The stock market is overbought. Since June 16, the S&P 500 is up 15% including its 1.2% decline last week back to 4228, failing to rise above its 200-day moving average, which was 4306 on Friday. Over the same period, the Nasdaq is up 19% after giving back 2% last week. Meanwhile, the 10-year US Treasury bond yield is up 41bps from a recent low of 2.57% on August 1 to 2.98% on Friday. The US dollar index (DXY) rose 2.9% since August 11 and 12.4% ytd.

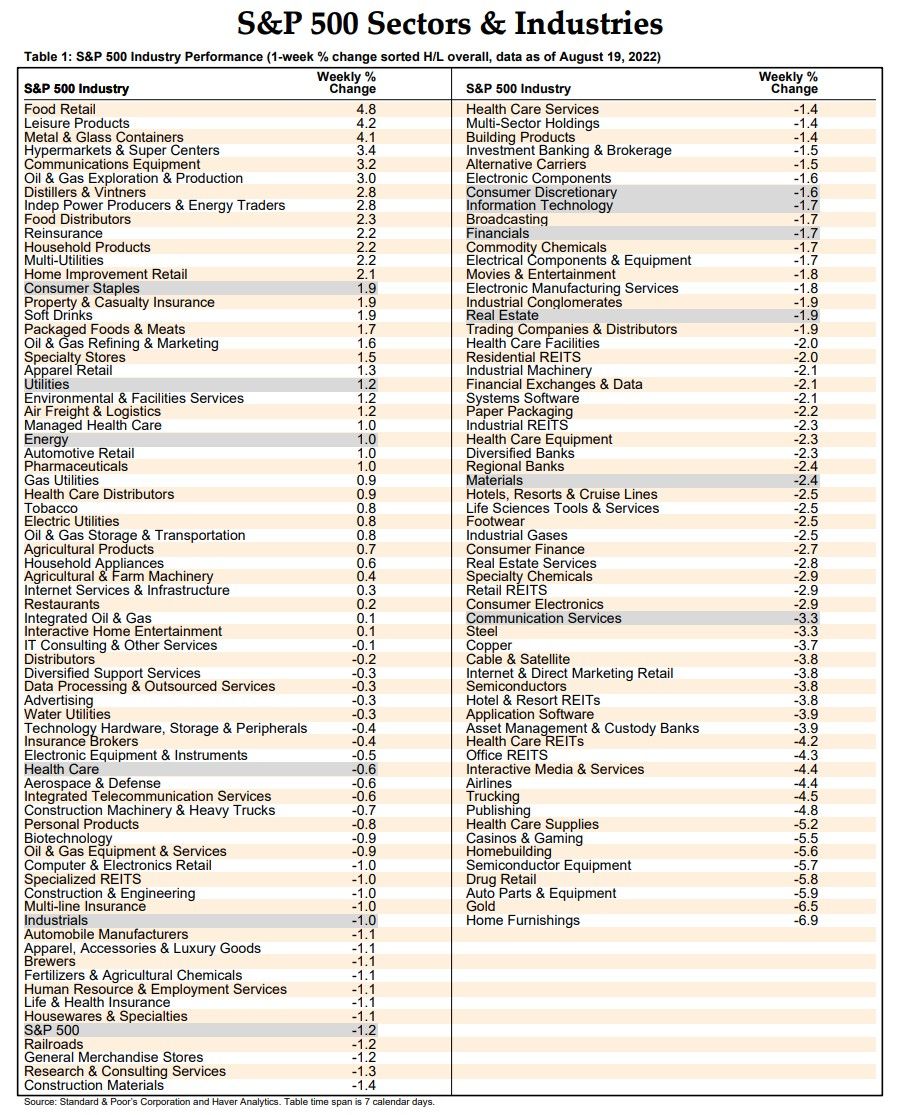

Last week's market moves suggest that traders are bracing for a mostly hawkish speech from Fed Chair Jerome Powell at Jackson Hole on Friday. That's evident in the following table showing last week's performance of the 11 sectors and 100+ industries in the S&P 500. The winners were the risk-off laggards since June 16, while the losers were the risk-on leaders since then.

We asked markets maven Joe Feshbach for his latest perspective on the stock market. Here it is: Joe says the rally since mid-June is showing signs of fatigue. The Nasdaq gave him a sell signal on Friday. Breadth narrowed recently. Sentiment has turned more bullish and the put/call ratio is low, both of which are contrary indicators). "That’s why I’ve been suggesting that investors hold off on new buying as a better opportunity should present itself in time." He doesn't expect the market to retest the mid-June low.