Let’s revisit our upbeat response to the most frequently cited reasons to be worried about a recession:

(1) Falling leading indicators and M-PMI.

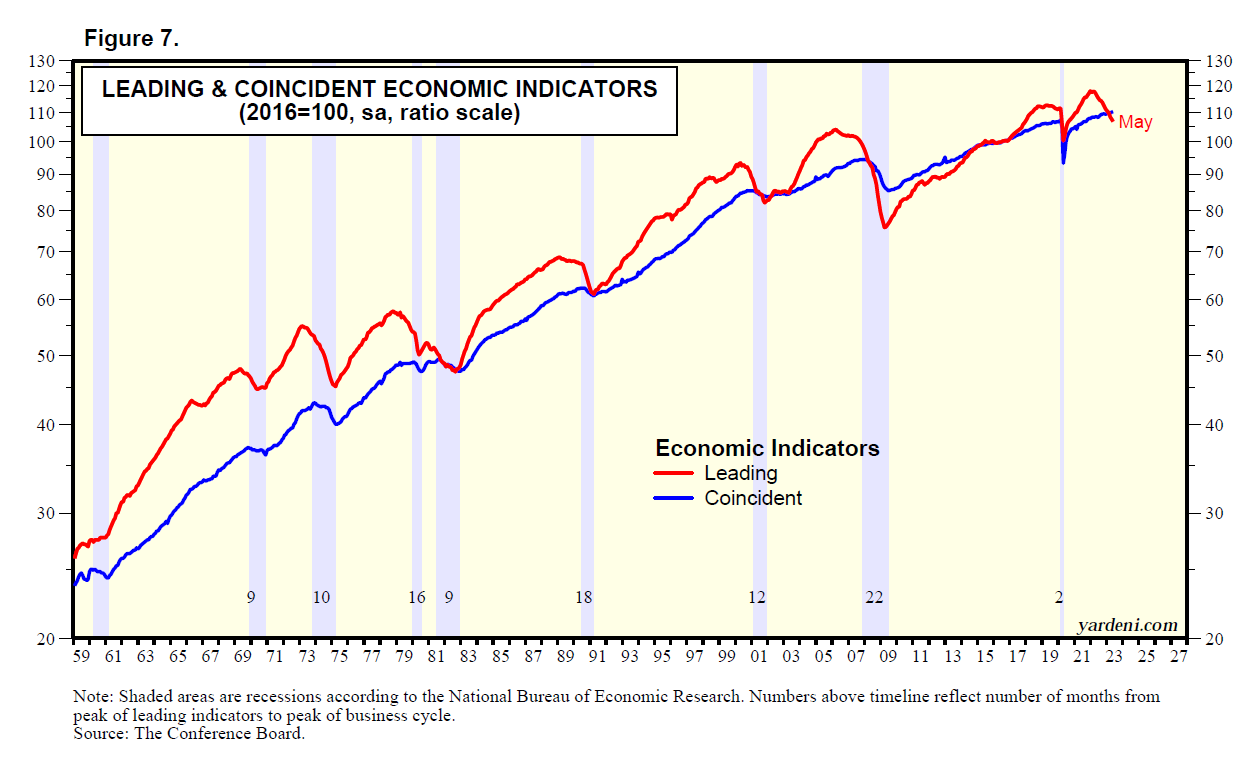

The Index of Leading Economic Indicators (LEI) peaked at a record high during December 2021 (Fig. 7). It is down 9.4% since then through May. The LEI correctly anticipated the previous eight recessions with an average lead time of 12 months.

We’ve previously shown that the LEI is biased, giving more weight to the manufacturing than the services sectors of the economy. The y/y percent change in the LEI (which was down 7.9% in May) closely tracks the M-PMI (which fell to 46.0 during June) (Fig. 8). Both are consistent with our rolling recession scenario, with the recession currently rolling through the goods sector. That’s confirmed by the weakness in the ATA truck tonnage index and railcar loadings of intermodal containers over the past year (Fig. 9).

(2) Inverted yield curve.

Melissa and I “wrote the book” on the yield curve in 2019. It is titled The Yield Curve: What Is It Really Predicting?. We concluded that inverted yield curves signal that investors believe that the Fed’s continued tightening of monetary policy would result in a financial crisis, which could turn into an economy-wide credit crunch and recession. It is credit crunches that cause recessions, not inverted yield curves that anticipate these events.

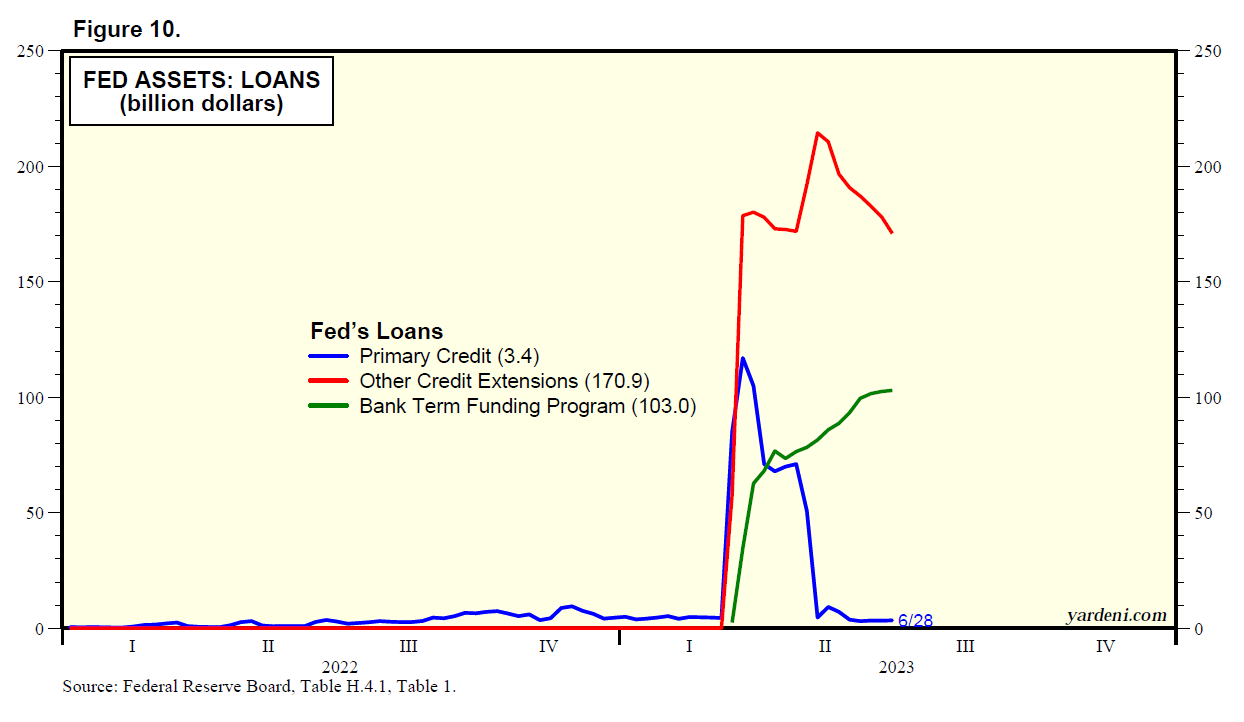

This time, the yield curve inverted last summer. It once again correctly anticipated a banking crisis, which occurred in March. What is different this time, so far, is that the Fed responded very quickly with an emergency bank liquidity facility, which has worked to avert an economy-wide run on the banks and a credit crunch, so far (Fig. 10).

So there has been no recession, so far. There still could be if the banking crisis slowly turns into a credit crunch. That’s why Melissa and I are closely monitoring the weekly commercial banks’ balance-sheet data (Fig. 11). They show that bank deposits peaked at a record $18.2 trillion during the week of April 13, 2022 and fell to $17.3 trillion during the June 21, 2023 week. Yet bank loans remained at a record high of $12.1 trillion during the June 21 week. Banks held a record $5.8 trillion in securities during the week of April 13, 2022. This sum has dropped by $645 billion to $5.2 trillion as the securities have matured. Banks are using the proceeds to offset the weakness in their deposits and to make loans.

(3) Declining M2.

Leer la noticia completa

Regístrese ahora para leer la historia completa y acceder a todas las publicaciones de pago.

Suscríbase a