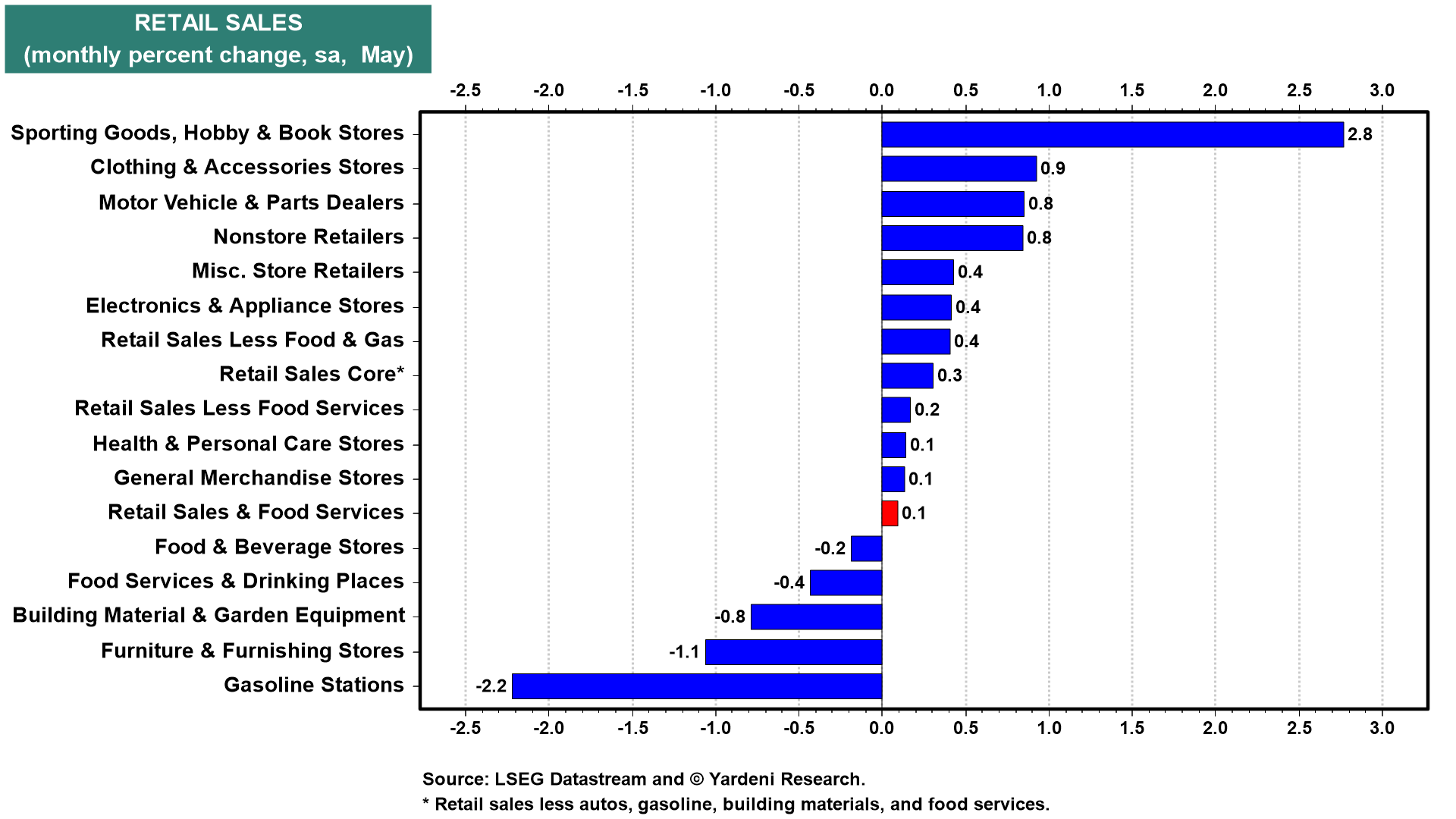

May's retail sales, including food services, rose just 0.1% m/m, weaker than expected (chart). That's in current dollars. Adjusted for inflation, they were not as weak. CPI goods fell 0.1% m/m during May. So real retail sales, less food services, rose 0.3%. Much of the recent weakness in retail sales has been in housing-related merchandise since housing sales remain weak.

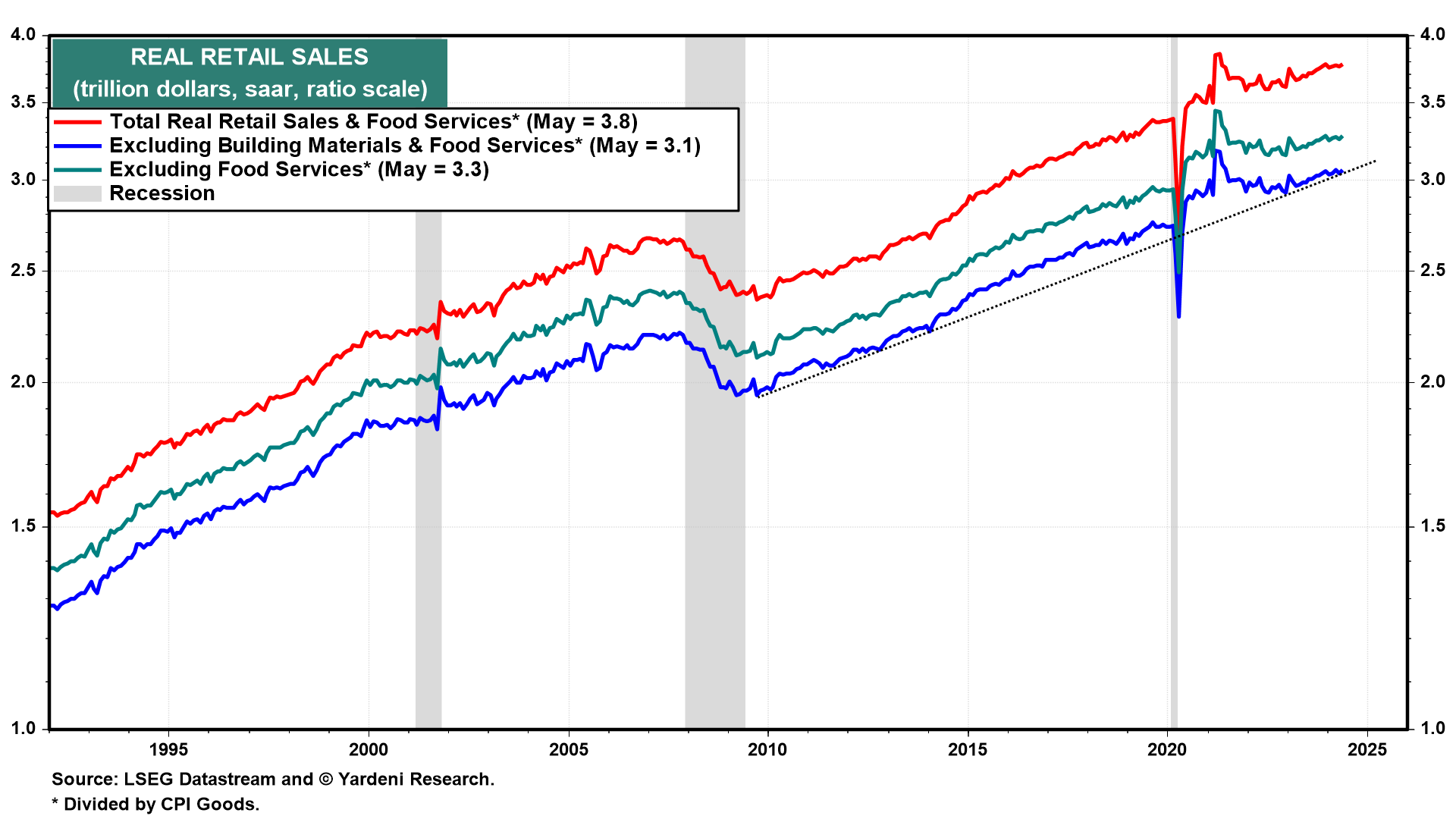

Real retail sales has stalled in recent months, but remains on its pre-pandemic uptrend (chart). Nevertheless, the Atlanta Fed's GDPNow tracking model currently shows real consumer spending (on both goods and services) rising 2.5% (saar) during Q2, down slightly from the previous estimate of 2.8%. The model is tracking Q2's real GDP at 3.1%.

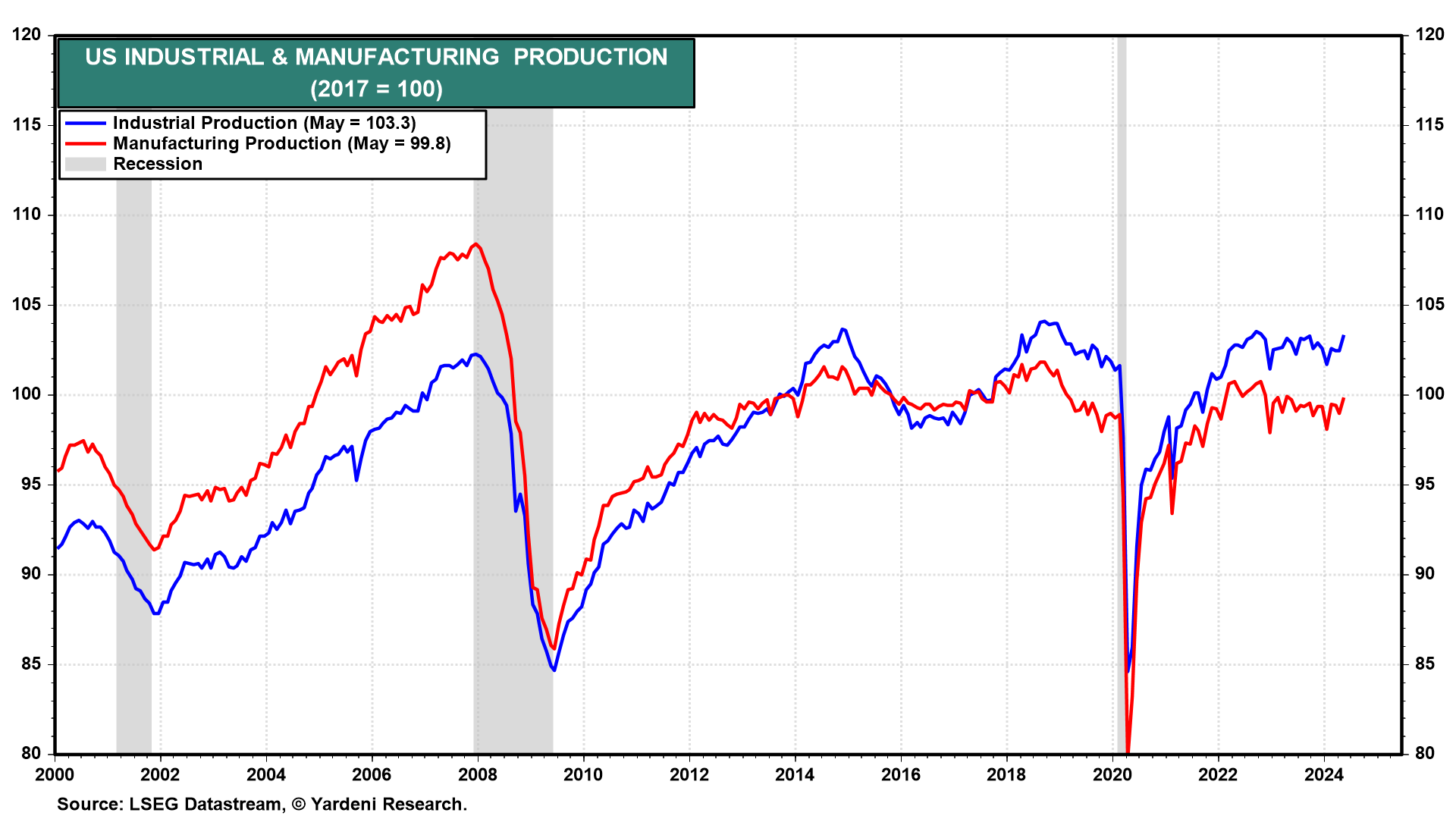

Meanwhile May's industrial production jumped 0.9% m/m (chart). Manufacturing output also rose 0.9%. Among the strongest industries were appliances & furniture (3.9%), petroleum & coal products (2.8), chemical products (1.9), textile & product mills 1.6), durable goods (1.3), defense & space (1.0), and information processing (1.0).

Now for the bad news: The nonpartisan Congressional Budget Office (CBO) revised its federal budget deficit estimate for fiscal-year 2024 to $1.9 trillion (6.7% of GDP) from $1.5 trillion (5.4% of GDP) in February. That's up from $1.7 trillion (6.3% of GDP) last fiscal year.

Leer la noticia completa

Regístrese ahora para leer la historia completa y acceder a todas las publicaciones de pago.

Suscríbase a