This morning's CPI report showed inflation continues to moderate. Nevertheless, stock prices initially fell sharply on the news. While the headline CPI was up 0.2% m/m as expected, the core rose 0.3% instead of the expected 0.2%. That minor difference convinced lots of traders that the Fed would cut the federal funds rate (FFR) by 25bps rather than 50bps on September 18.

Nevertheless, the markets still seem to expect two more rate cuts after that one, including a possible 50bps cut, before the end of the year. They might be similarly disappointed by stronger-than-expected economic indicators up ahead, as we've discussed recently. We reckon that the S&P 500 may remain choppy through the November 5 elections before resuming its climb to new record highs, assuming neither political party wins a sweep. In any event, the stock market's hissy fit seemed to be over by mid-day today.

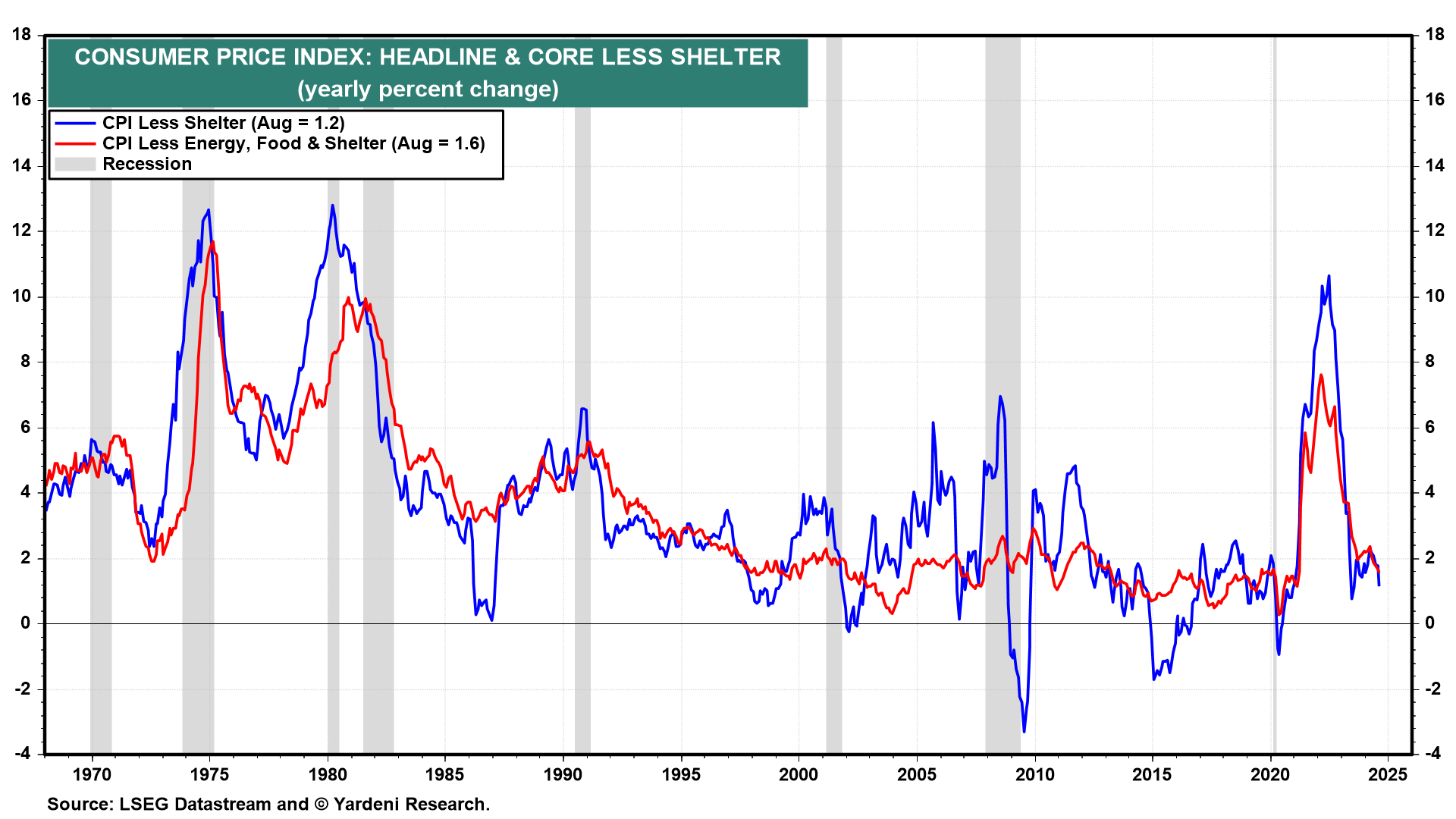

The headline and core CPI increased 2.5% y/y and 3.2% y/y in August. Excluding shelter, they were down to 1.2% and 1.6% (chart). This supports our long-held view that the Fed's preferred PCED inflation rate should reach 2.0% by the end of this year.

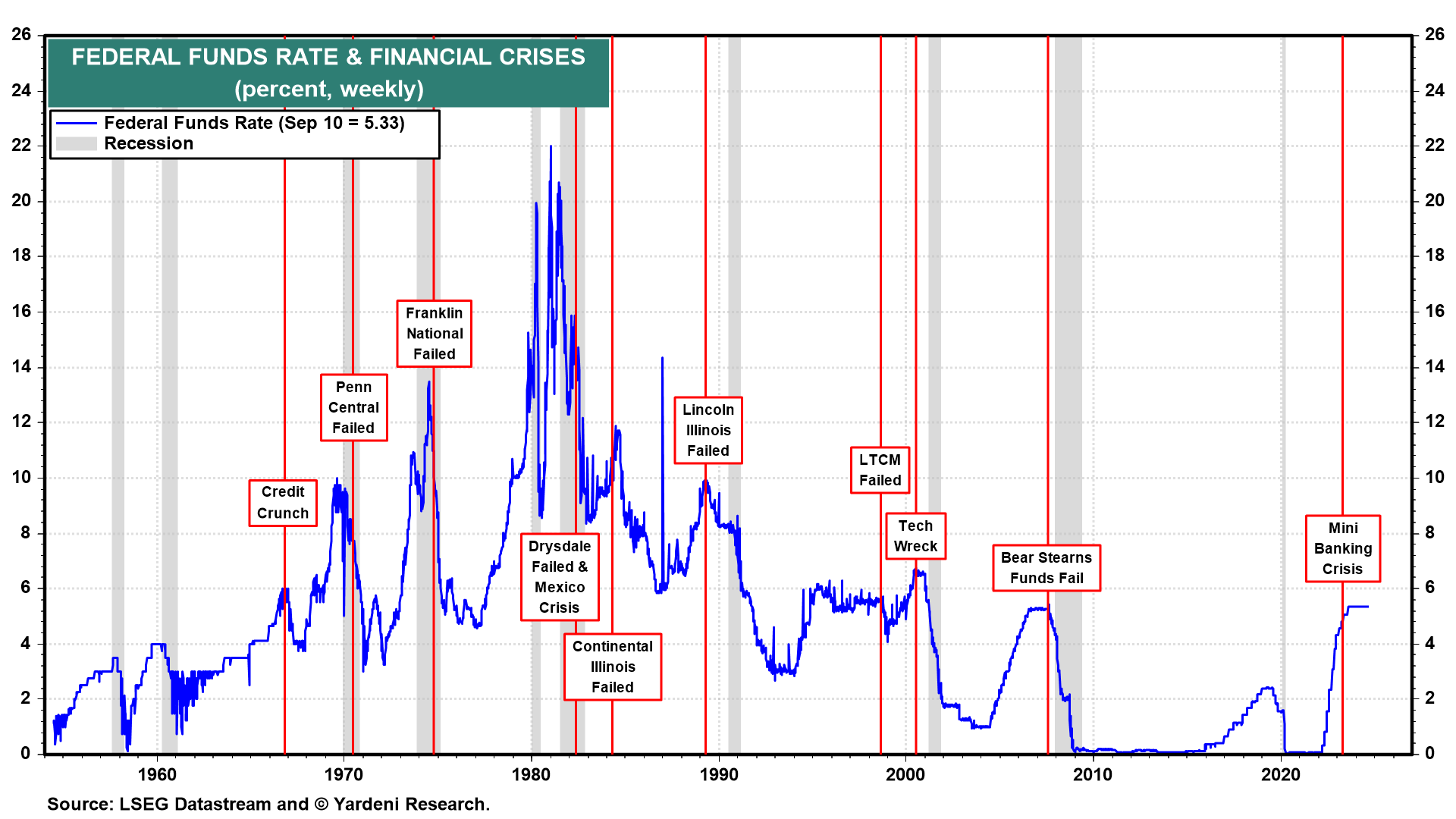

So why shouldn't Fed officials declare "mission accomplished" and start cutting the FFR in large 50 basis point increments at each of the three remaining FOMC meetings this year? In the past, monetary easy cycles entailed large and numerous rate cuts because the Fed was responding to a financial crisis that quickly turned into a credit crunch and a recession (chart). This time is different so far because there has been no credit crunch and no recession. This time the Fed is aiming to avert a recession, which is likely to require fewer rate cuts to accomplish.

Let's have a closer look at today's CPI:

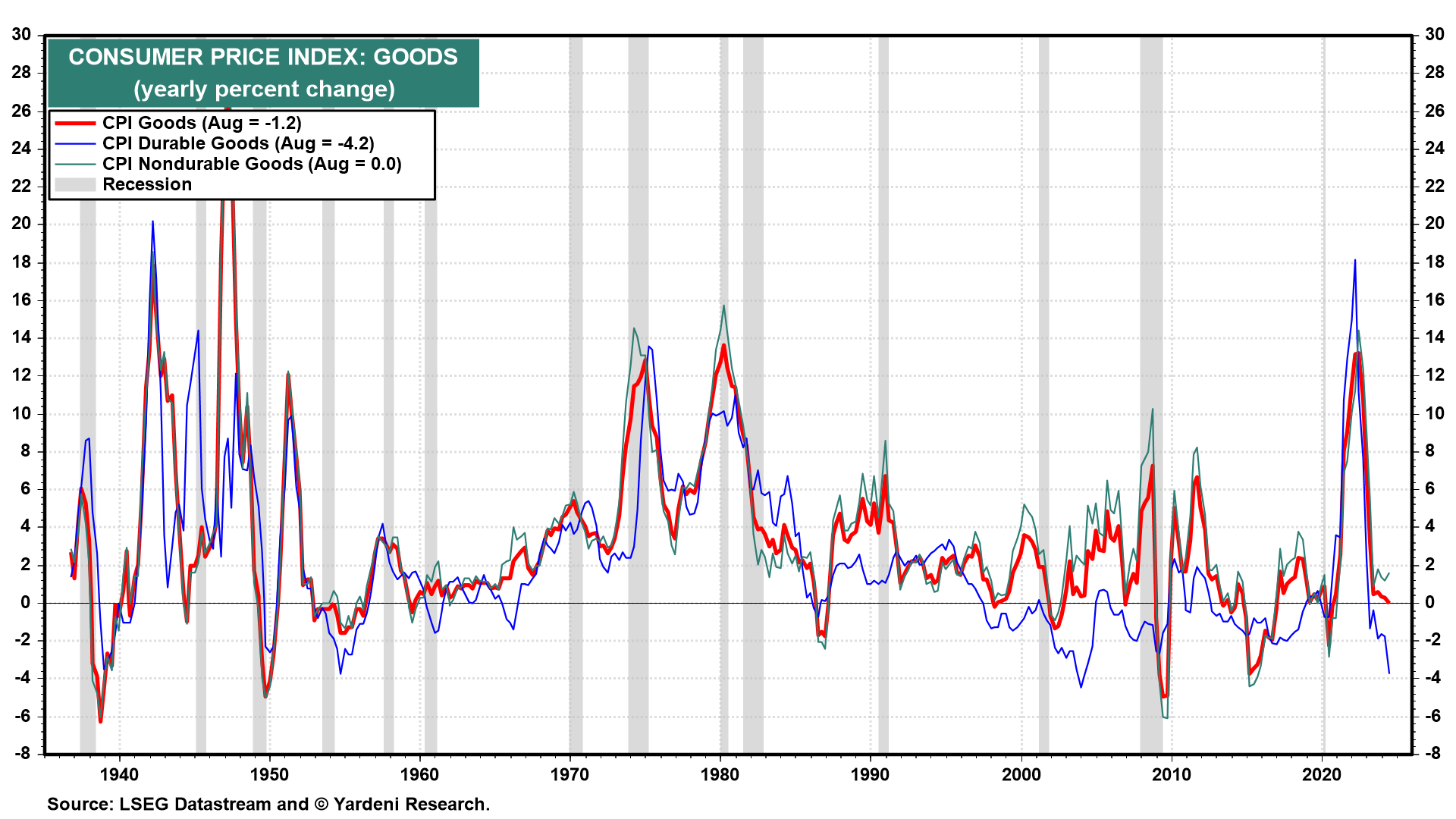

(1) Goods & energy. Two important sources of downward pressure on inflation have been consumer goods and energy prices. As we discussed in yesterday's QuickTakes, China's dumping of cheap exports is helping deflate goods prices in the US (chart). Consumers' demand for long-lasting goods is also weak after they loaded up on things like appliances and furniture during the pandemic. China's recession has also reduced oil demand, lowering gasoline prices by 10.3% y/y in August.

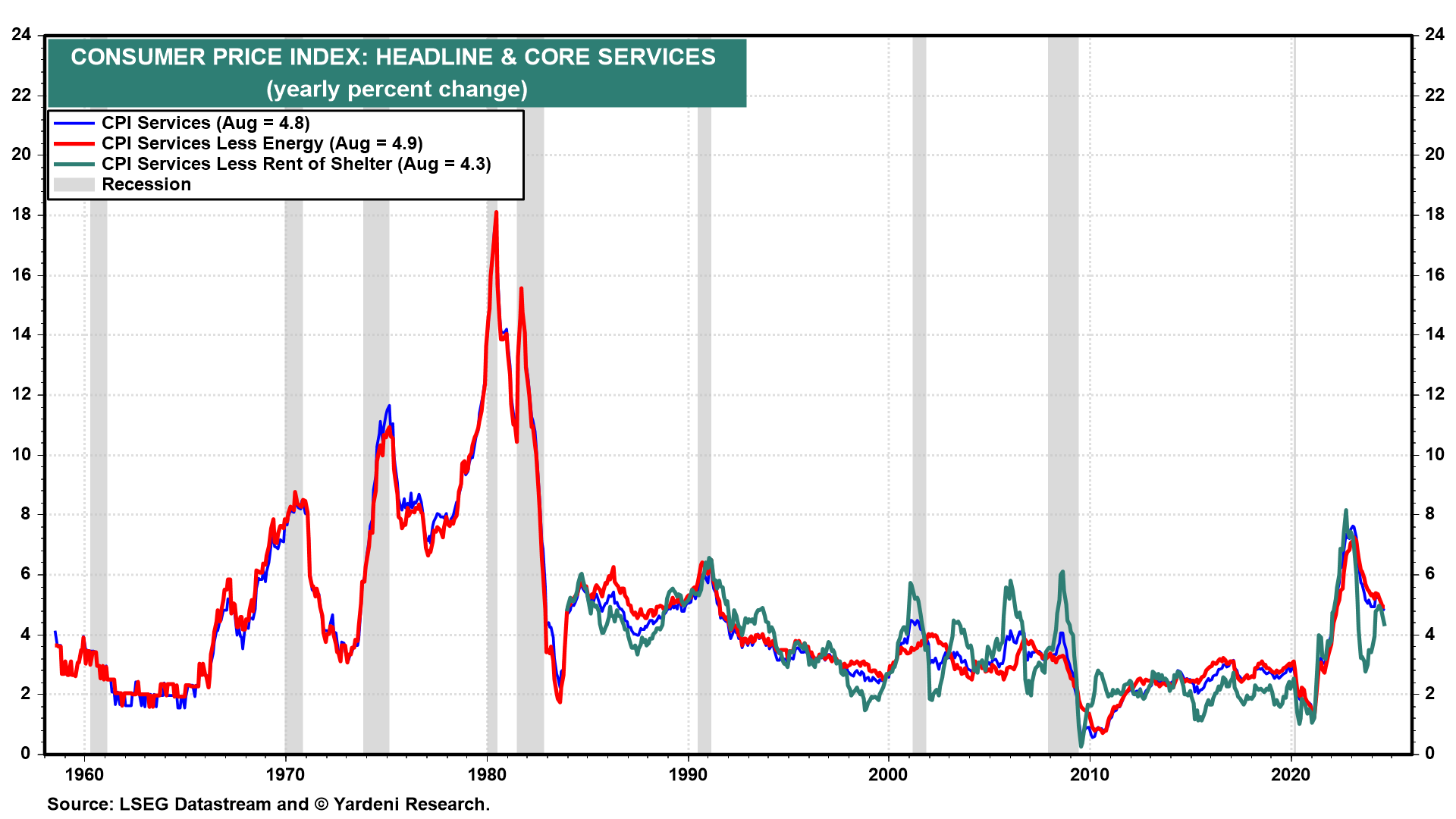

(2) Growth & services. We think the primary reason the Fed will not cut as much as the market expects is because US real GDP growth will remain strong. We see a healthier labor market and better productivity growth backdrop than most. Resilient consumer spending could continue to boost services prices. CPI services rose 4.8% in August, and even after removing shelter, was still up 4.3% (chart).

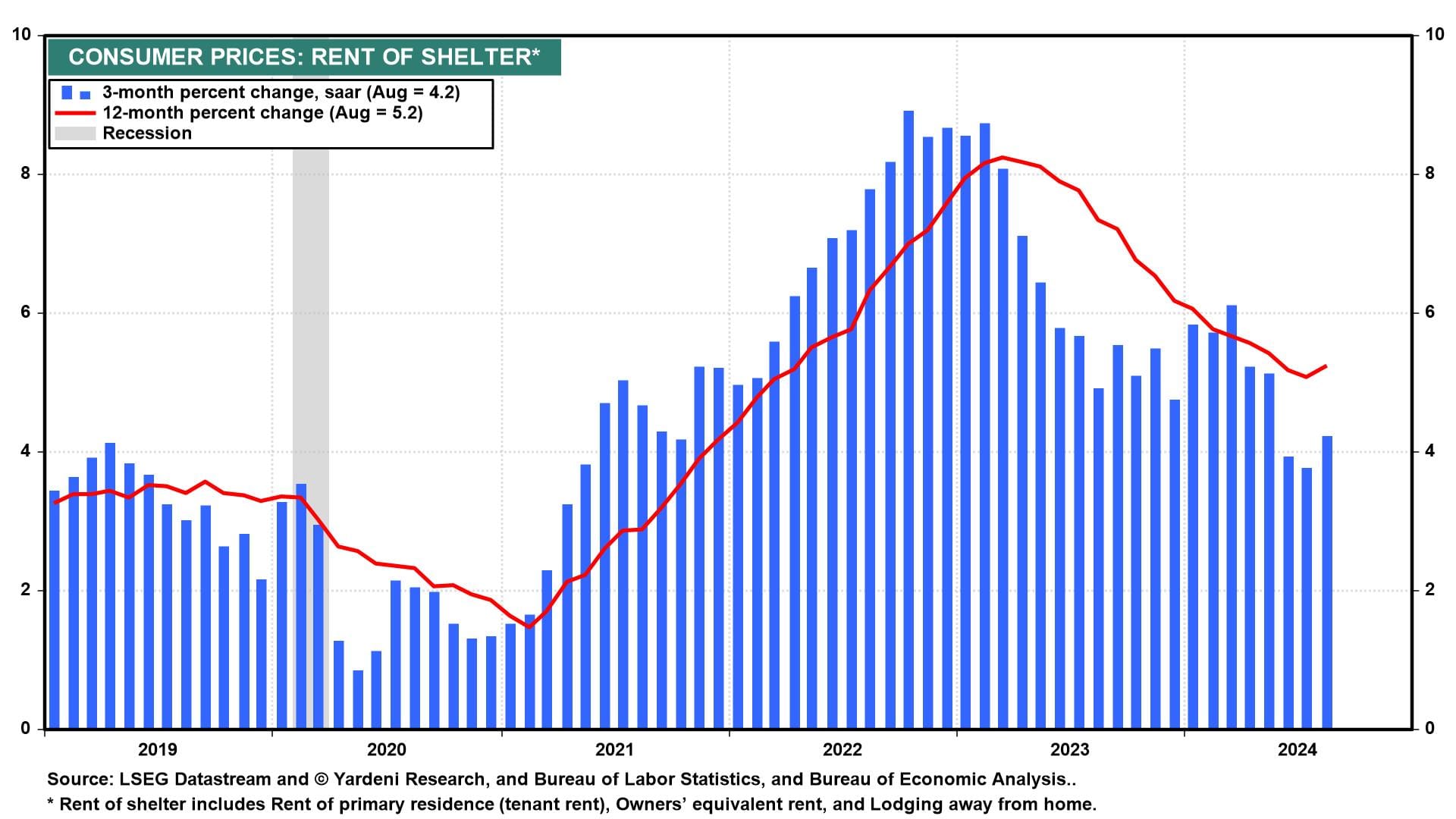

(3) Housing. New market rents point to shelter inflation falling. The way the Bureau of Labor Statistics calculates housing inflation is quirky and lagging. But shelter inflation reheated 0.5% m/m in August, its highest since January. So shelter prices rebounded to 5.2% y/y after moderating for several consecutive months (chart).

Sticky shelter inflation could put a floor under how low CPI inflation can go, despite more chatter recently that if the Fed does not cut the FFR swiftly, CPI inflation will turn into deflation. Along with stronger-than-expected growth data, that should lead to a measured and gradual pace of Fed rate cuts.