The following are some questions we have received in the comments section of our QuickTakes recently, and Dr Ed's brief answers:

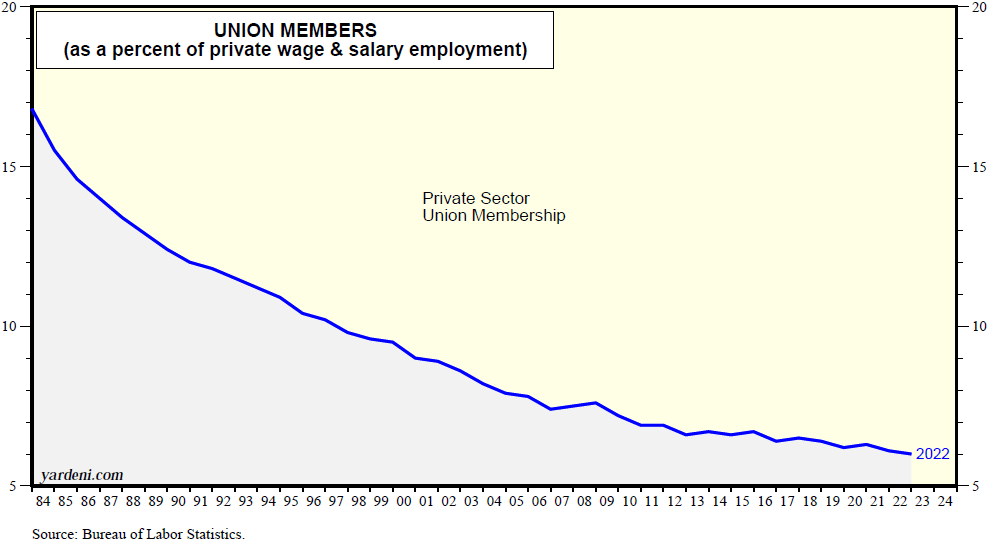

(1) Oaul S. asks: "Dr Ed, what's your response to inflationary concerns about a wage-price spiral triggered by big wage increases coming at UPS, and the prospect of labor unions negotiating similar wage spikes at Amazon and elsewhere?"

Dr Ed says: "This is certainly on our worry list. However, in the US, union membership in the private sector has dropped significantly since the 1970s. The available data show that 16.8% of private wage and salary employment was unionized in 1983 (chart). This percentage dropped to a record low of 6.0% during 2022. So we don’t expect that the headline-grabbing news about recent union settlements will be as likely to boost overall wage inflation as it did in the 1970s."

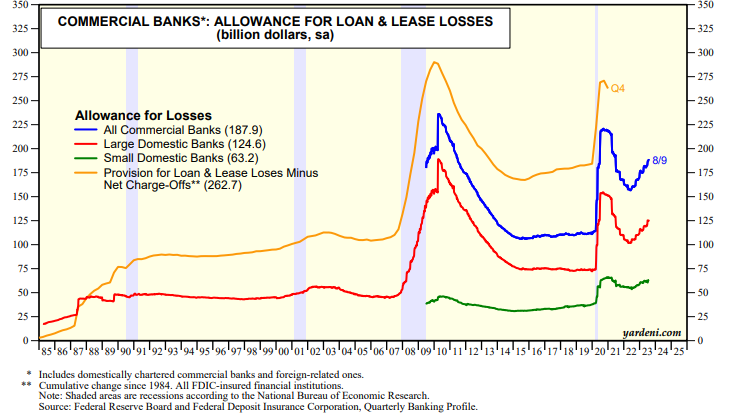

(2) Joe J. asks: "Should we start to fear some banking trouble given how rates are again? Assuming part of their portfolio is still unhedged, the same exact problem would arise right?"

Dr. Ed says: "This is also on our worry list, of course. Most bonds owned by financial institutions are categorized as "held to maturity" in their accounts so they don't have to take hits on them. However, higher interest rates mean more defaults on CRE loans. We are expecting a wave of M&A consolidation among the small banks that are most exposed to this risk. Meanwhile, weekly commercial bank data compiled by the Fed show that banks are provisioning more reserves for loan losses but not at an alarming pace (chart)

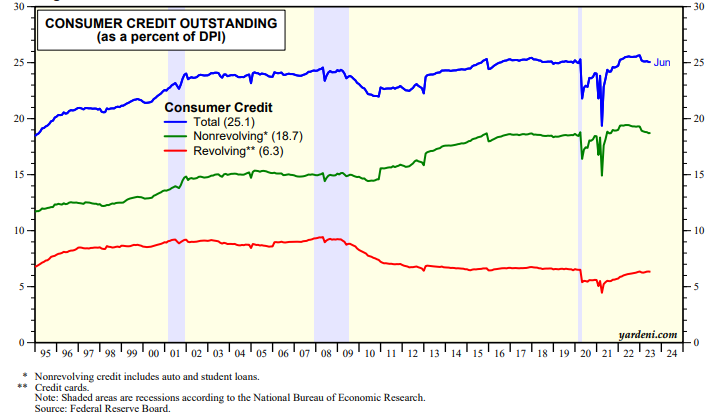

(3) Konrad P. asks: "What are your thoughts on the current credit card debt of consumers and the added weight of student loans coming? If consumer spending comes down because of debt payoff what will support the economy?"

Dr. Ed says: "This is yet another item on our worry list that we are monitoring closely with the relevant data. Keep in mind that consumer credit is actually a lagging and not a leading economic indicator. In any event, revolving credit (i.e., credit cards) is equivalent to only 6.3% of disposable personal income currently (chart). Most of it is paid in full on a monthly basis. Nonrevolving credit includes autos and student loans and is equivalent to 18.7% of DPI currently. The resumption of student loan payments will weigh on consumer spending, but that should be more than offset by a continuation of solid employment gains and increases in inflation-adjusted wages.