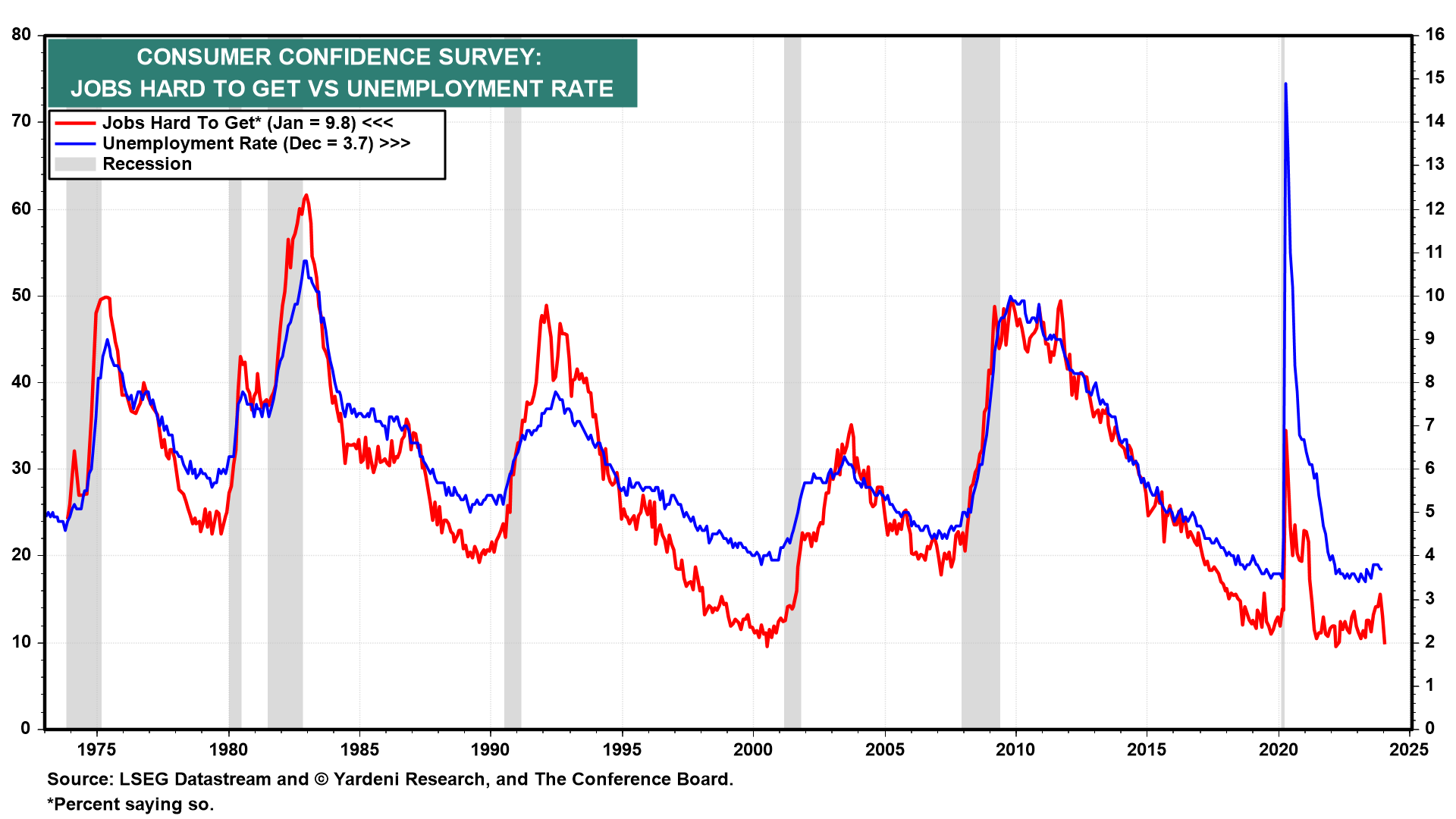

The job market remains strong. That was the message from a couple of labor market indicators today. The most timely was January's consumer confidence survey. The series for "jobs hard to get" dropped to 9.8% of respondents, almost a record-low reading (chart). This suggests that the unemployment rate remained below 4.0% this month.

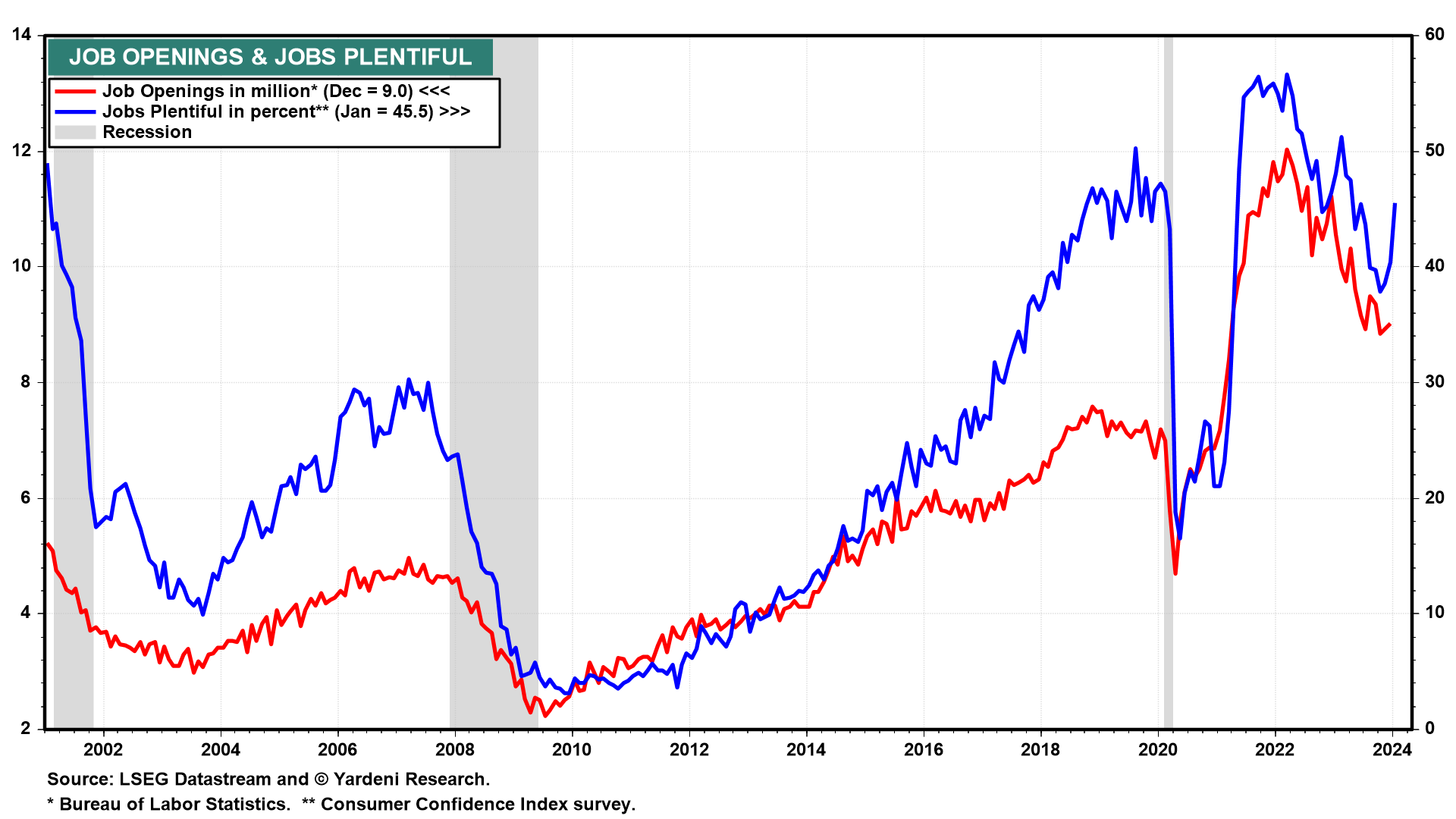

The survey's "jobs plentiful" series jumped to 45.5% during January (chart). The JOLTS series on job openings through December came out today too; it ticked up to 9.0 million, which is a high reading and might have gone higher this month according to January's consumer confidence survey.

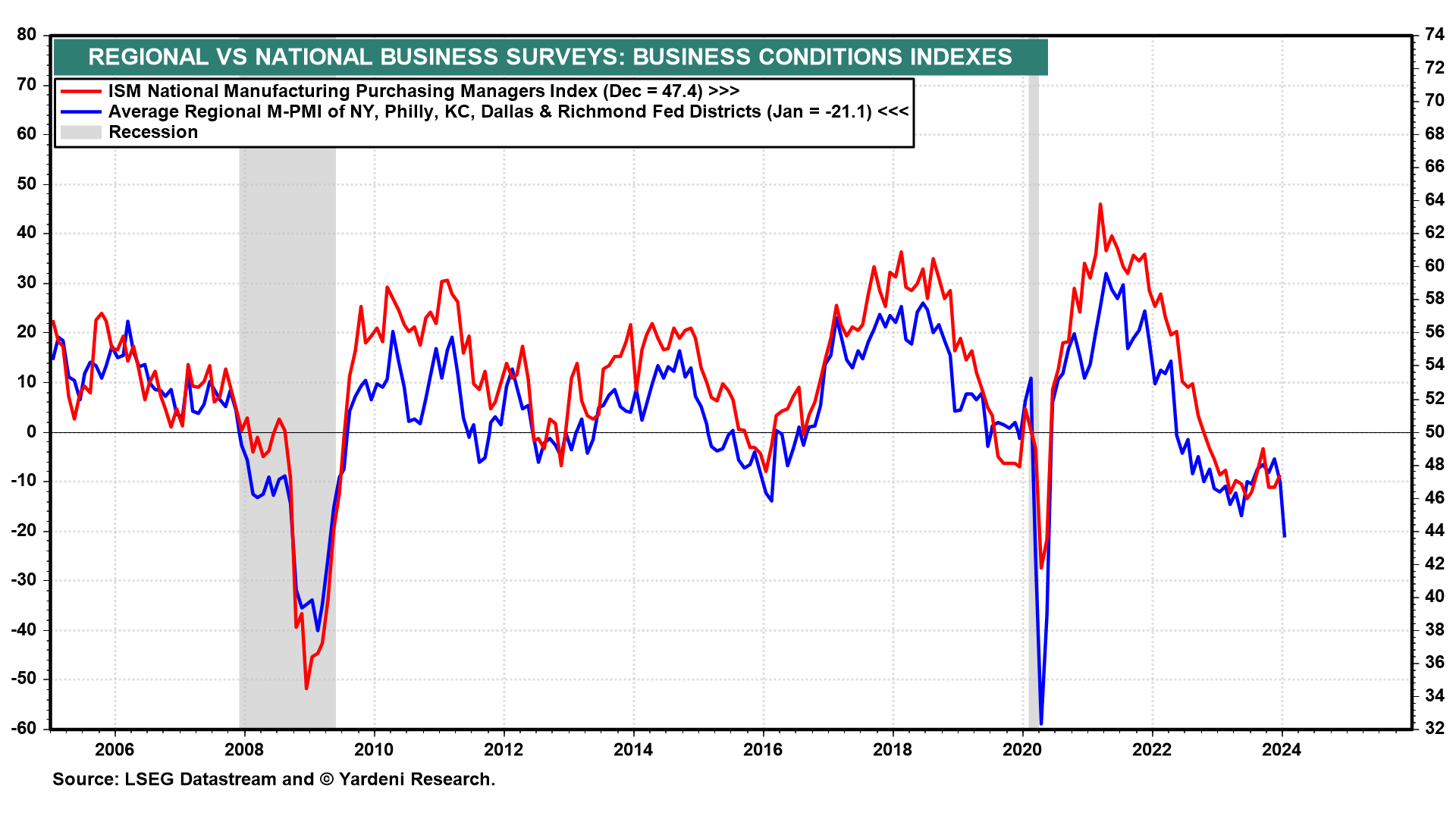

On the other hand, we now have all the regional business surveys conducted by five of the 12 Fed district banks in January. The average of their general business indexes plunged during January suggesting that the national M-PMI might have done the same (chart). That should cheer the hard-landers. However, it doesn't make much sense to us no-landers. Too many other indicators show that the economy is chugging along just fine.

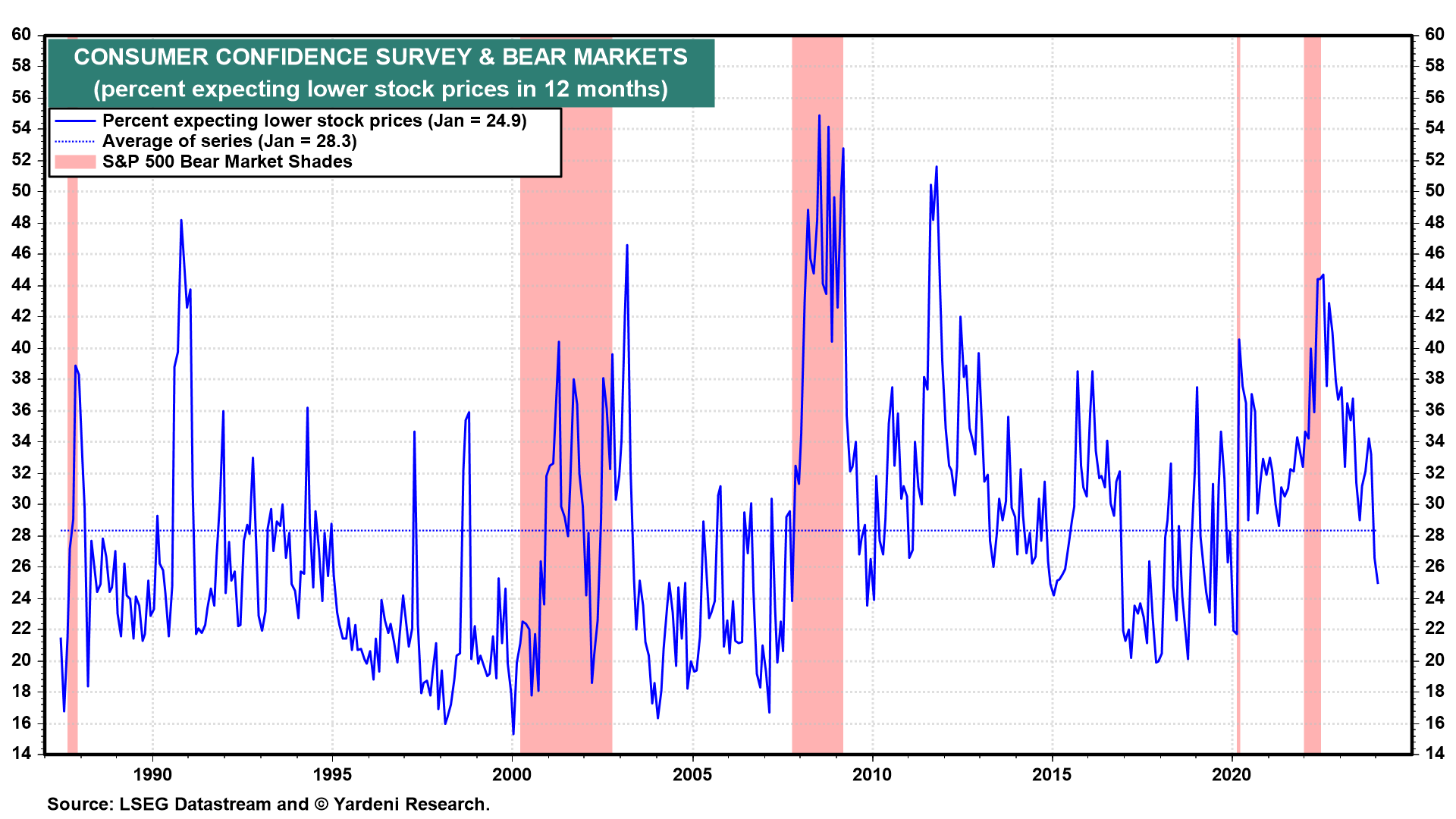

By the way, the consumer confidence survey cited above also has a series showing the percentage of respondents who believe that stock prices will be lower in 12 months (chart). It fell sharply in January to only 24.9%. The bull market may be running out of bears!