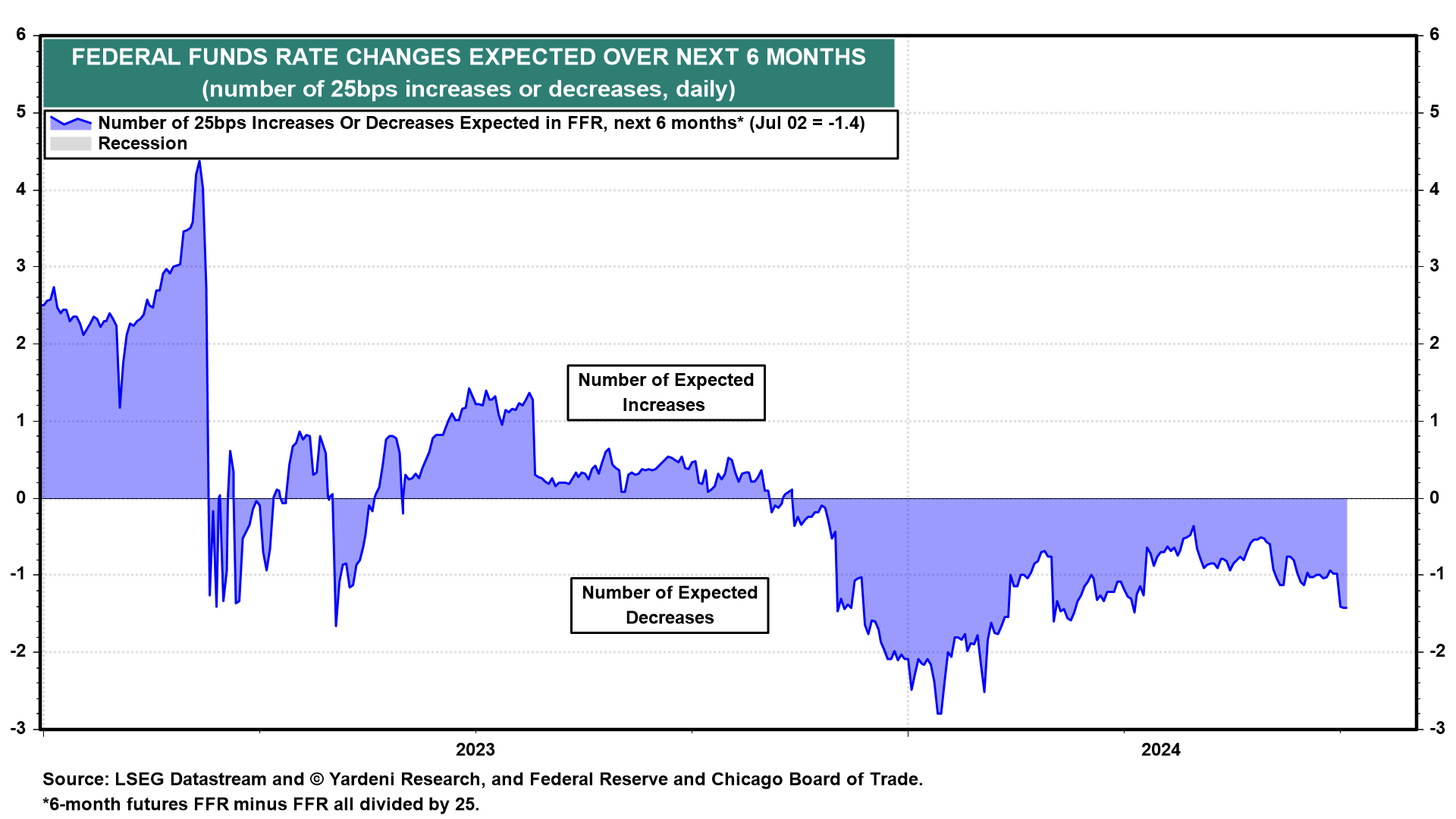

The S&P 500 jumped to a new record high of 5509 today on better-than-expected Tesla vehicle deliveries. In addition, today’s JOLTS report showed more job openings. Nevertheless, two Fed officials suggested today that the Fed Put is back because they are worried that the Fed might cause job losses if monetary policy stays too tight for too long. Their dovish comments reinforced expectations that the Fed will cut the federal funds rate by 25bps at least once and maybe twice over the remainder of this year (chart).

Here's more on today's economic developments:

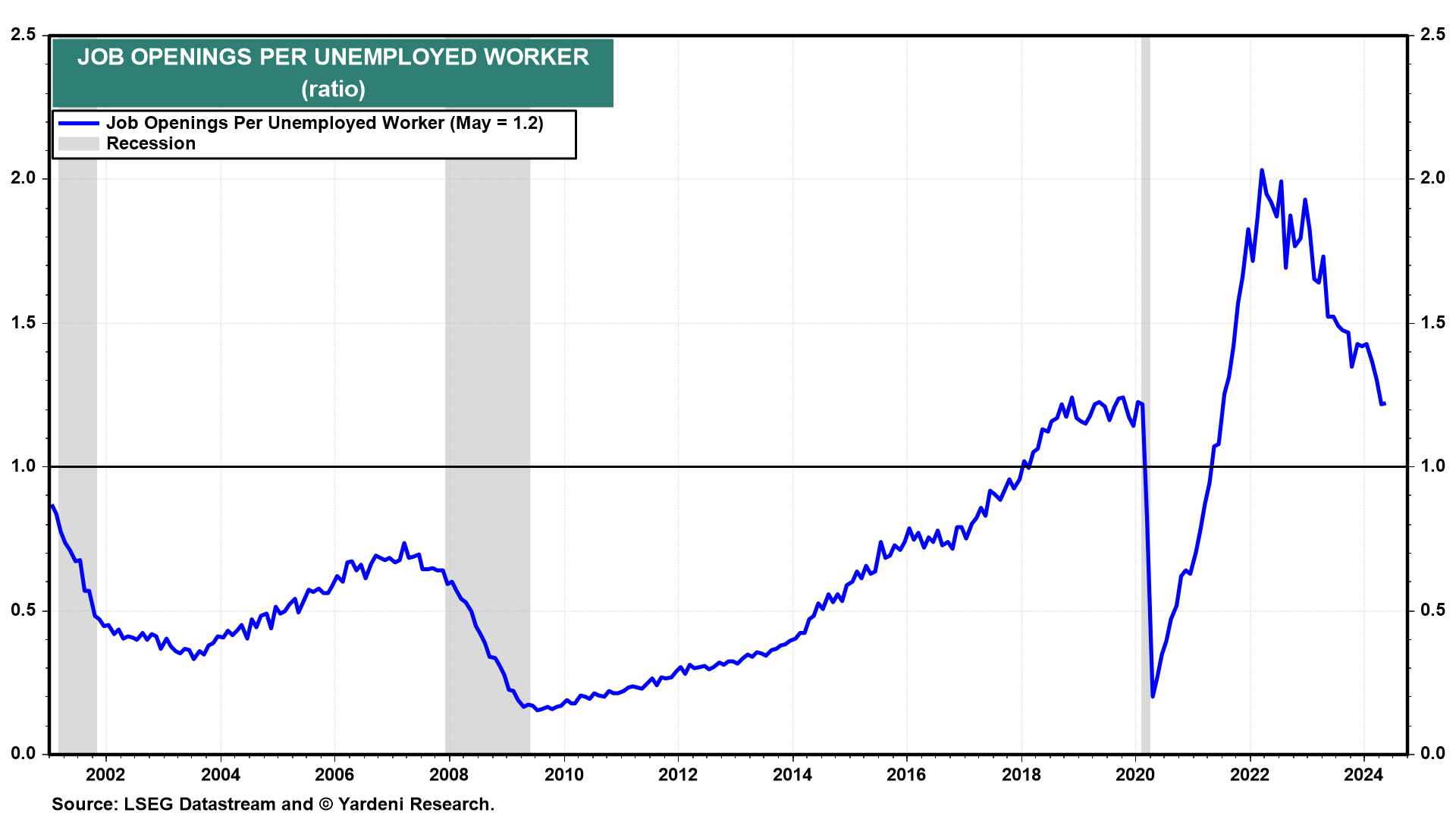

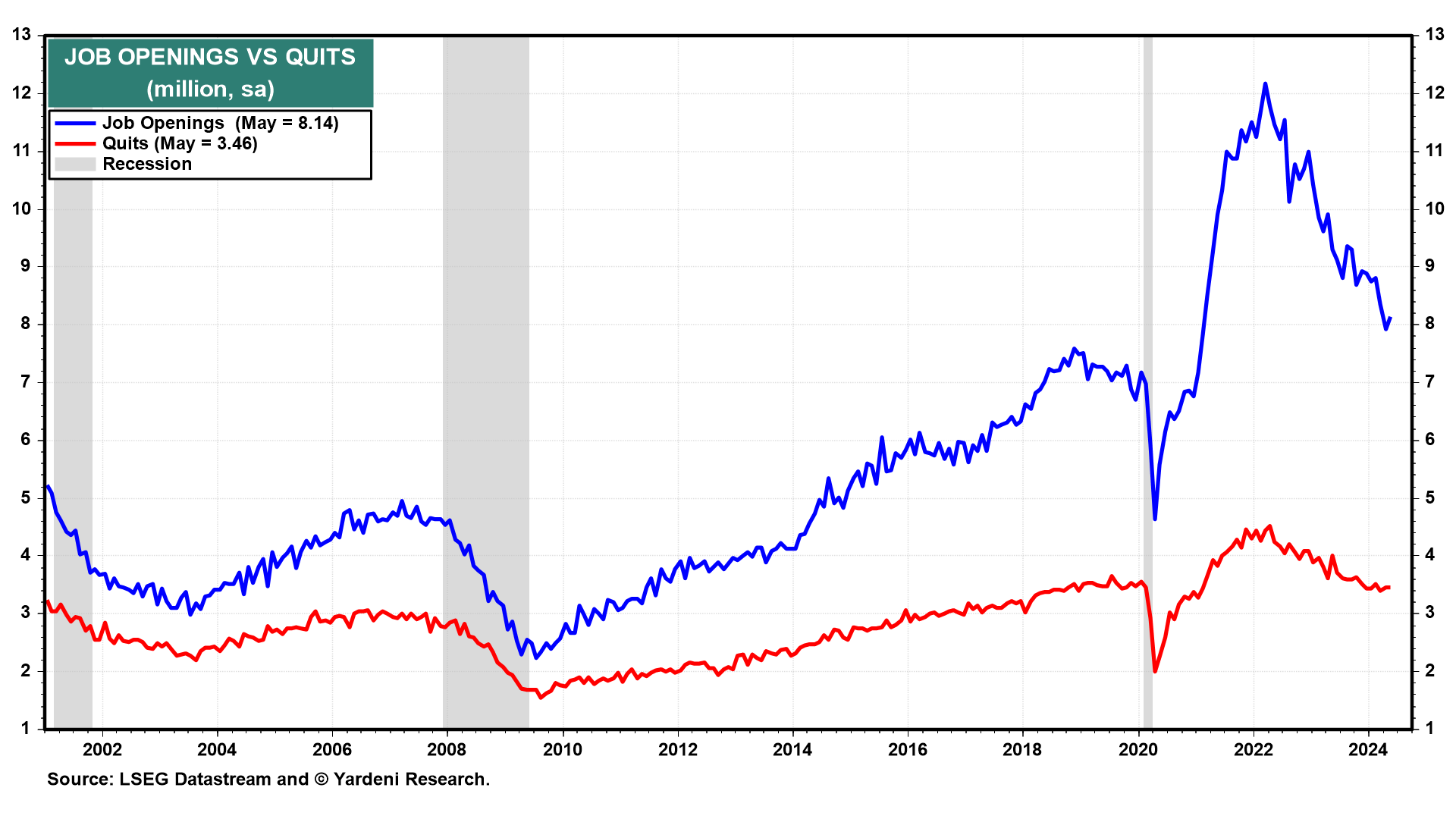

(1) Job openings. The labor market remains relatively strong. Job openings rose 221,000 to 8.14 million in May. Job openings per unemployed worker remained steady at 1.2 in May (chart). That's well off the 2.0 peak during March 2022. But it remains relatively high.

(2) Quits. The number of quits has remained relatively flat around 3.5 million in recent months through May (chart). That's down from the 4.5 million peak during April 2022. Fewer quits mean fewer job openings, which some economists point to as a sign that the labor market is weakening. For now, we see it as a normalization of the labor market following the pandemic shock.

Leer la noticia completa

Regístrese ahora para leer la historia completa y acceder a todas las publicaciones de pago.

Suscríbase a