The 10-year US Treasury bond yield dropped sharply from 4.25% on October 24 to 3.72% today. Recent CPI and PPI readings suggest that inflation is peaking, though it clearly remains high. Furthermore, Fed officials seem to agree that the federal funds rate needs to be raised closer to 5.00%. Then they intend to keep the federal funds rate at the terminal rate for a prolonged period of time until inflation falls closer to their 2.0% target. Furthermore, recent economic indicators are pointing to strong economic growth during Q4, which should be bearish for bonds since the Fed may feel compelled to tighten even more to cool the economy.

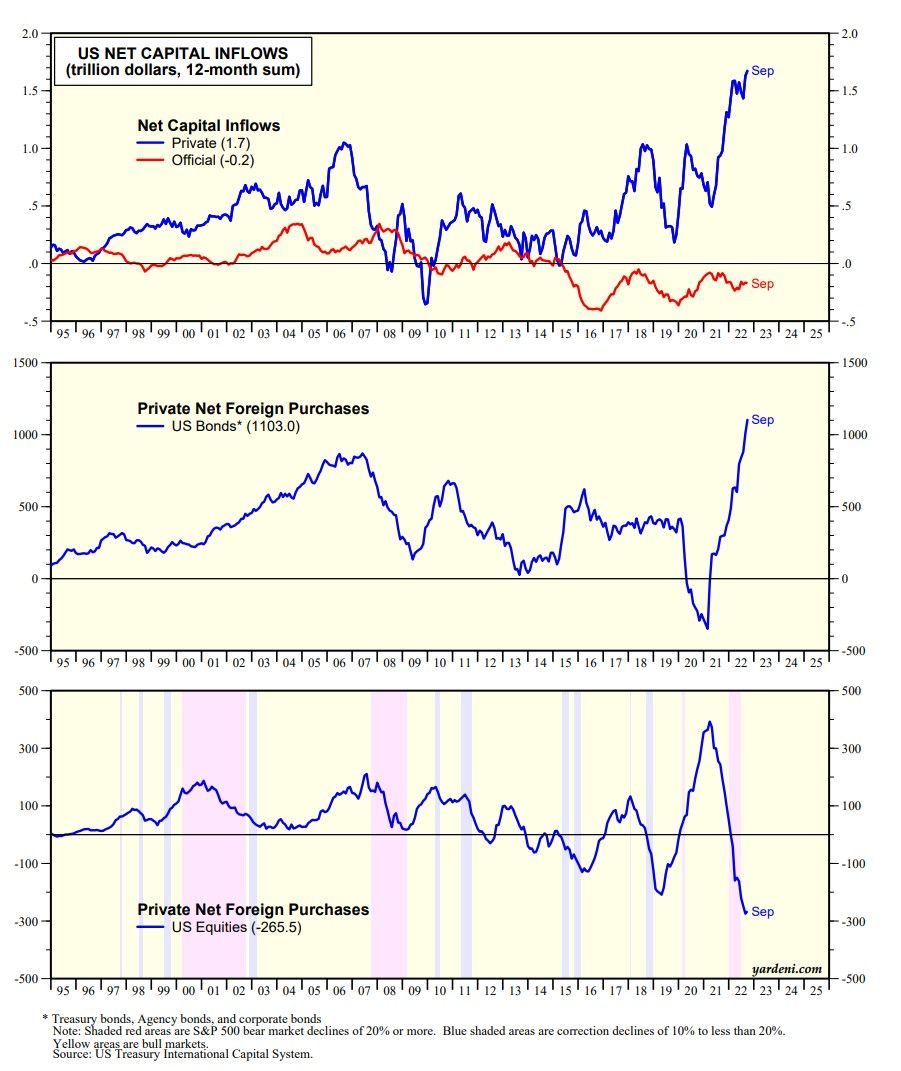

How can we explain this latest bond market conundrum? The Treasury International Capital data posted September data for net capital inflows today (chart). Over the past 12 months through September, private inflows jumped to a record $1.7 trillion. Foreigners' net purchases of US bonds soared to a record $1.1 trillion. Meanwhile, they sold $265.5 billion in US equities over the 12-month period through September. For contrarians, this is a bullish signal since foreigners have a tendency to get in (out) at stock market tops (bottoms) in the US.

The US dollar has been propelled higher by these inflows. The recent weakness in DXY suggests that the inflows may be slowing, so why are bond yields still falling?

We believe that global investors continue to view the US as a safe haven for their investments in a world that has been going quite mad. Their mantra is "TINAC" (there is no alternative country!).