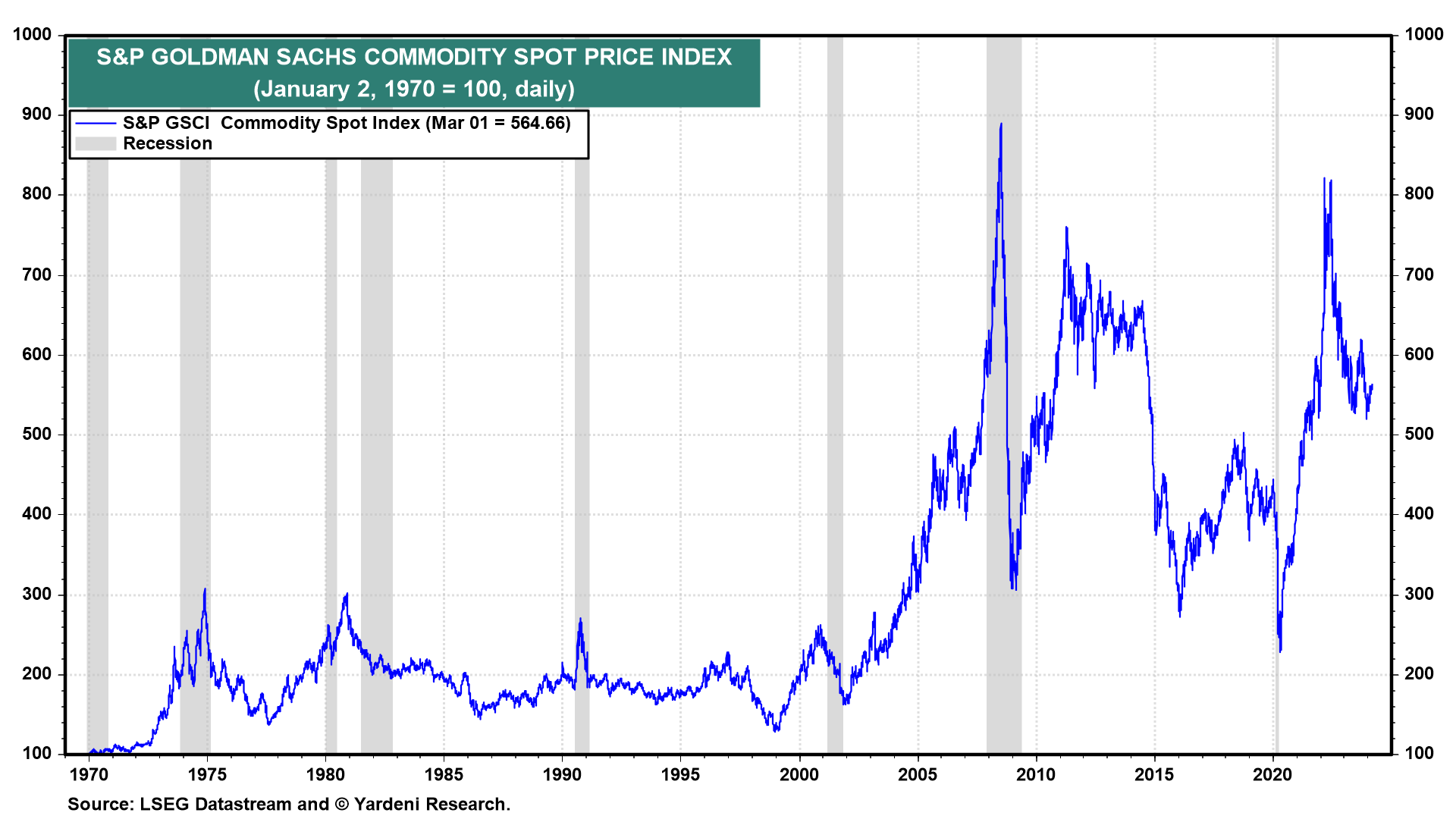

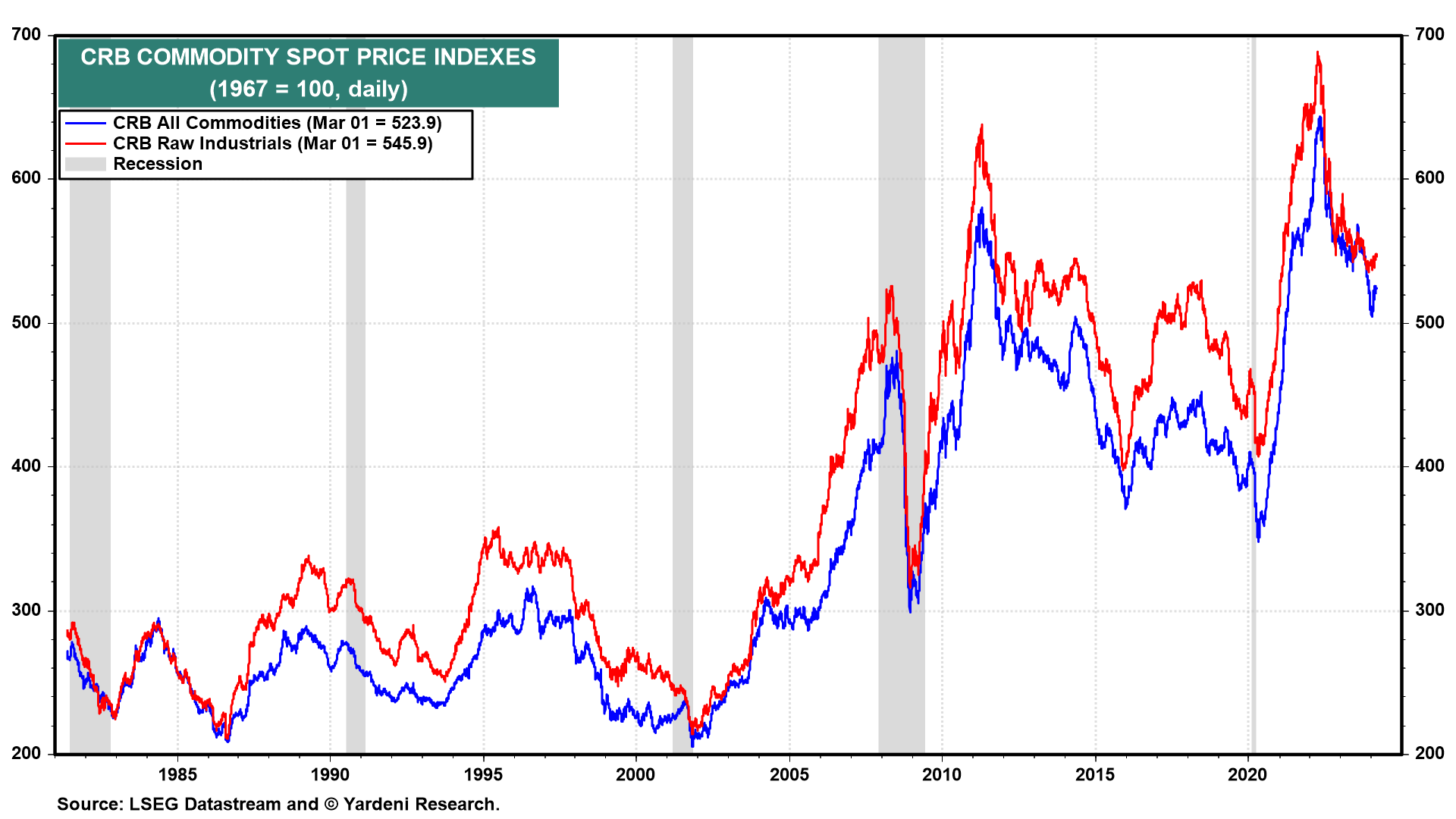

The UK and Japan are in recessions. Germany is on the edge of falling into a recession. China’s property bubble has burst, which is depressing the overall economy and weighing on other Asian economies. The weakness in the global economy is evident in commodity prices. The S&P Goldman Sachs Commodity Price index is down 31% from its March 8, 2022 peak (Fig. 1 below). The CRB raw industrials spot price index (which does not include energy commodities) is down 21% since its record-high peak on April 4, 2022 (Fig. 2 below).

Those peaks occurred when Russia invaded Ukraine in early 2022 and disrupted several commodity suppliers. The subsequent declines have reflected the slowing of global economic growth since then, though the declines haven’t been as severe as those associated with past global recessions. That’s because the US economy has been chugging along. As a result, the global economy has been muddling along. It is likely to continue to muddle along this year, while the US economy should continue to chug along.

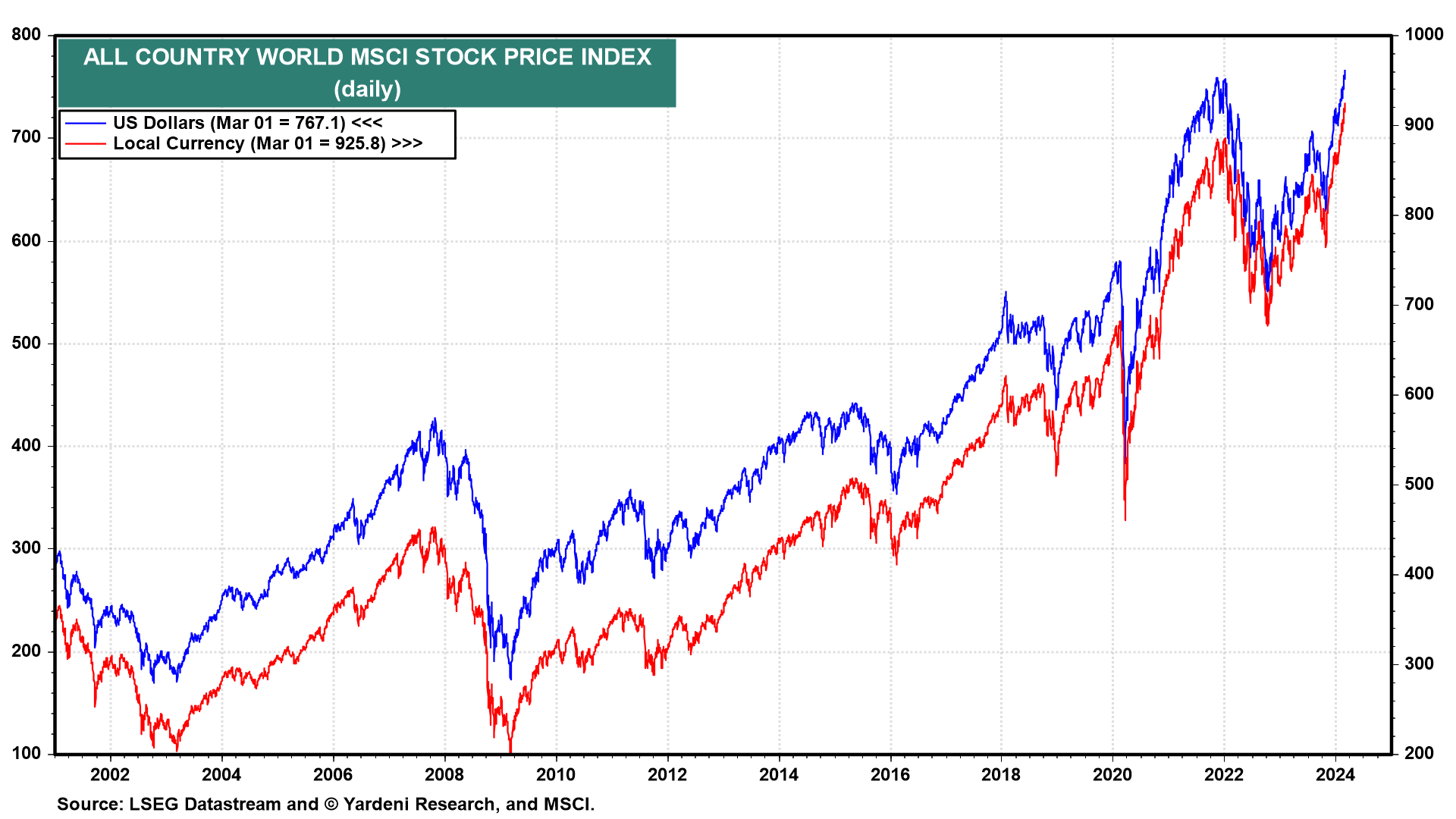

Yet global stock markets collectively are at a record high based on the All Country World MSCI stock price index (Fig. 3 below).

Here’s more:

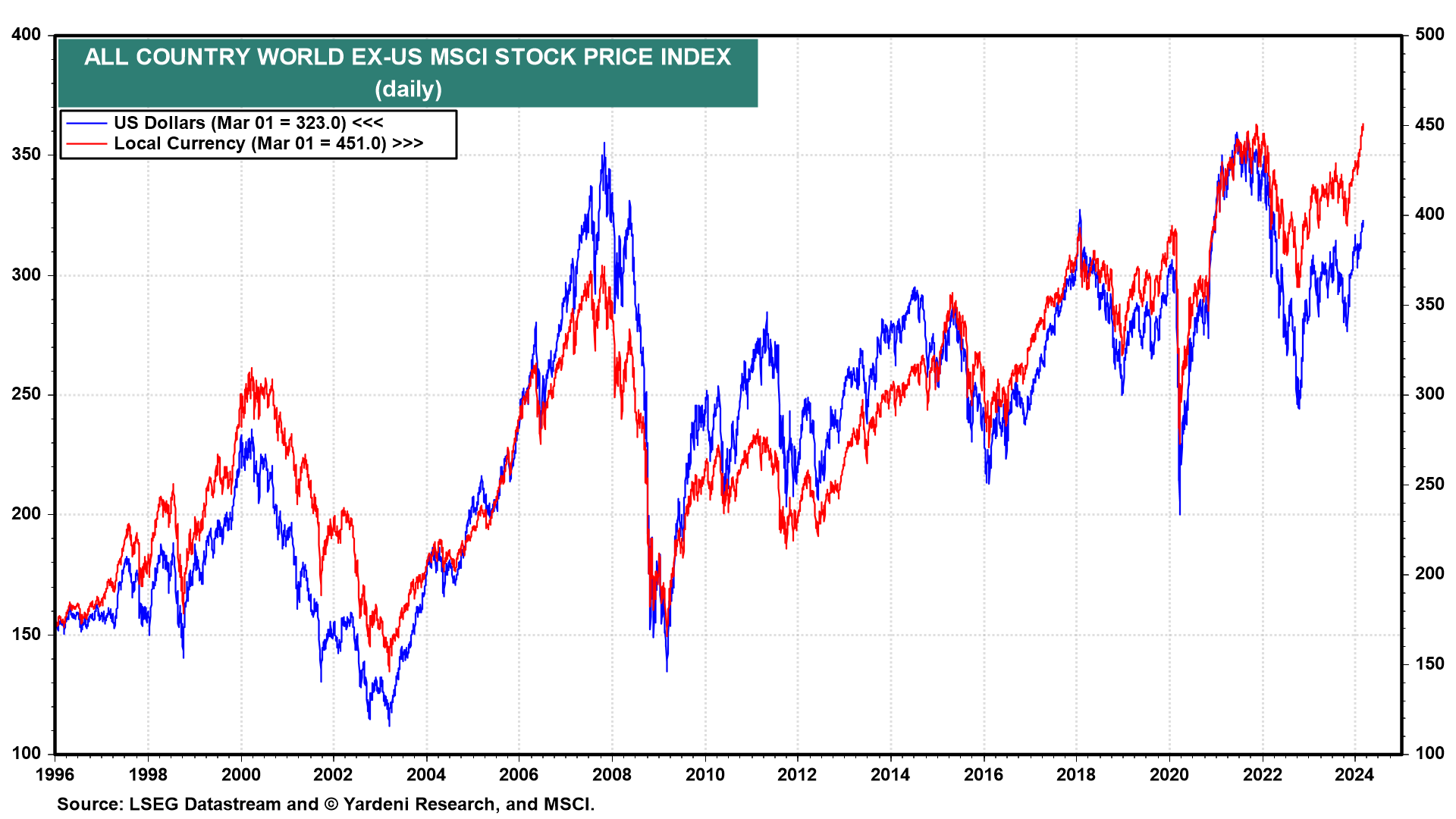

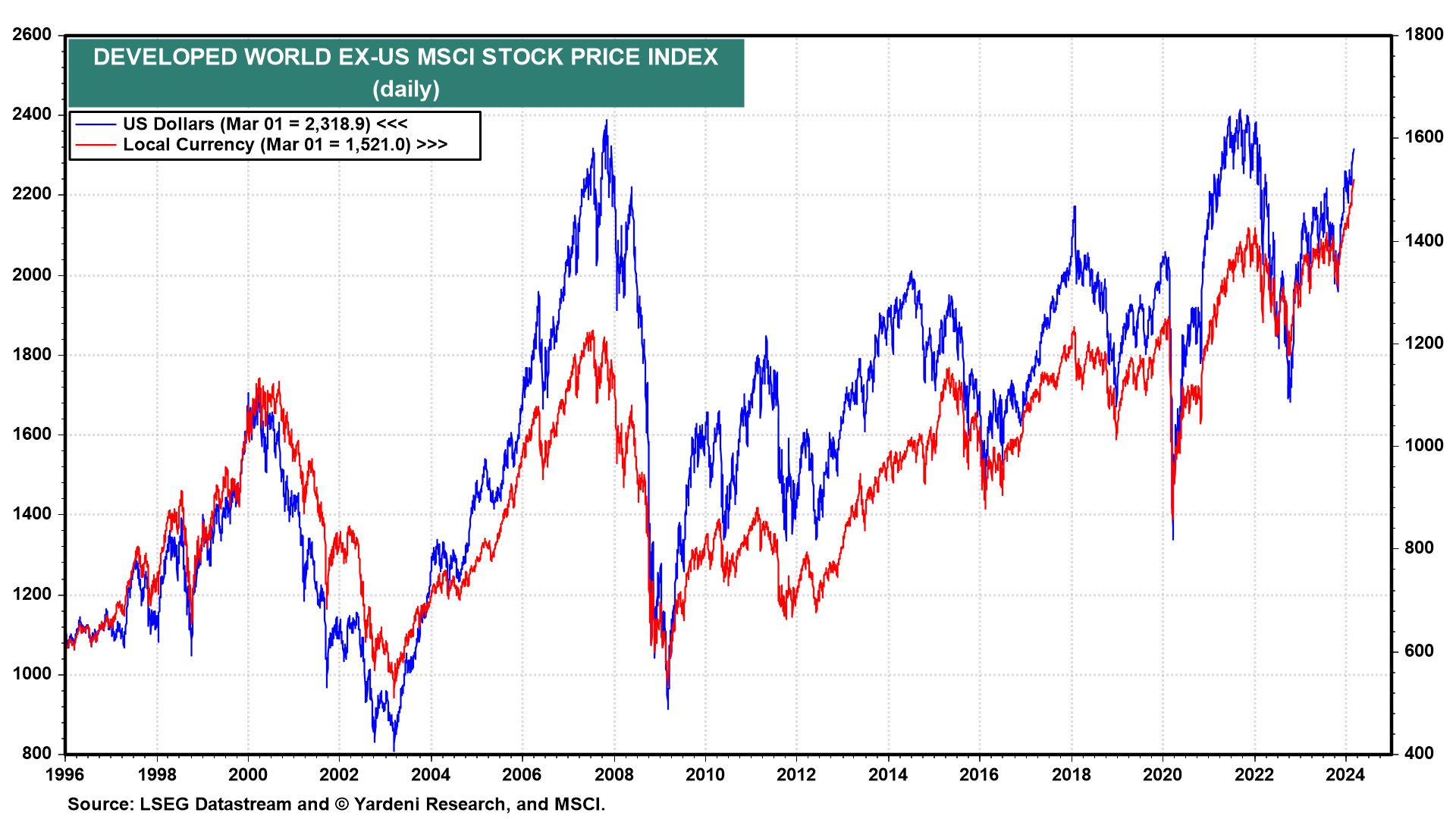

(1) Developed Country MSCI. Of course, the US MSCI has been leading the way. However, the ACW ex-US MSCI stock market index (in local currency) edged up to a new record high as well last week (Fig. 4 below). The Developed World ex-US MSCI stock price index (in local currency) has been rising in record territory since the end of last year (Fig. 5 below). Joining this index in the new-high festivities have been the MSCI indexes of Australia, Canada (almost at a new high), the EMU (led by France), Japan, and Sweden (almost at a new high).

Leer la noticia completa

Regístrese ahora para leer la historia completa y acceder a todas las publicaciones de pago.

Suscríbase a