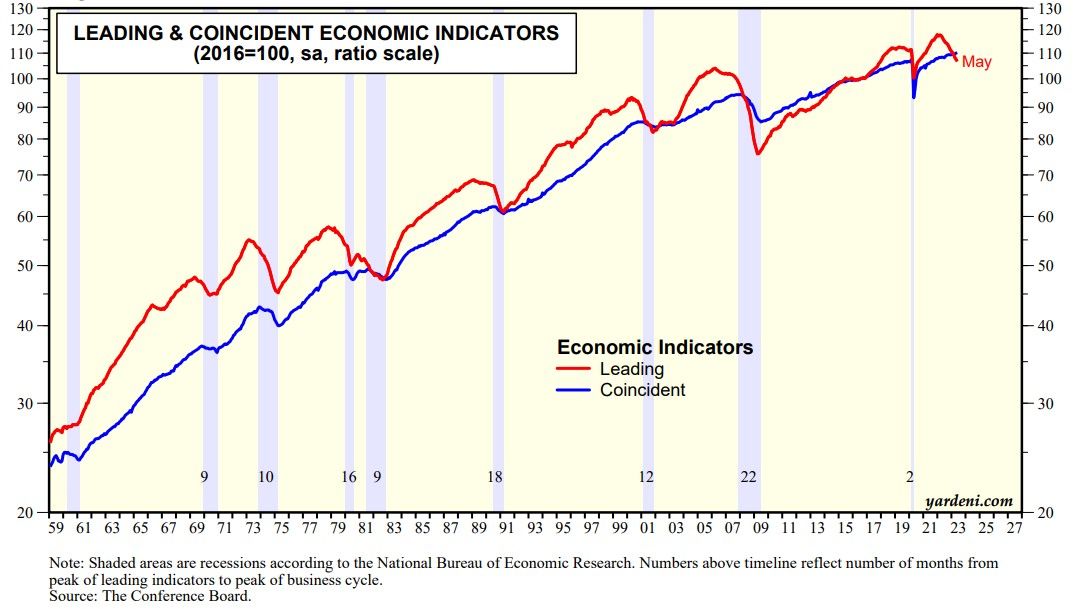

The Index of Leading Economic Indicators (LEI) peaked at a record high during December 2021. It dropped 0.7% m/m in May and declined for the 14th month in a row, but there’s still little evidence the US is headed toward recession. Indeed, the Index of Coincident Economic Indicators (CEI) edged up by 0.2% m/m during May to yet another record high (chart). The Conference Board, which compiles both the LEI and CEI, is still anticipating a recession, but now it starts during Q3-2023 and lasts through Q1-2024. We still believe that we have been in a rolling recession, making an economy-wide recession less likely.

Data from the Bureau of Labor Statistics on Thursday showed 264,000 new claims were filed for jobless benefits on a seasonally adjusted basis in the week ended June 17, unchanged from the prior week's upwardly revised level, which is the highest level of initial claims activity since October 2021 (chart). The monthly jobless series is one of the 10 components of the LEI. However, job openings still remain very high.

Leer la noticia completa

Regístrese ahora para leer la historia completa y acceder a todas las publicaciones de pago.

Suscríbase a