The stock market has been melting up since late October 2023, when investors concluded that the Fed was done raising interest rates. It melted up during the fall and winter. We think it might continue to do so in the spring and summer. It could be a meltup for all seasons.

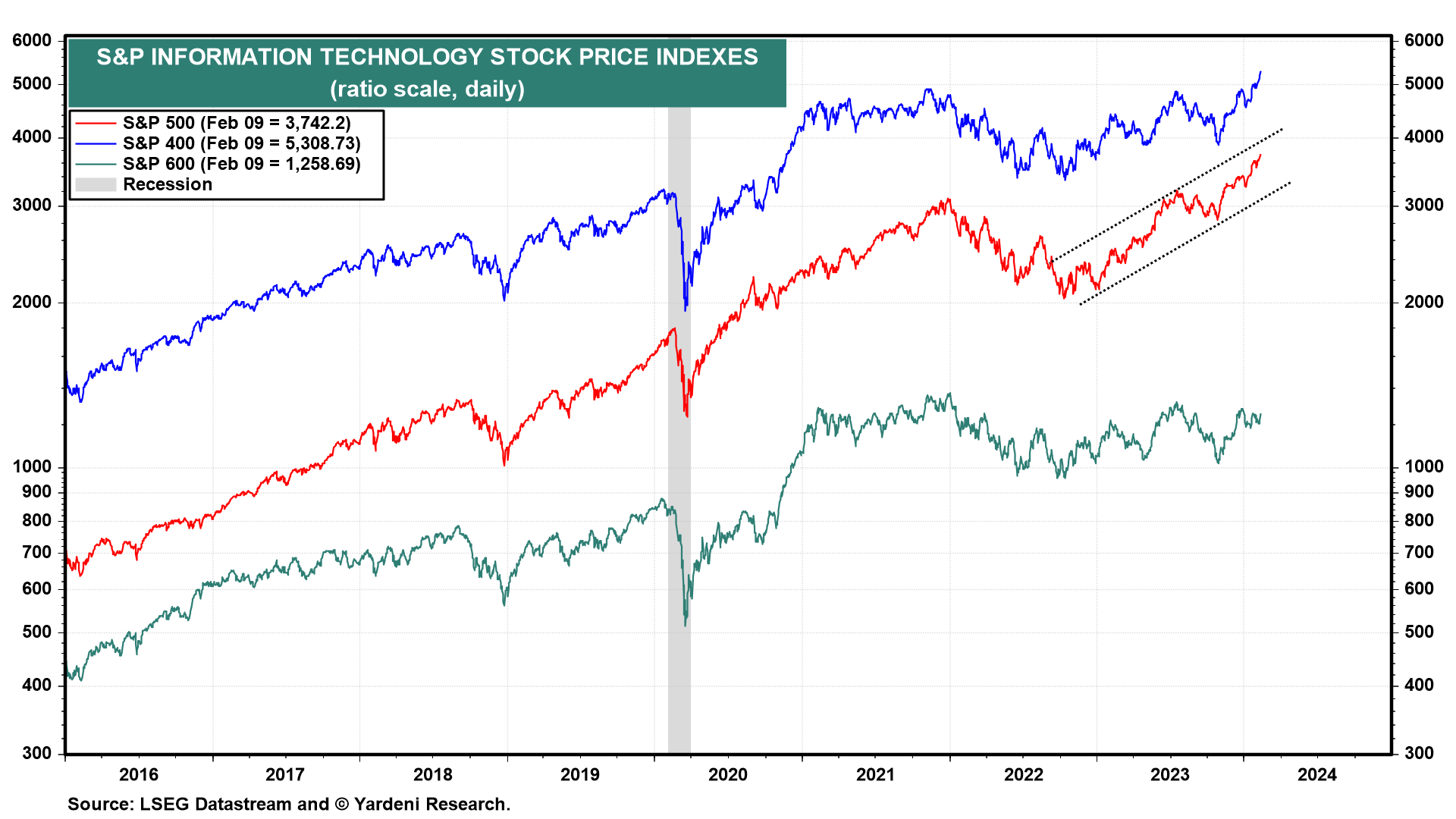

Leading the S&P 500 stock price index to a new record high on Friday was the S&P 500 Information Technology sector. It includes three of the MegaCap-8, namely Apple, Microsoft, and Nvidia. It is up 32% since October 26, 2023 to a new record high. Also at a new record high is the S&P 400 MidCap Information Technology sector, which is up 36% since October 30, 2023 (chart). There are no MegaCaps in this index. So the market has been broadening in this sector for sure.

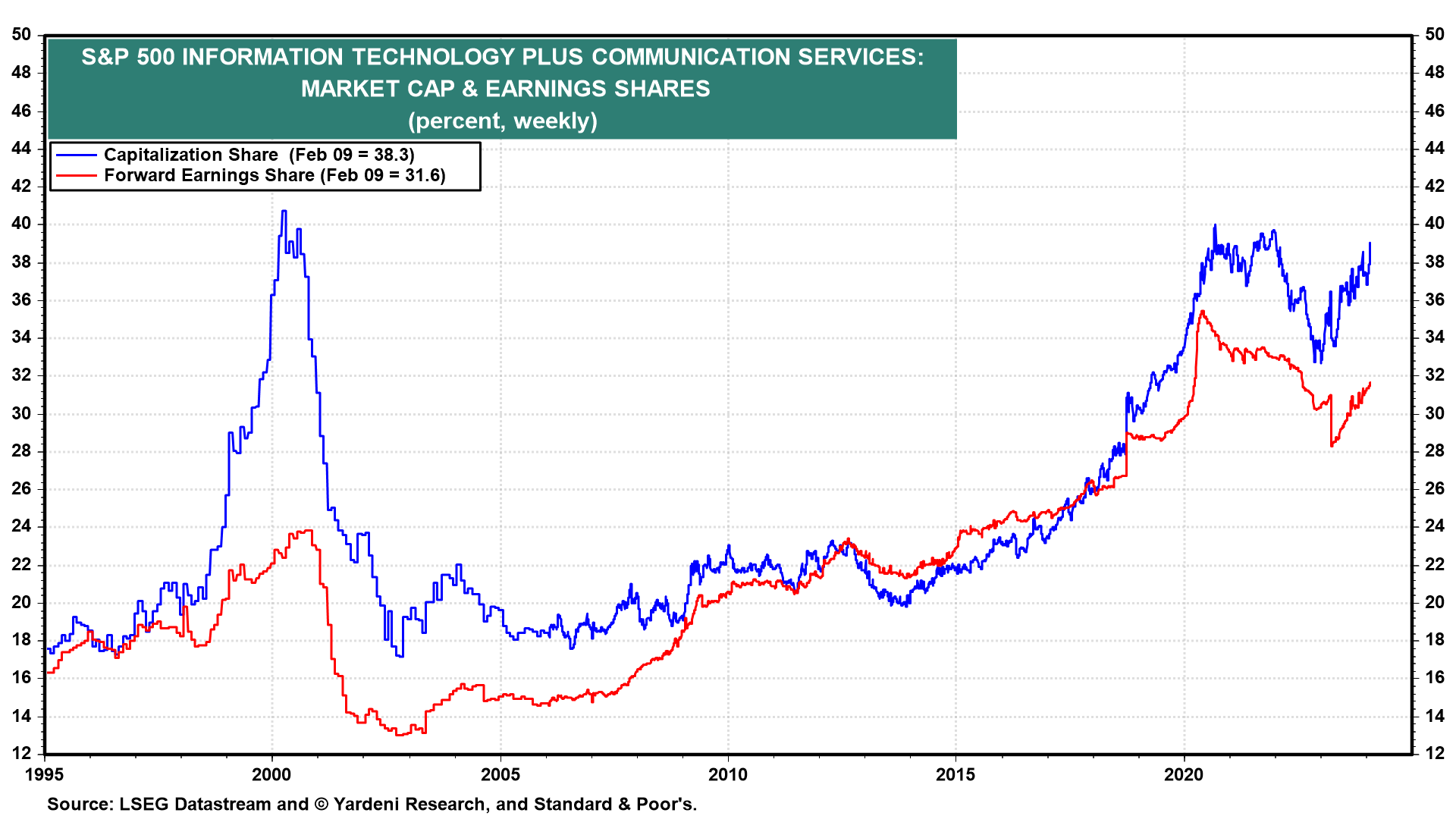

The S&P 500 Communication Services sector includes three of the MegaCap-8 as well, namely Alphabet, Meta, and Netflix. Together, the Information Technology and Communication Services sectors now account for 38.3% of the S&P 500's market capitalization (chart). Collectively, the two sectors now account for 31.6% of S&P 500 earnings. This isn't a tech-led speculative bubble like the one of the late 1990s, so far, though it has the potential to be so. Back then, the two sectors accounted for about the same market-cap share (38%-40%), but the earnings share was only around 24%.

We asked Michael Brush for an update on insider activity: "As we progress through earnings season, insider activity has picked up as news-related restrictions roll off. This improves our view of insider thinking about the economy and the markets. I see three key takeaways:

"(1) The biggest trend is the sharp increase in insider buying at regional banks. Insiders even bought in size at the New York bank at the epicenter of the current mini-crisis of confidence in the sector linked to fears about commercial real estate exposure. Regional bank insiders are telling us the odds of a bank sector crisis are low. Meanwhile, short selling in banks picked up. This implies short-covering will amplify the likely sector reversal to the upside.

"(2) Insiders are showing a preference for economically-sensitive cyclical areas like energy, tech, package delivery, containers and packaging, and payment systems.

"(3) Insiders continue to place bets on declining interest rates. This is evident in stepped up purchases in areas that benefit from lower rates. This means closed end funds paying 10% or more yields, biotech (lower rates improve discounted cash flow model valuations), insurance (large bond holdings go up in value as rates decline) and companies selling big-ticket items that require loans–like boats." Thanks, Michael.