August's CPI unnerved the stock market because its core inflation rate was higher than expected. August's PCED will be released on September 30 and is likely to show a lower rate of inflation. Consider the following:

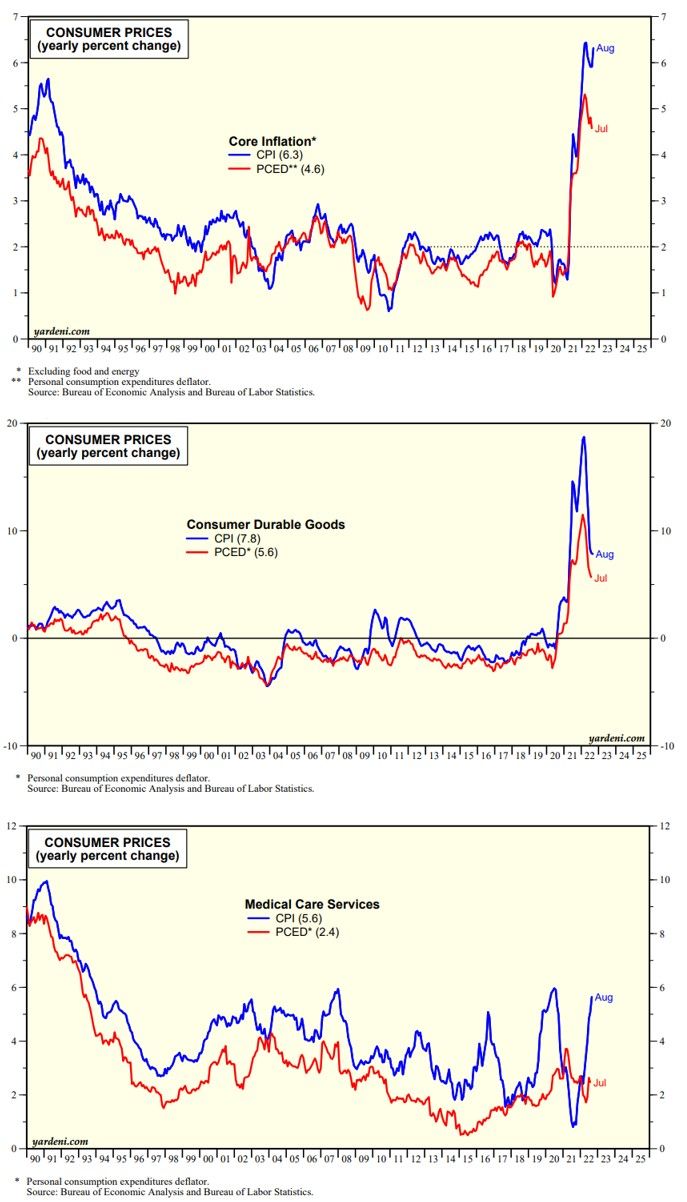

(1) The core CPI inflation rate tends to be higher than the core PCED. That's because the inflation rates of both durable goods (especially furniture & bedding) and medical care services (especially hospitals) tend to run hotter in the former compared to the latter (charts below).

(2) Medical care services inflation in the CPI reflects the out-of-pocket outlays of consumers. The PCED category also reflects the prices of medical care services funded by the government, which negotiates lower prices for such services.

(3) Rent inflation has been rising more rapidly in recent months. It tends to be identical in both the CPI and PCED. However, it has a higher weight in the former than in the latter. The current weights of OER and tenant rent components of the headline CPI are 24% and 7%, respectively, and those of the headline PCED are 11% and 4%. The combined weights for tenant rent and OER are unrealistically high in the CPI at 31% but about right in the PCED at 15%.

(OER is a bizarre concept reflecting how much homeowners would have to pay themselves in rent if they were their own landlords.)