Joe has been tracking the quarterly earnings forecast for S&P 500 companies collectively each week since the series started in Q1-1994.

The typical playbook: Industry analysts cut their estimates gradually until reality sets in during the final month of the quarter, when some companies warn of weaker results. The combination of falling forecasts for companies that have underperformed earlier expectations, steady forecasts for those holding good news close to their vests, and insufficient estimate increases so close to reporting time to balance out the lowered expectations invariably creates an “earnings hook” pattern in the charted estimate/actual data as reported earnings exceed the latest estimates—i.e., a positive earnings surprise. In other words, the final month of quarters usually sets the stage for better-than-expected earnings reports.

What does the consensus forecast data say about the upcoming Q2 earnings reporting season? Interestingly, the playbook was discarded. Joe explains:

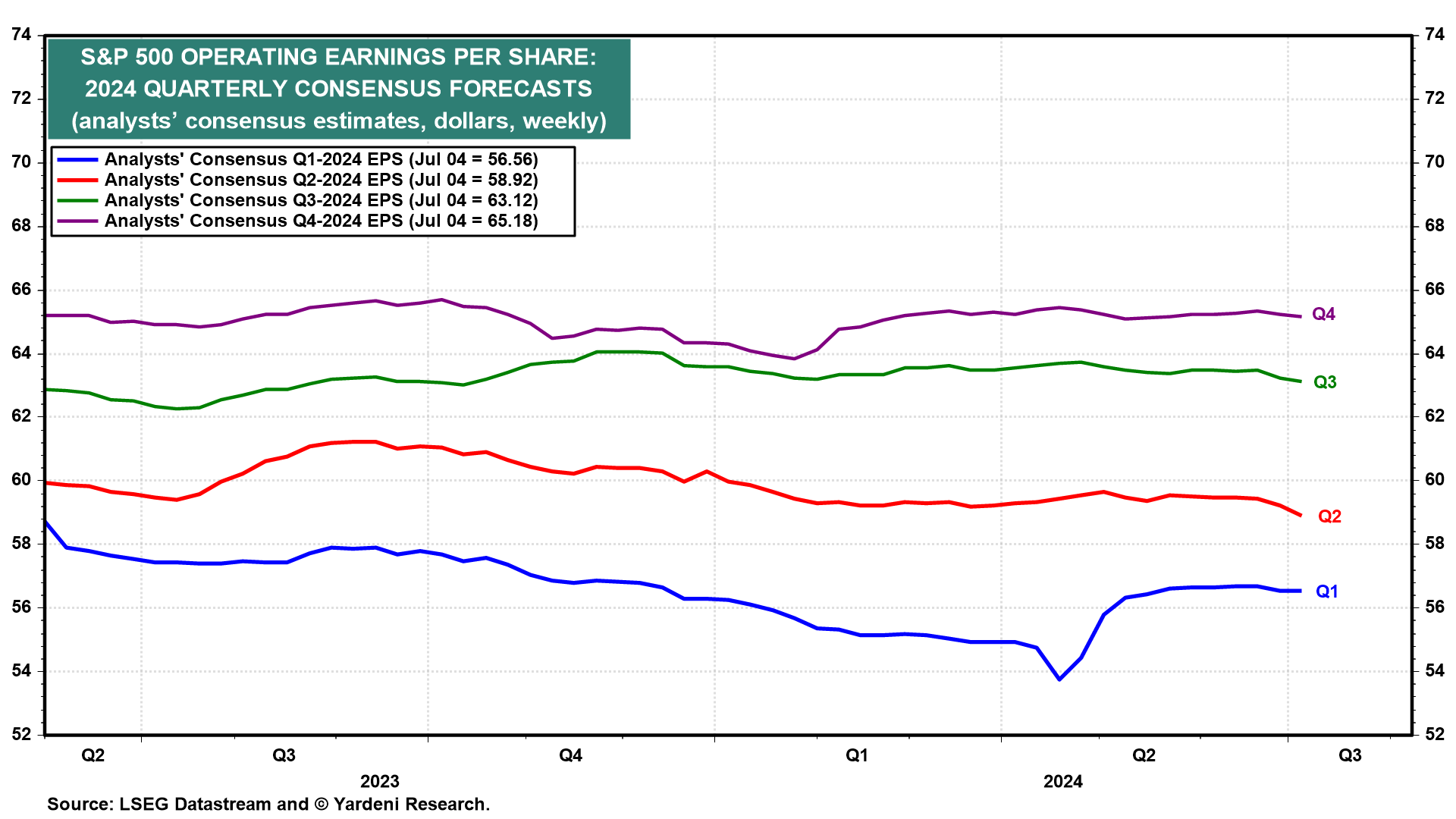

(1/5) Q2 estimate unchanged over the course of the quarter. The S&P 500’s Q2-2024 EPS estimate of $59.22 didn’t change from the start to the end of the quarter (Fig. 14 below). Typically, there’s a decline as the quarter progresses (a 2.4% drop for Q1-2024, a 5.9% drop for Q4-2023, and an average decline of 4.0% in the 120 quarters since consensus quarterly forecasts were first compiled in 1994). The quarter’s 0% change is great news and implies yet another strong earnings surprise.

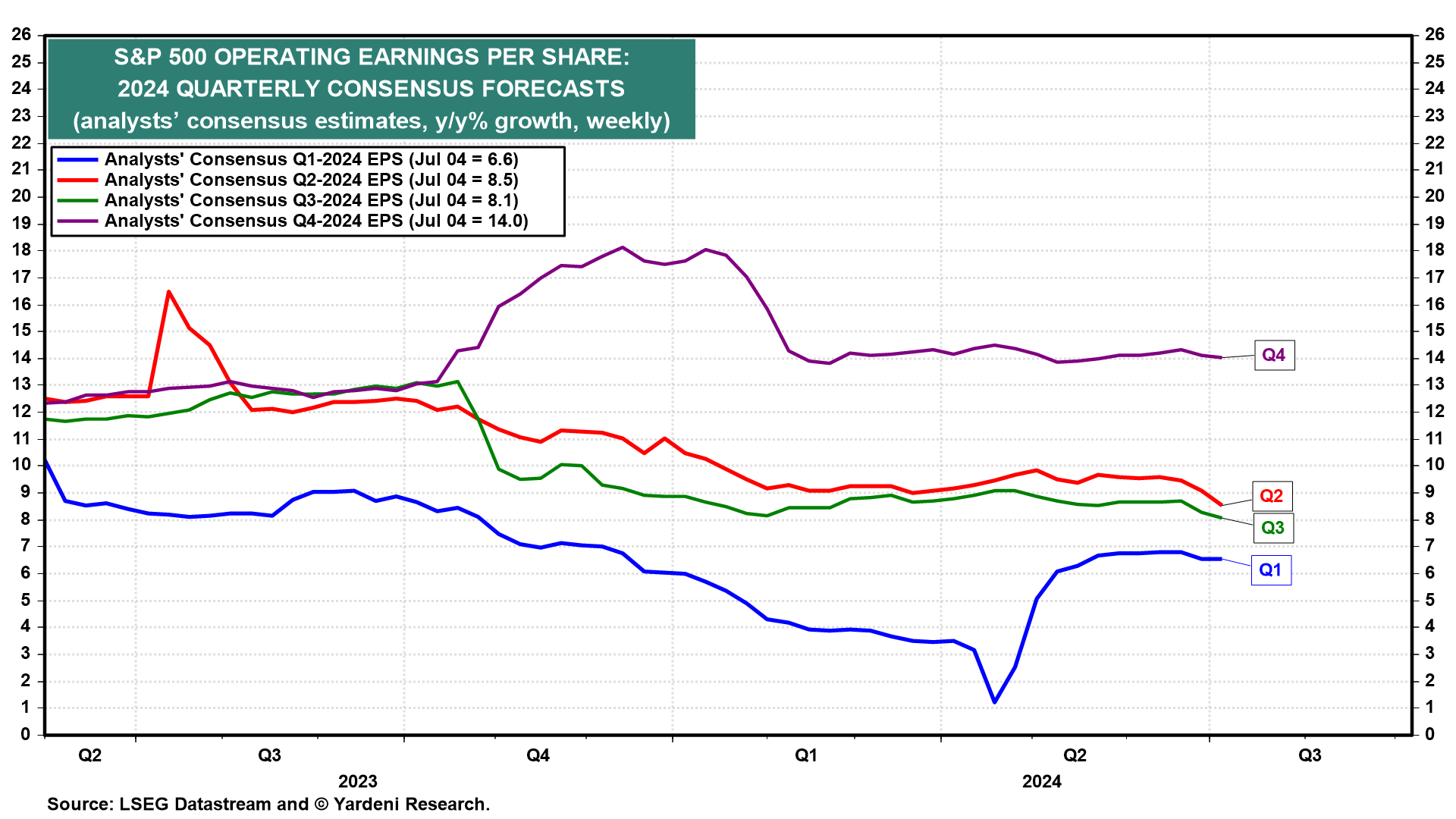

In Q2-2024, analysts expect the S&P 500’s earnings growth rate to be positive on a frozen actual basis for a fourth straight quarter following three y/y declines through Q2-2023. Their 8.5% y/y growth expectation for Q2-2024 compares to 6.6% y/y growth in Q1-2024, 7.5% in Q4-2023, 4.3% in Q3-2023, -5.8% y/y in Q2-2023, -3.1% in Q1-2023, and -1.5% in Q4-2022 (Fig. 15 below). On a pro forma basis, they expect a fourth straight quarter of positive y/y growth as well, with earnings forecasted to rise 10.1% (versus 8.2%, 10.1%, 7.5%, -2.8%, 0.1%, and -3.2% for the previous six quarters). When the dust finally clears on the Q2-2024 earnings season, we think y/y growth has an even chance of crossing into the double-digit percentage territory on both bases.

Leer la noticia completa

Regístrese ahora para leer la historia completa y acceder a todas las publicaciones de pago.

Suscríbase a