Why were so many economists and strategists so wrong in their predictions of a recession over the past two years? Now seems to be a good time to answer this question since there are lots of lessons to be learned from the widely held misconceptions of the past two years.

Let’s review them:

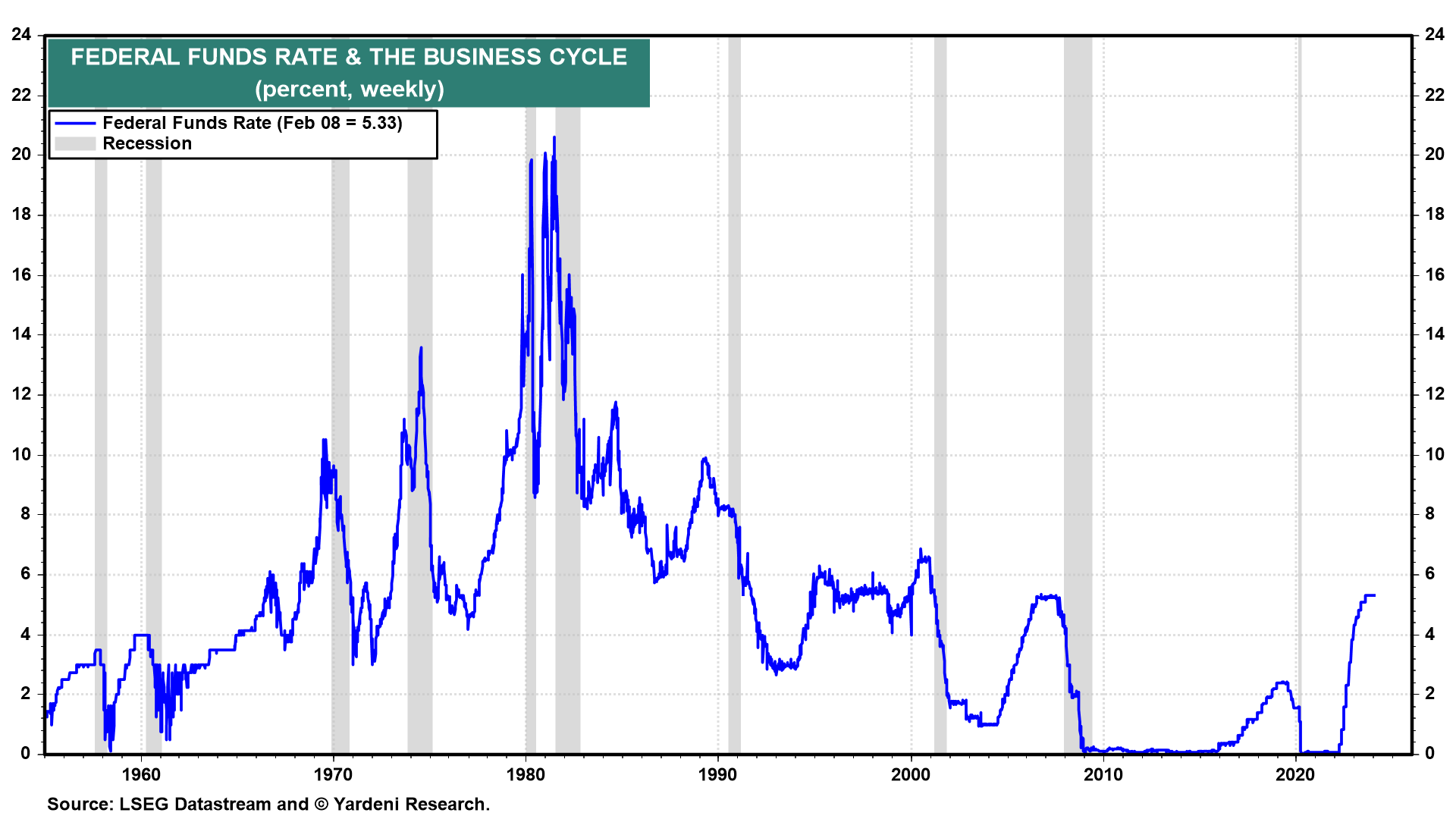

(1/10) Tight monetary policies always cause recessions. The Fed raised the federal funds rate (FFR) by 525bps to 5.25%-5.50% from March 2022 through July 2023. That’s the most aggressive round of rate hikes since the late 1970s, when then-Fed Chair Paul Volcker let the FFR soar (Fig. 7 below). The past 10 recessions were preceded by a series of rate hikes.

Over the past two years, Fed officials expected that rate hikes and QT would bring inflation down by weakening interest-sensitive demand, boosting the unemployment rate, and slowing the real GDP growth rate. The pessimists logically expected a recession to ensue, as it had in the past and as confirmed by the LEI and inverted yield curve.

We argued that the economy would prove to be resilient and that the result would be rolling recessions in different sectors of the economy, not an economy-wide recession. This scenario had played out before, during the mid-1980s and mid-2010s.

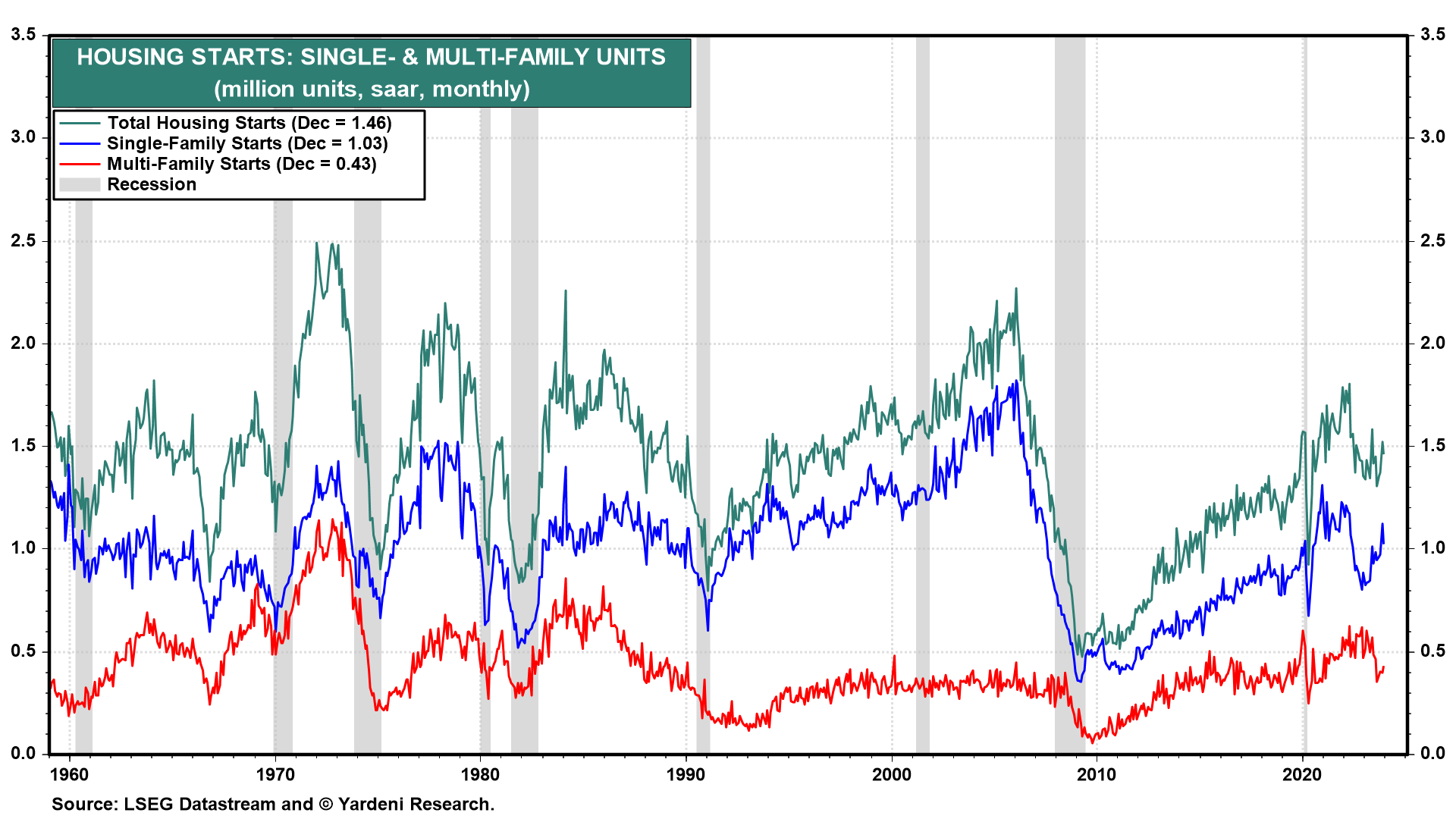

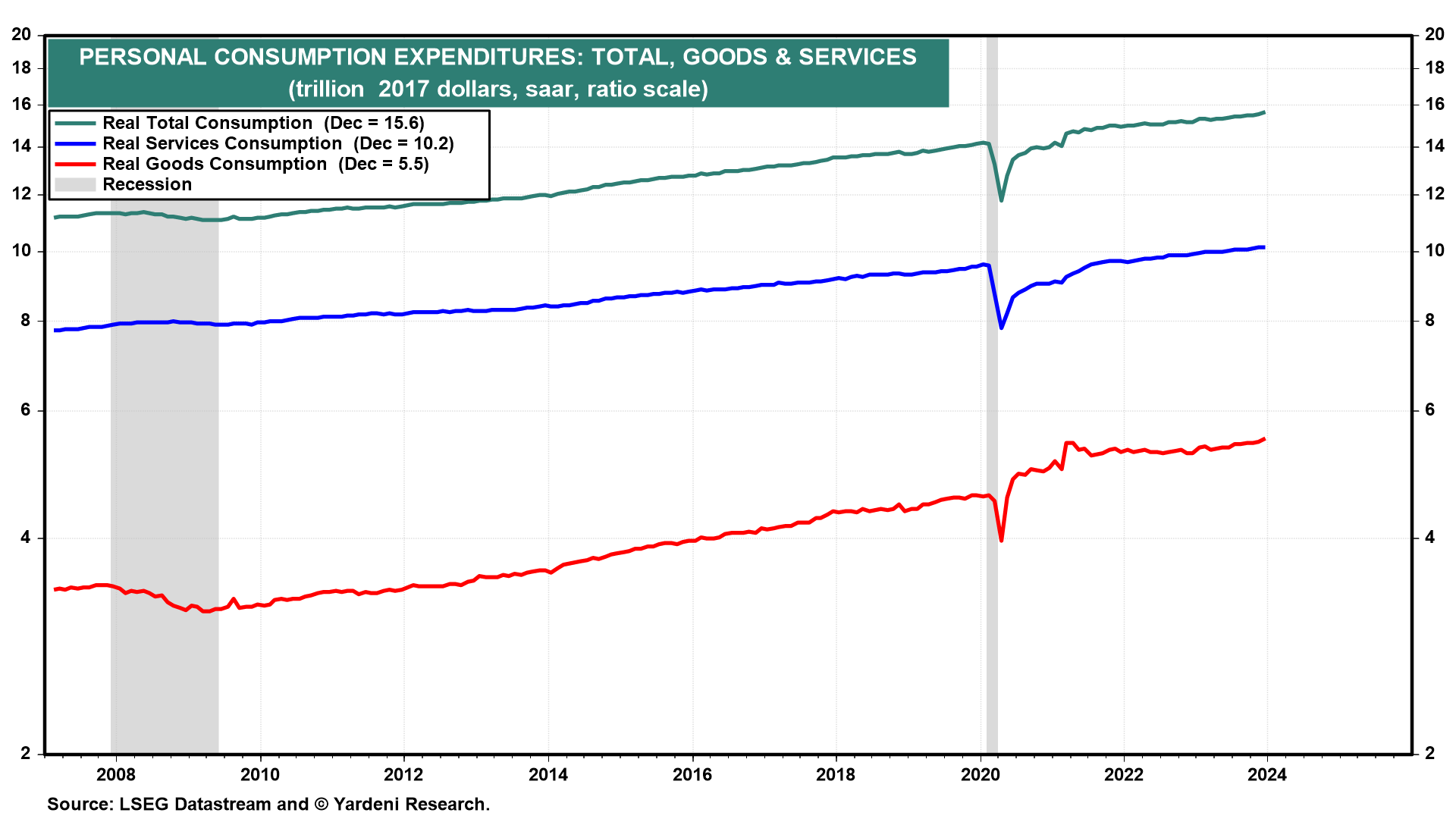

This time, over the past two years, there was a relatively moderate and short recession in single-family housing, but multi-family construction remained strong (Fig. 8 below). There was a relatively long but shallow growth recession among consumer goods producers and providers, while demand for consumer services rose over the past two years (Fig. 9 below). In fact, demand for goods remained relatively flat near its post-pandemic record high. It rose to a new record high in December.

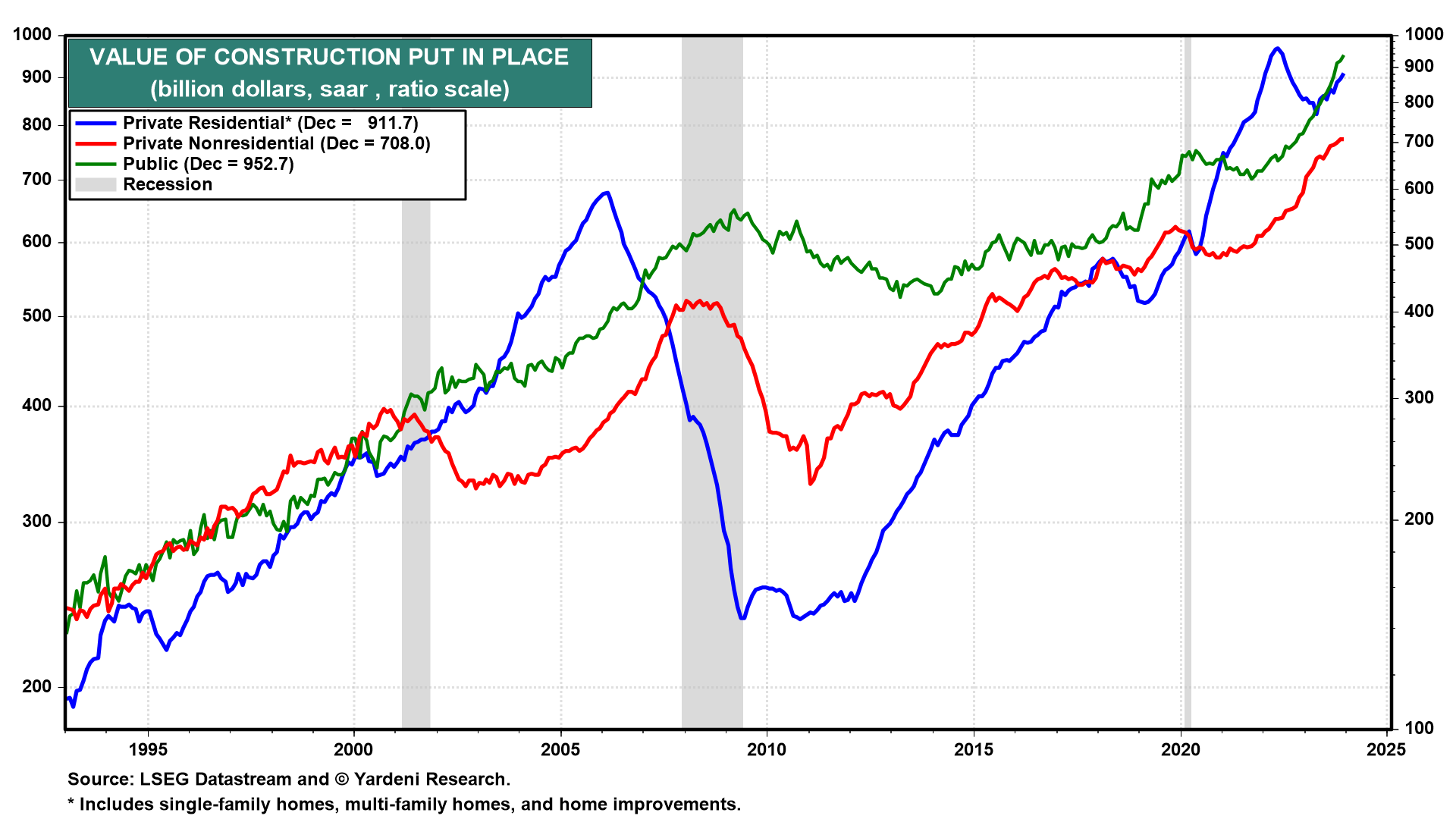

(2/10) Monetary policy matters more than fiscal policy. While most economists obsessed about the tightening of monetary policy, they mostly ignored the stimulative impact of fiscal policy. Legislation passed in 2022 provided a big boost to spending on public infrastructure and manufacturing facilities and provided tax incentives for such construction. As a result, private nonresidential and public construction soared to record highs over the past two years, and so did total payroll employment in the construction industry (Fig. 10 below and Fig. 11).

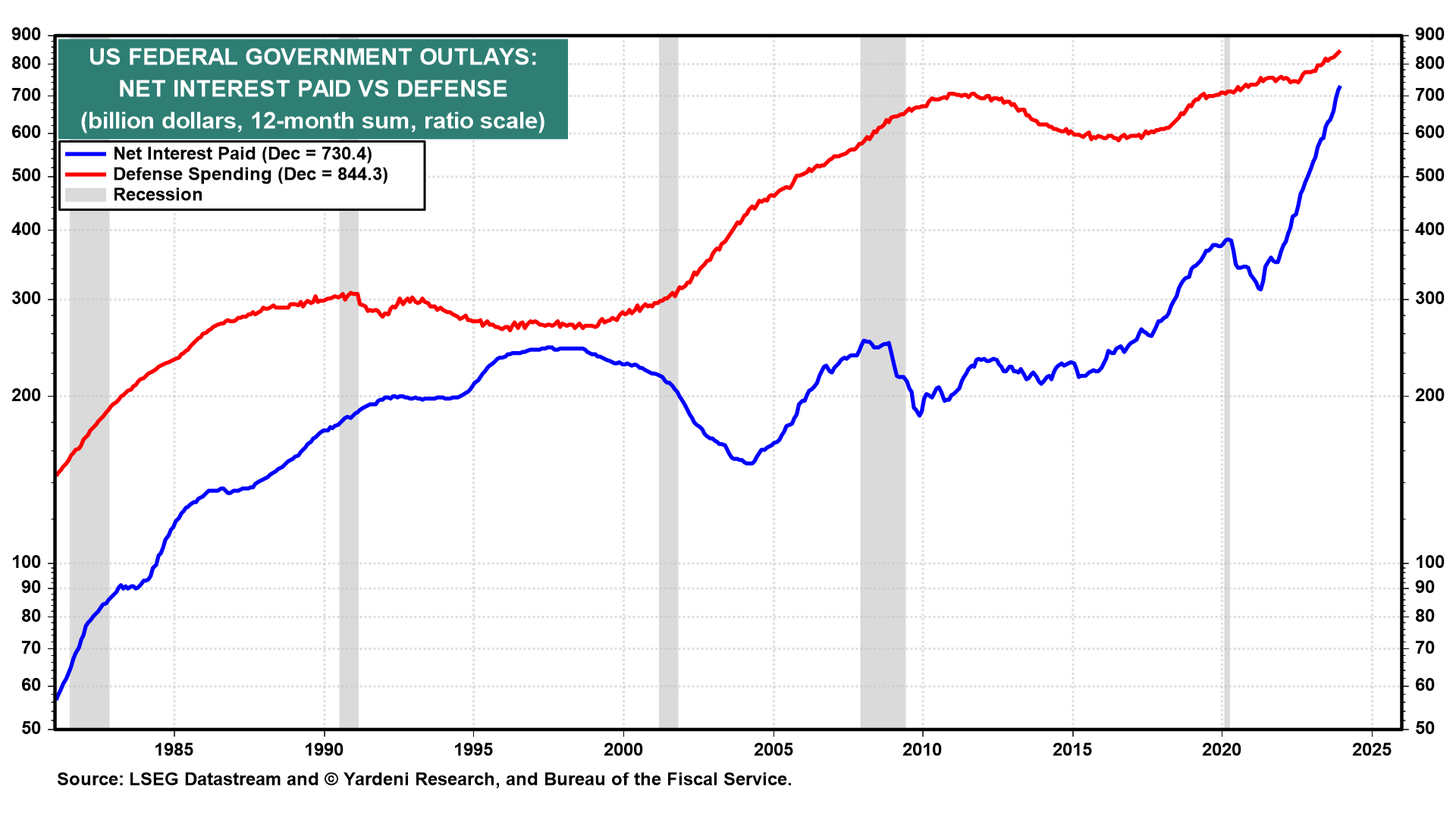

Federal government outlays on defense spending have been boosted over the past two years by US support for Israel, Ukraine, and Taiwan to a record high of $844.3 billion over the past 12 month through December (Fig. 12 below). The fastest growing federal government outlay over the past two years has been on net interest paid on the federal debt. That’s boosted the net interest received component of personal income, which hit a record-high $1.8 trillion (saar) in December (Fig. 13).

(3/10) Consumers are running out of excess saving. The personal saving rate has been depressed around 4% for the past two years (Fig. 14). That may indeed reflect the fact that consumers have been spending their pandemic-related excess saving. If consumers are running out of that money, they might boost their saving rate by cutting spending on goods and services, which could cause a consumer-led recession.

Leer la noticia completa

Regístrese ahora para leer la historia completa y acceder a todas las publicaciones de pago.

Suscríbase a