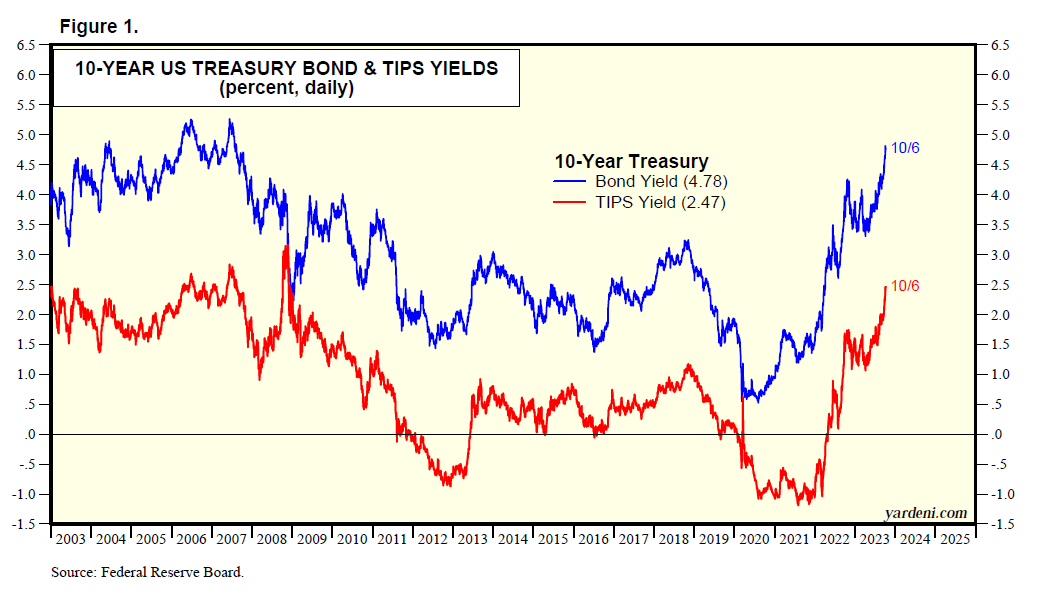

Why did the 10-year Treasury bond yield soar from 3.97% on July 31 to 4.81% on October 3 (Fig. 1 below)? There are several explanations, and the answer is probably “all of the below.”

Consider the following seven points:

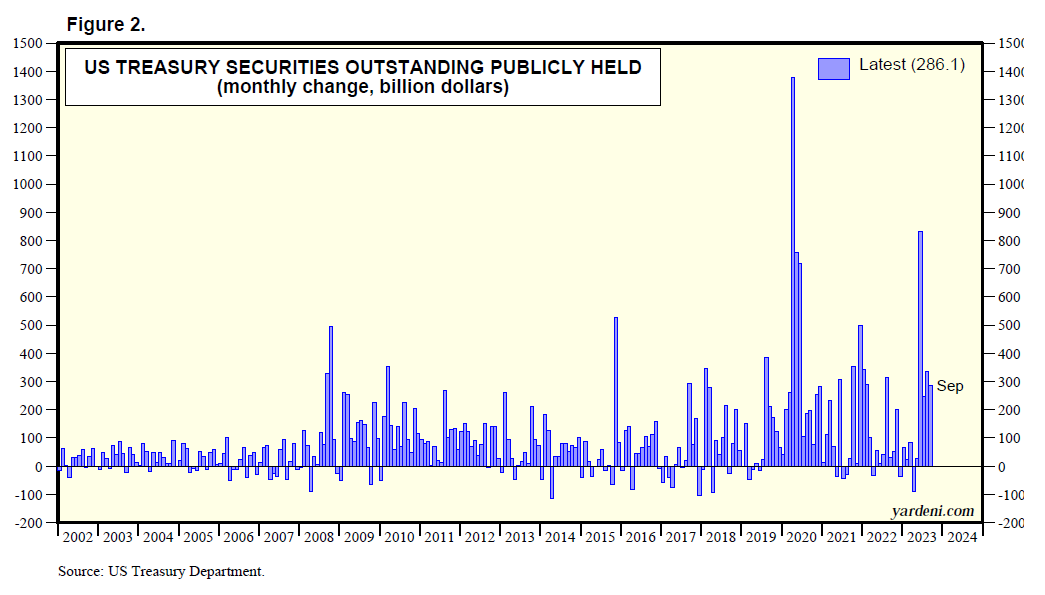

(1) Too much supply of Treasuries. We’ve been arguing that the deluge of Treasury supply has been the main driver of this rout in the bond market. The rapidly widening federal deficit forced the Treasury to announce during the summer a significant increase in the securities that would have to be sold over the rest of the year. During August and September, the amount of US Treasury debt held by the public rose $335 billion and $286 billion, respectively (Fig. 2 below). The bond yield rose quickly to a level that should stimulate enough demand to clear the increased supply of Treasuries over the rest of this year through next year.

(2) Higher for longer short-term interest rates. Another thesis that also makes sense is that the rout was exacerbated by Fed Chair Jerome Powell when he reiterated at his September 20 press conference that the FOMC intended to remain restrictive through next year by maintaining the federal funds rate higher for longer. Specifically, he said: “We’re prepared to raise rates further if appropriate, and we intend to hold policy at a restrictive level until we’re confident that inflation is moving down sustainably toward our objective. In determining the extent of additional policy firming that may be appropriate to return inflation to 2 percent over time, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments.”

The big shock that same day was the release of the FOMC’s latest quarterly Summary of Economic Projections (SEP). Instead of four rate cuts totaling 100bps next year (as was projected in June’s SEP), the latest SEP showed two cuts totaling 50bps.

Leer la noticia completa

Regístrese ahora para leer la historia completa y acceder a todas las publicaciones de pago.

Suscríbase a