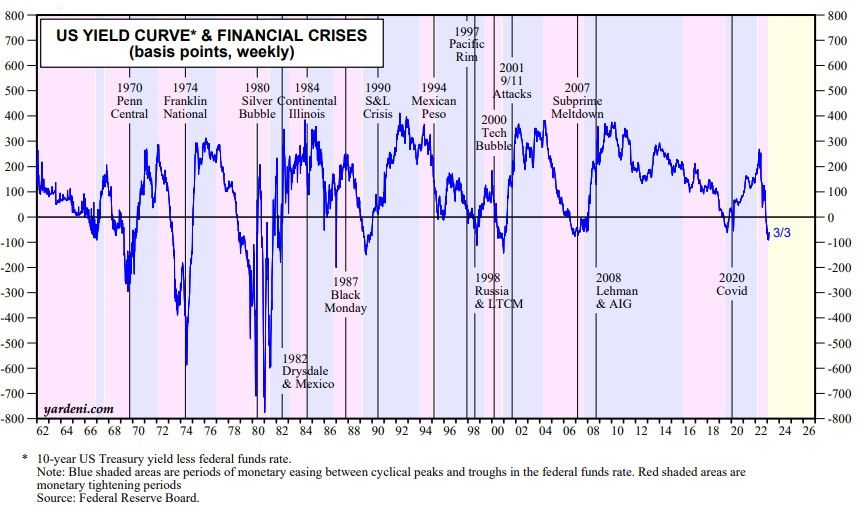

Yesterday's sell-off in the stock market was led by bank stocks. It was mostly triggered by fears that SVB may be the start of a financial crisis that leads to an economy-wide credit crunch and recession. As it has done often in the past, the inverted yield curve has been signaling since last summer that something could break in the financial system if the Fed continues to tighten monetary policy (chart).

The meltdown in SVB may be the beginning of a credit crunch for tech startups since the bank has been a major lender in that space. However, we doubt that it is the canary in the coal mine for the overall credit system.

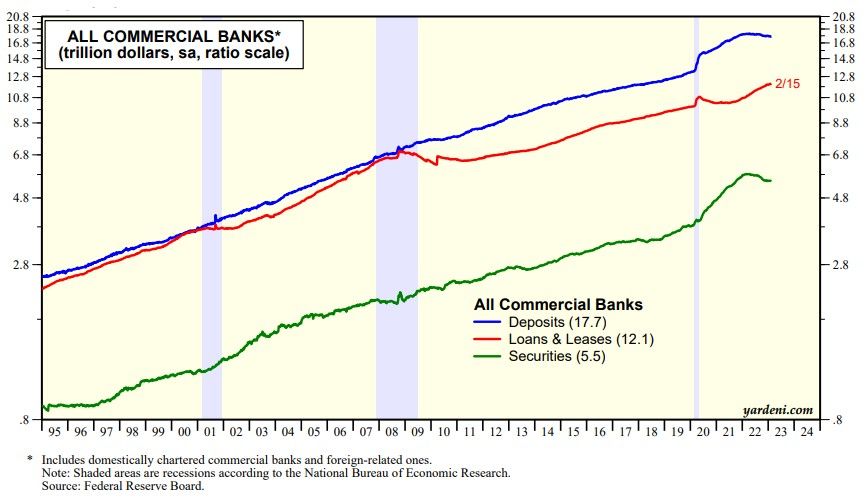

On the other hand, the bank's woes may convince Fed officials to at least slow the pace of tightening. SVB may be experiencing an old-fashioned bank run as depositor withdraw their funds forcing the bank to sell bonds at a loss. This event should alert Fed officials that by raising money market rates so rapidly over the past year, the result has been disintermediation as depositors move their funds to money market instruments (chart). Banks are forced to increase their deposit rates, which narrows their interest margins on loans so they will make fewer of them.

In other words, monetary policy is already sufficiently restrictive to engineer a soft landing and continued disinflation. Our advice to the Fed: Go ahead with a 25bps hike in the federal funds rate at the March 21-22 meeting of the FOMC to 4.75%-5.00%. Then give it a rest for a while.