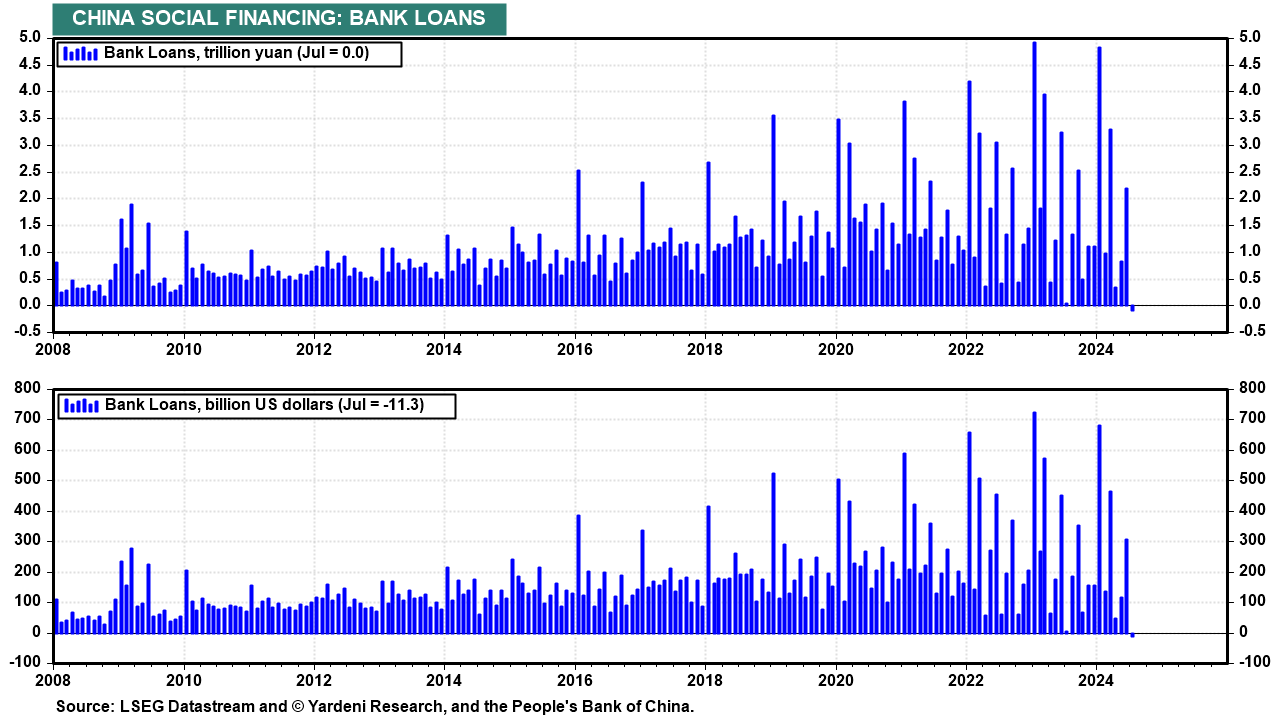

China's economy is faltering. July data suggest the government will have to provide more stimulus to meet its 5% economic growth target for the year. Most striking is the small but unusual decline in bank loans during the month (chart). It suggests a lack of confidence among businesses and consumers, potentially leading to reduced investment and spending.

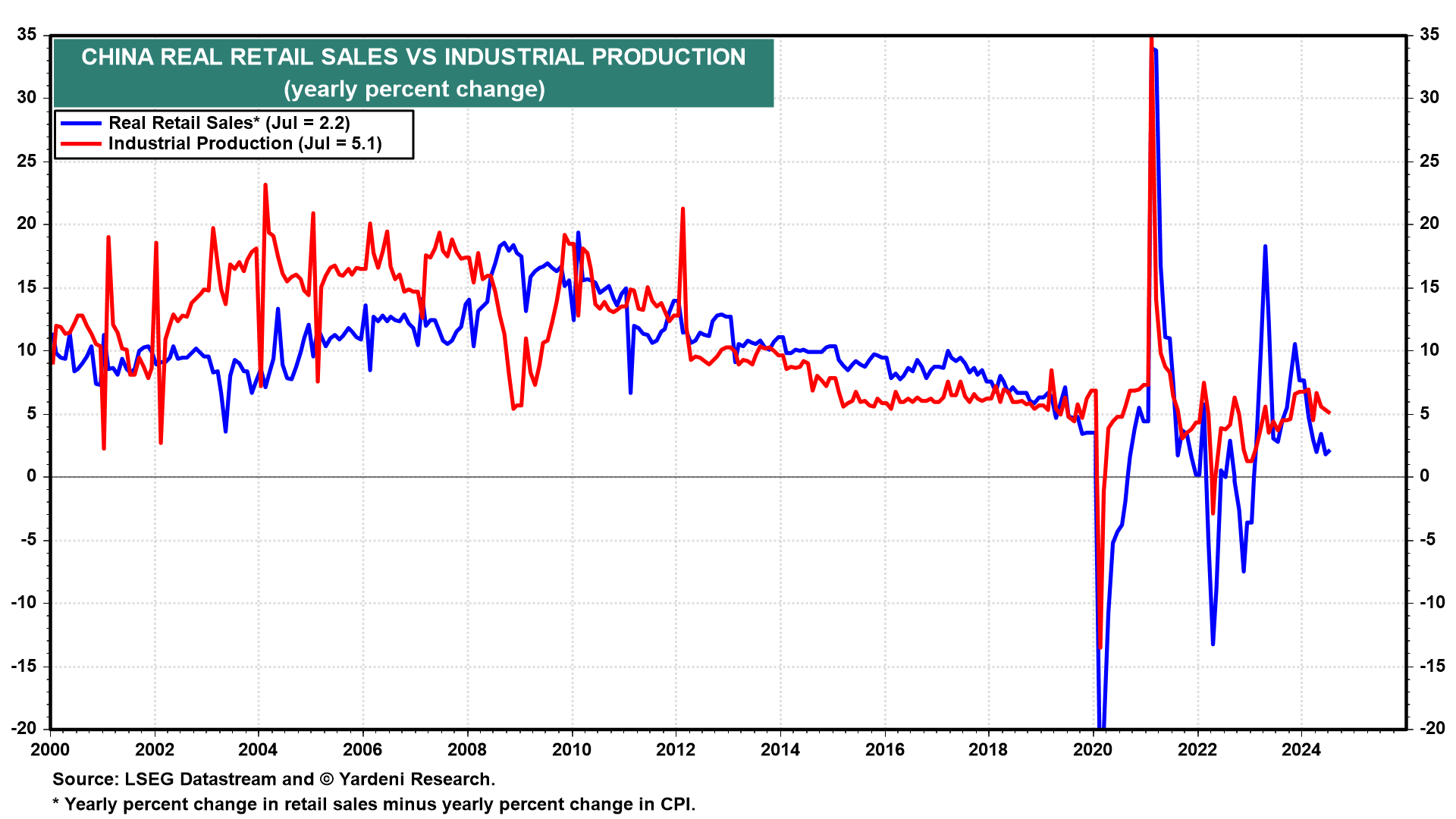

China's real retail sales rose just 2.2% y/y during July, well below the 5.1% y/y increase in its industrial production (chart). The excess production is getting exported, which has other countries protesting that China is dumping goods in global markets and exporting deflation, which is what it is doing.

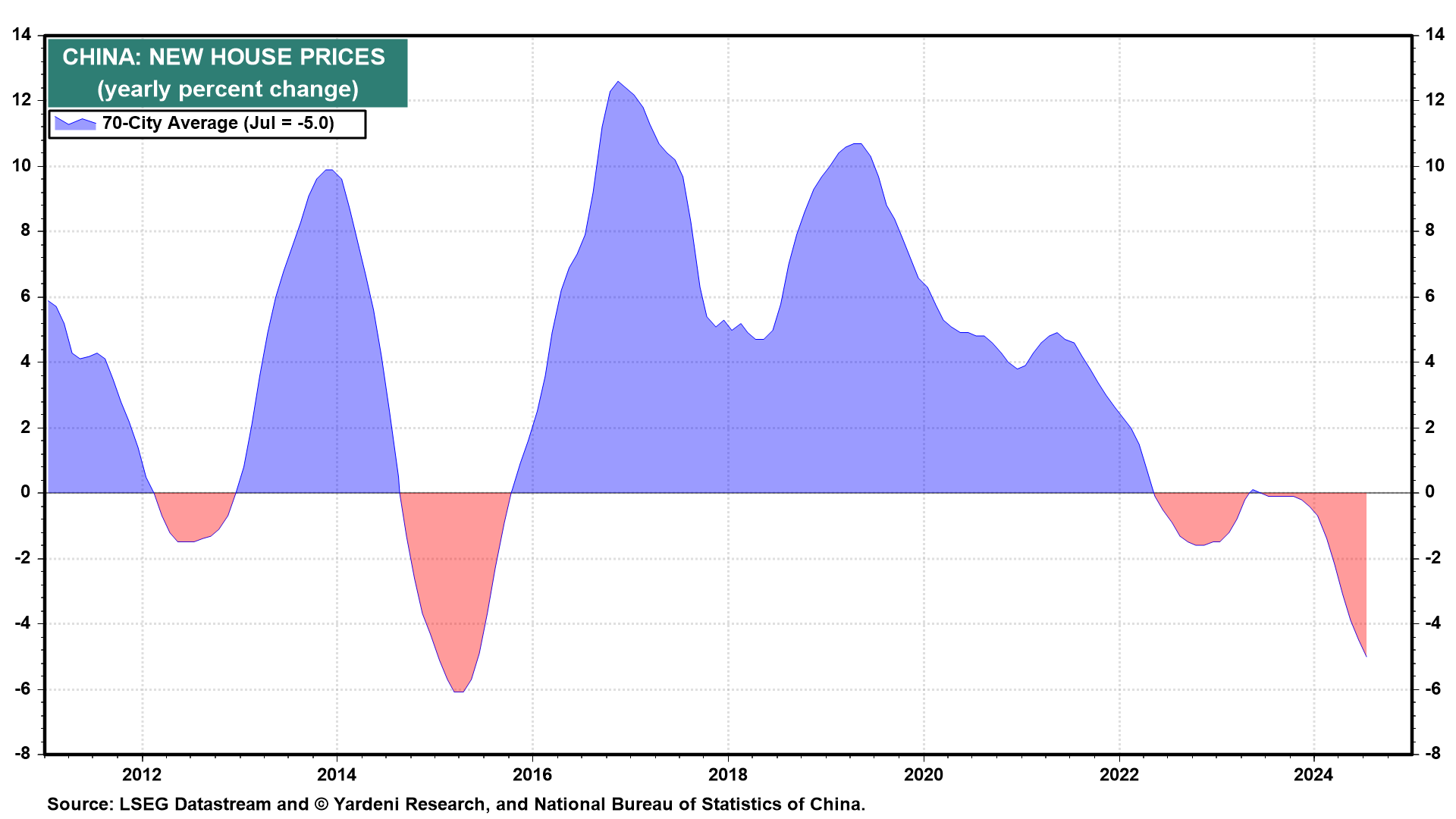

In July, home prices in China continued to decline. New home prices fell for the 13th consecutive month, dropping by 0.7% m/m and 5.0% y/y, the steepest annual decline in nine years (chart). Despite efforts by the Chinese government to stabilize the housing market, including reducing mortgage rates and lowering home buying costs, these measures haven't worked so far.

The struggling real estate sector is depressing steel output. During July, it dropped by 9% y/y.

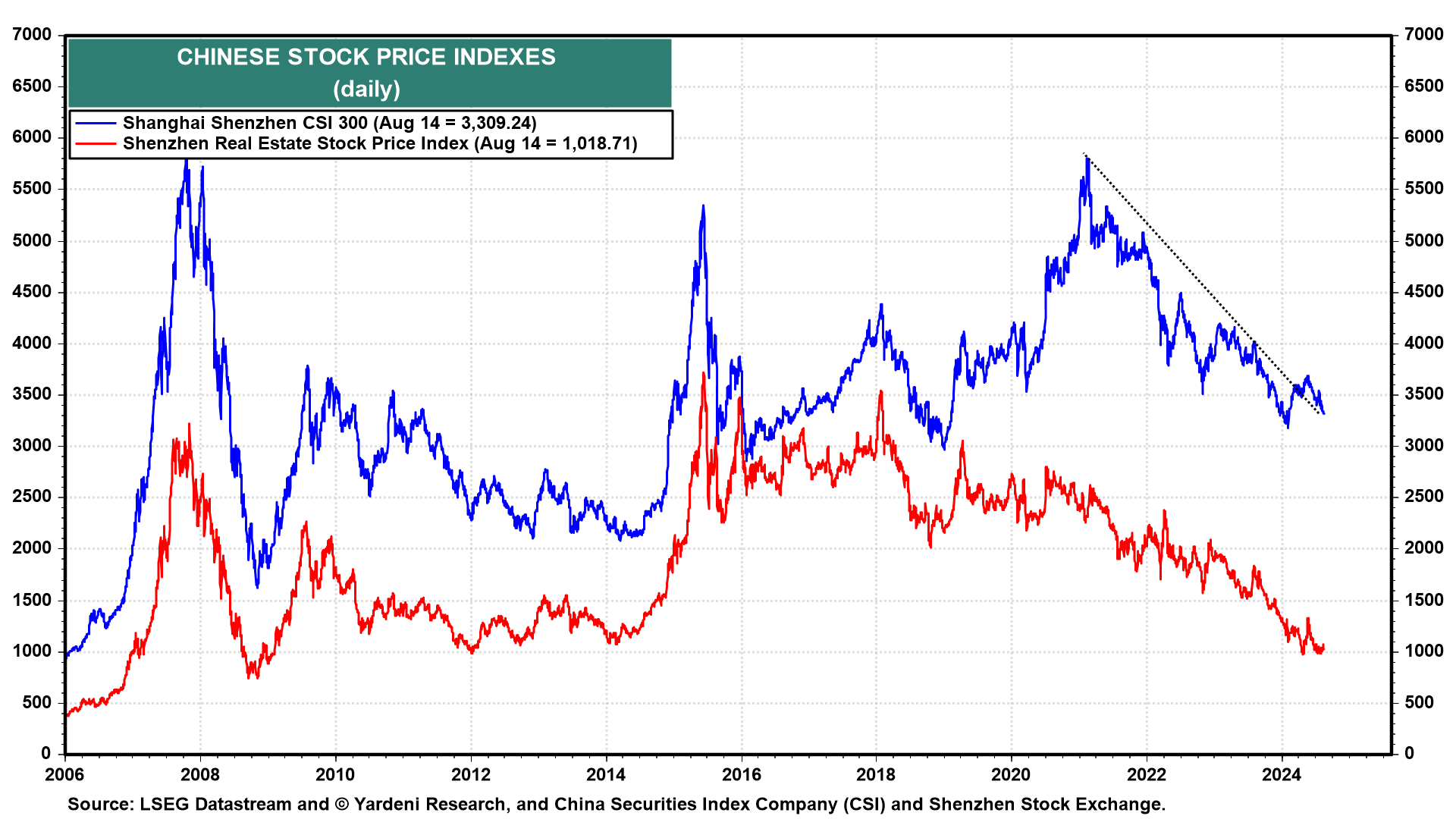

The Chinese stock market remains on a downward trend led by falling real estate stock prices (chart).

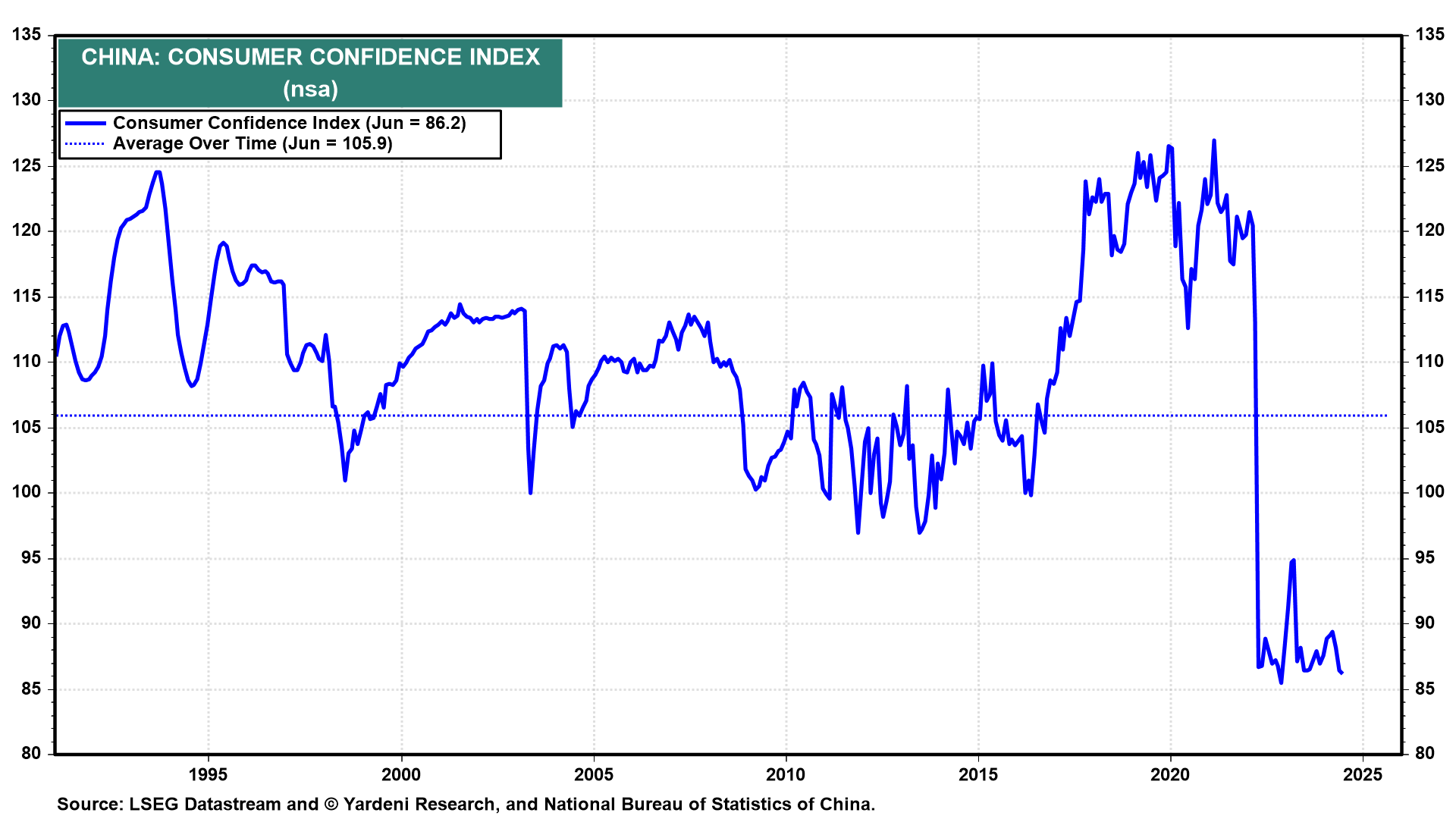

Given the significant negative wealth effect from falling real estate and stock prices, it's no wonder that consumer confidence remains remarkable depressed in China (chart).

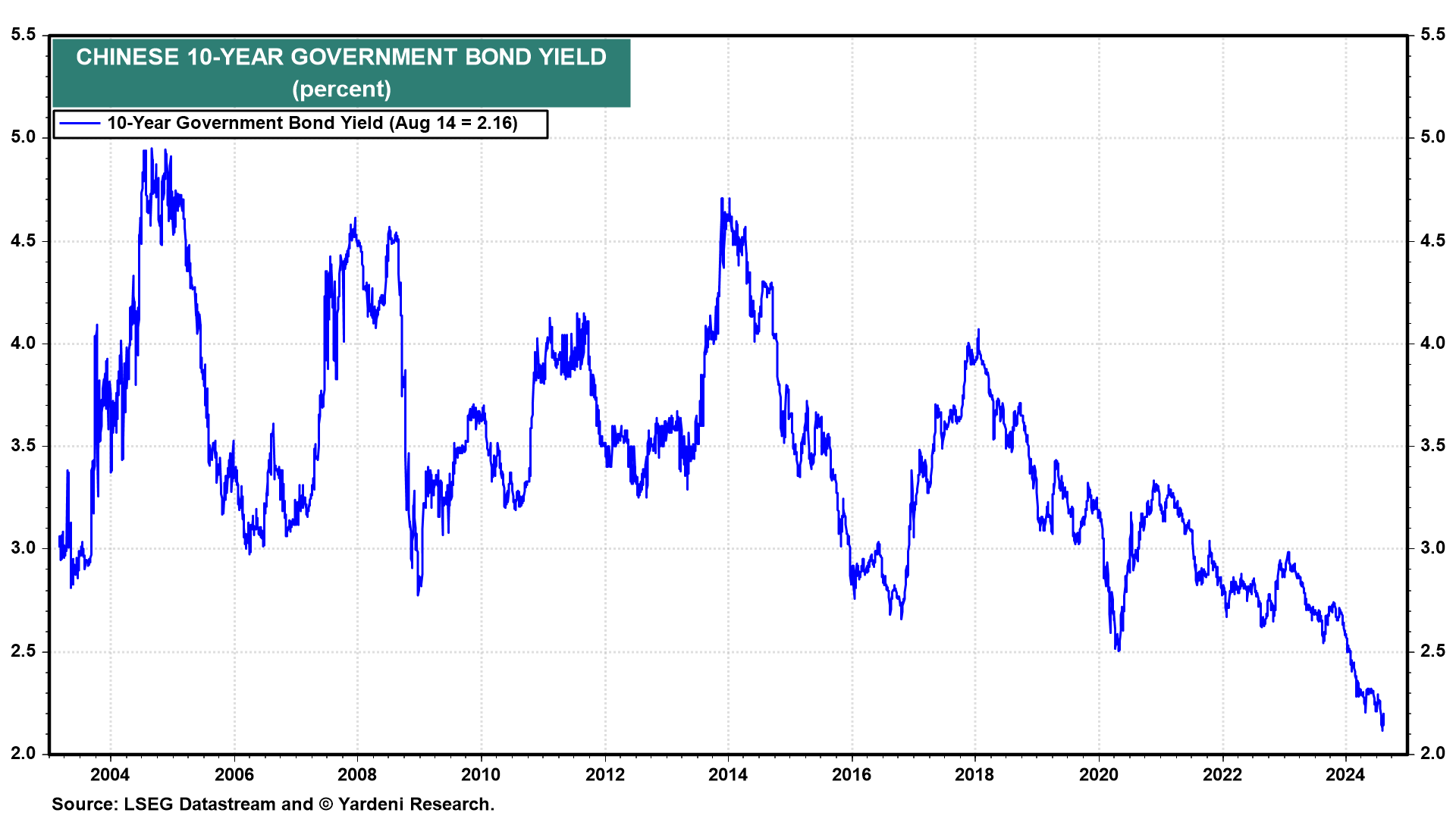

The 10-year government bond yield was down to 2.16% today. The sharp drop so far this year is largely attributed to weaker-than-expected economic and lending growth. The reduced credit demand has heightened concerns about the overall economy, prompting speculation that the central bank may introduce further monetary easing measures.