The stock market rallied from Friday through Wednesday despite Fed Chair Jerome Powell’s hawkish speech at Jackson Hole on Friday. The rally received a bullish jolt from July’s JOLTS report on Tuesday morning showing both fewer job openings and fewer quits than expected during the month.

These are bullish developments, as we discuss further below, because they suggest that the labor market is “rebalancing,” with demand for labor easing. Powell has stressed the importance of these two variables for the setting of monetary policy. Both are heading in the right direction, i.e., the one that increases the likelihood that the Fed is done raising interest rates.

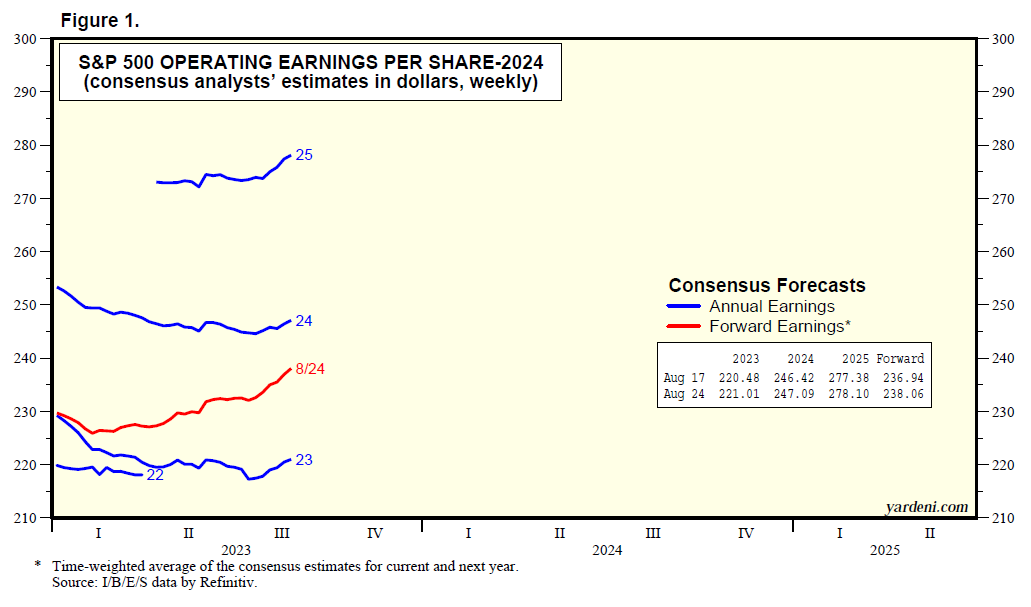

Also heading in the right direction are analysts’ consensus expectations for the operating earnings of the S&P 500. During Q2, the actual result fell 5.3% y/y, led by a 48.0% y/y drop in the Energy sector. Excluding Energy, S&P 500 earnings rose 3.4%. Meanwhile, industry analysts have been raising their earnings estimates for 2023, 2024, and 2025 in recent weeks (Fig. 1 below). They’ve also been raising their estimates for the final two quarters of 2023 as well as all four quarters of 2024 (Fig. 2 and Fig. 3).

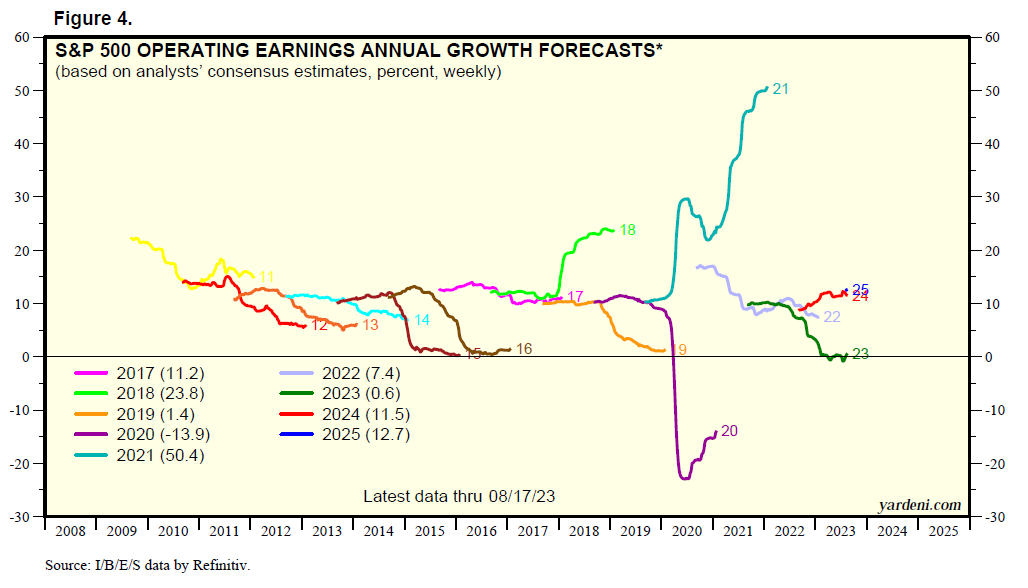

There’s no recession apparent in the analysts’ consensus earnings forecasts. Let’s review the latest data:

(1) Quarterly

Here are the actual and current expected y/y quarterly growth rates for 2023 (-3.1%, -5.3%, -0.1%, and 9.1%). Here are the expectations for 2024’s quarters (8.8%, 12.0%, 12.7%, and 12.8%).

(2) Annually

The analysts are currently expecting that earnings on a “frozen actual” basis will rise 11.8% y/y next year to $247.09 from $221.01 this year, which would be up 1.3% from 2022 (Fig. 4 below). They expect 2025 earnings to increase 12.6% to $278.10.

(3) Forward

Leer la noticia completa

Regístrese ahora para leer la historia completa y acceder a todas las publicaciones de pago.

Suscríbase a