Strategy I: Hoof Marks.

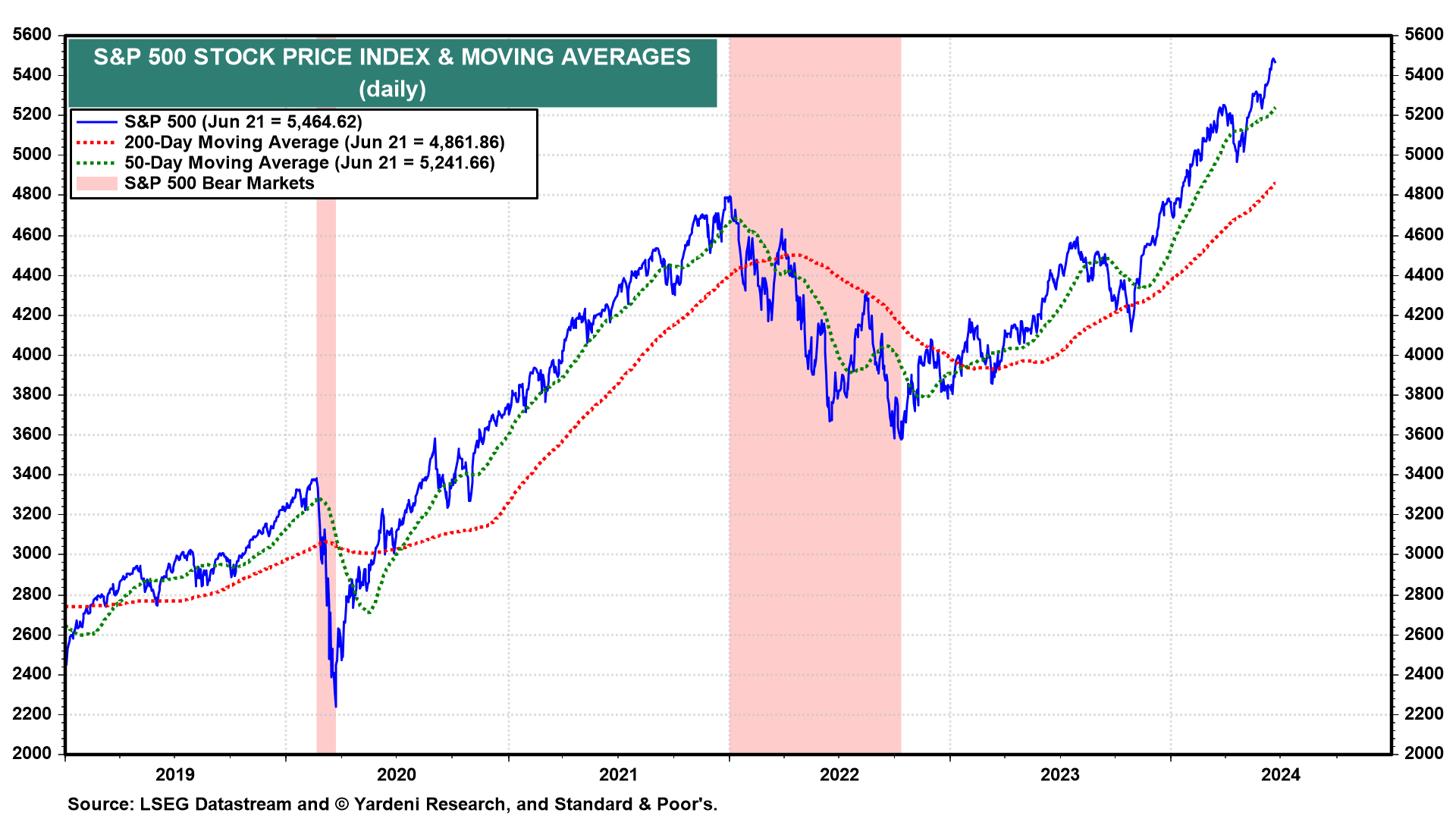

Even the bulls are getting trampled by the bull market in stocks. Many investment strategists are scrambling to raise their targets for the S&P 500. At the end of 2022, we predicted that the index would increase 20% from 3839 to 4600 by the end of 2023. It got there by the end of July of that year. We stuck to our target as a correction down to 4117 unfolded through October 27, 2023. The index rebounded to 4769 by the end of last year, slightly exceeding our target (Fig. 1 below).

At the end of last year, our year-end target for 2024 was 5400, which was among the most bullish forecasts out there. The index surpassed our target on June 12. It closed at 5464 on Friday.

Joe and I aren’t scrambling to raise our target. Instead, we are reiterating that the bull market is likely to continue through 2025 and 2026, with our year-end targets at 6000 and 6500, respectively. By the end of the decade, we see 8000 on the S&P 500. After all: It’s the Roaring 2020s, Baby! (Our Roaring 2020s thesis reflects our expectation that rising productivity growth, thanks to widespread adoption of new technologies in response to the shortage of skilled labor, will support robust growth in GDP and profits, while keeping a lid on inflation.)

A few strategists recently raised their year-end 2024 targets for the S&P 500 to 6000, with the hedge that the index, after reaching that level, might take a dive. We agree that the market is showing signs of a meltup that might be setting the stage for a meltdown. But if so, we think the meltdown would more likely be a rapid 10%-20% correction than an outright bear market (i.e., with a drop greater than 20% from the peak). That’s because we aren’t expecting a recession. Furthermore, the Fed Put is back now that consumer price inflation has fallen closer to the Fed’s 2.0% y/y target by the end of the year. If the stock market starts to fear that a recession is nearing, the Fed will most likely relieve that anxiety by easing.

By the way, on January 20, 2023, Bloomberg posted its list of Wall Street’s investment strategists with their outlook for S&P 500 year-end targets and earnings per share for the year. The averages were 4050 and $210; we had 4,600 and $225. On January 19 of this year, the averages were 4867 and $234; we were and still are at 5400 and $250. Our S&P 500 target for the end of this year was the highest of the lot.

Strategy II: Earnings & Valuation.

In a recent QuickTakes, we observed that an earnings-led meltup should be more sustainable than a valuation-led meltup. The meltup of the late 1990s was mostly a valuation-led one for the S&P 500 Information Technology sector. However, industry analysts joined the irrational exuberance party by raising their earnings estimates, especially for Information Technology companies back then.

Currently, the valuation multiple of Information Technology is elevated, but not as much as it was during the late 1990s. This time, earnings expectations are also rising for Information Technology, but they look to be based on more solid fundamentals than during the dot.com frenzy of the late 1990s.

Let’s have a closer look at the outlook for the broad market before turning to a comparison of the 1990s and now:

Leer la noticia completa

Regístrese ahora para leer la historia completa y acceder a todas las publicaciones de pago.

Suscríbase a