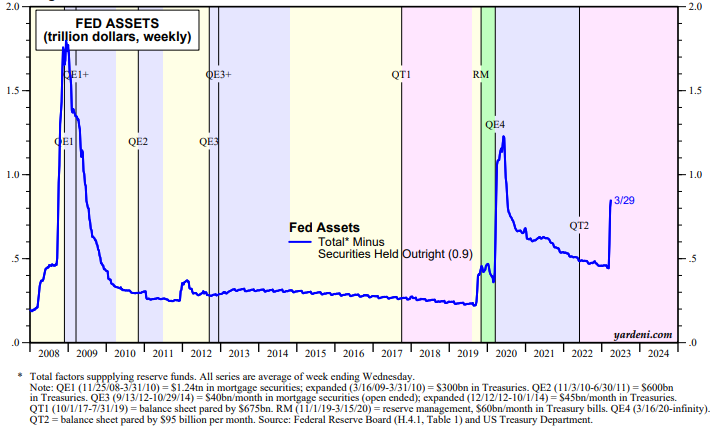

The Fed has the banks' backsides covered. The Fed can't insure deposits, but it can guarantee that the banks have access to plenty of liquidity to meet deposit outflows without having to sell securities from their bond portfolios at a loss as happened to Silicon Valley Bank (SVB), forcing it into receivership on March 10. The banks are required to put up bonds as collateral for their Fed loans, but the bonds are priced at par rather than at depressed market values.

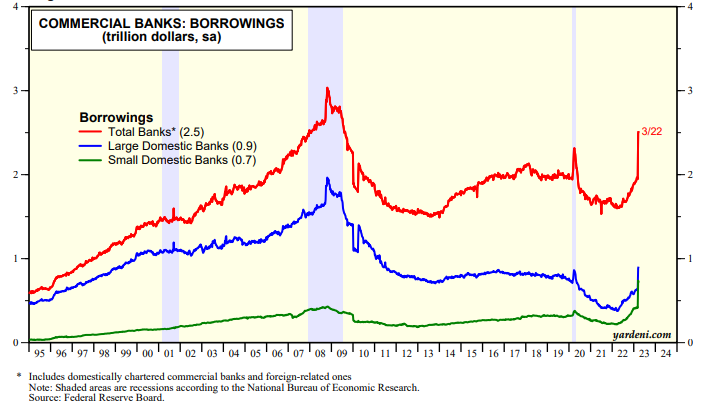

In the past two weeks through the March 22 week, banks' borrowings jumped by $570 billion to$2.52 trillion (chart). Borrowings by large and small domestically chartered banks rose $266 billion and $300 billion over the latest two weeks!

We can track the activity of the Fed's liquidity facilities by simply subtracting the central banks securities holdings from its total assets. From Wednesday, March 8 through Wednesday, March 29, this figure rose by $386 billion to $830 billion (chart). The Fed flooded the banks with liquidity to extinguish the banking crisis fire.

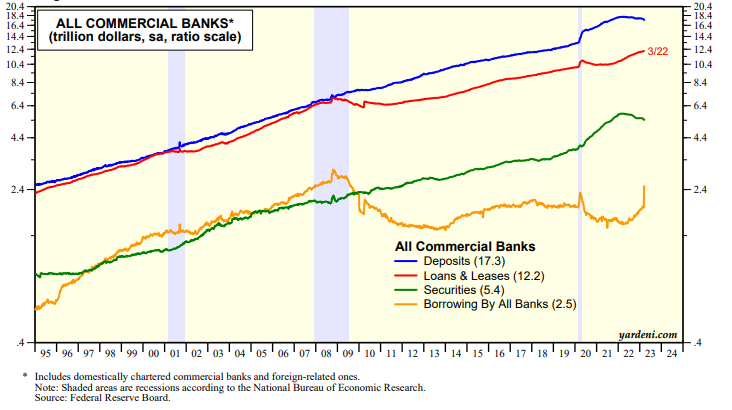

Over the two weeks through March 22, at all US commercial banks, loans rose $46 billion, while securities fell $69 billion (chart).

Deposits fell $300 billion with net outflows of $191 billion at large banks, $23 billion at small banks, and $87 billion at foreign-related banks. Keep in mind that SVB was included in the large banks category (i.e., the 25 largest ones) with its deposits around $190 billion. It was reclassified as a small bank once it was turned over to a FDIC bridge bank.