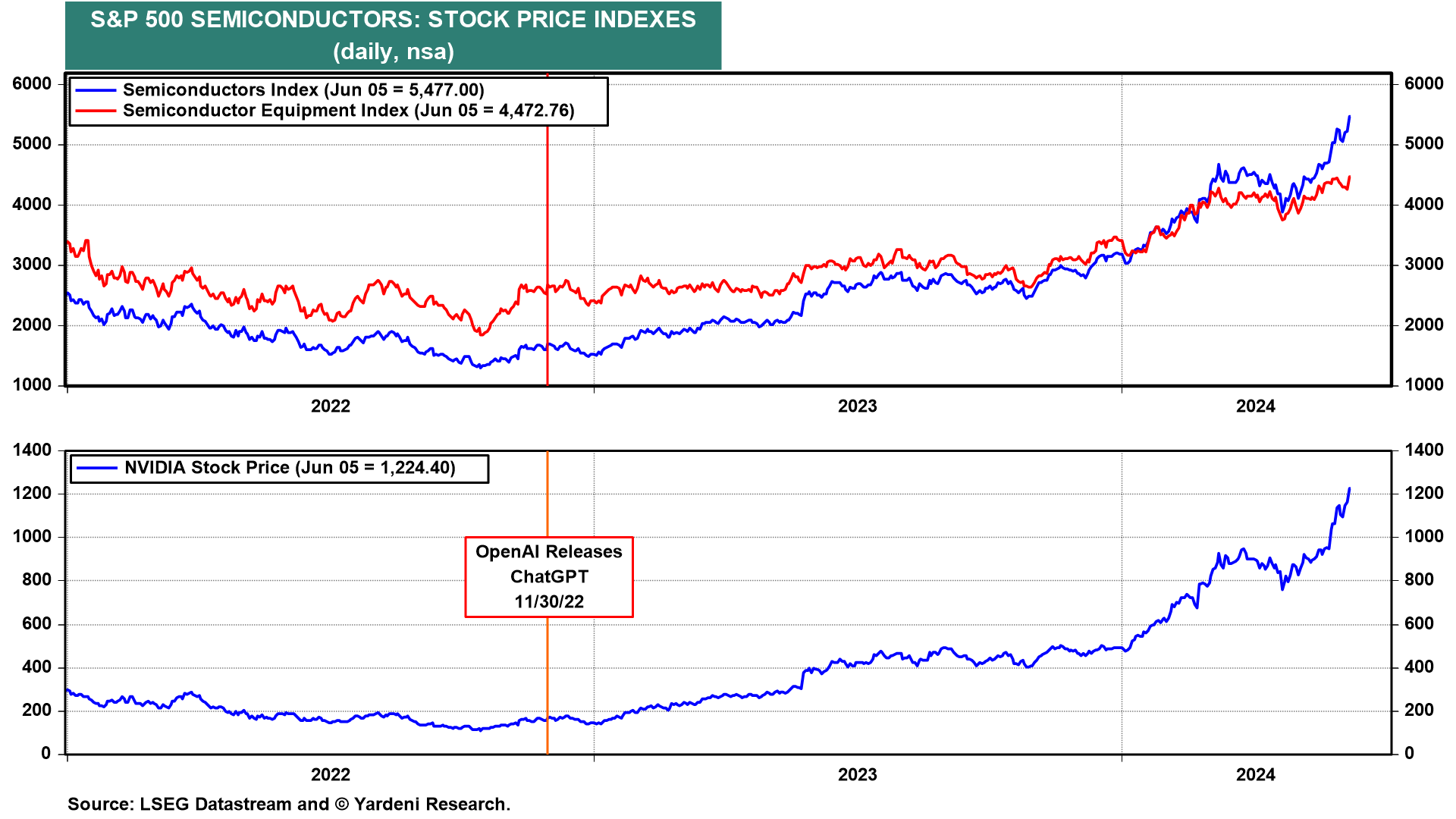

The S&P 500 rose to yet another record high today, once again led by semiconductor stocks, in particular, by Nvidia (chart). The chipmaker just joined the $3 trillion dollar market-cap club along with Microsoft and Apple. The long line to buy the company's GPU chips keeps getting longer. It will have a 10-for-1 stock split on Friday.

Perversely, the bulls are also charged up by the latest batch of relatively weak economic indicators, including May’s M-PMI and ADP payrolls reports. They figure this increases the odds of the Fed cutting the federal funds rate (FFR) this year.

In our opinion, the latest data suggest that the economy is slowing rather than heading for a hard landing that would force Fed officials to cut the FFR in the coming months. If they do act prematurely--before inflation is convincingly back down to their 2.0% target--they risk fueling a meltup in the stock market, one that may already be underway.

Consider the following:

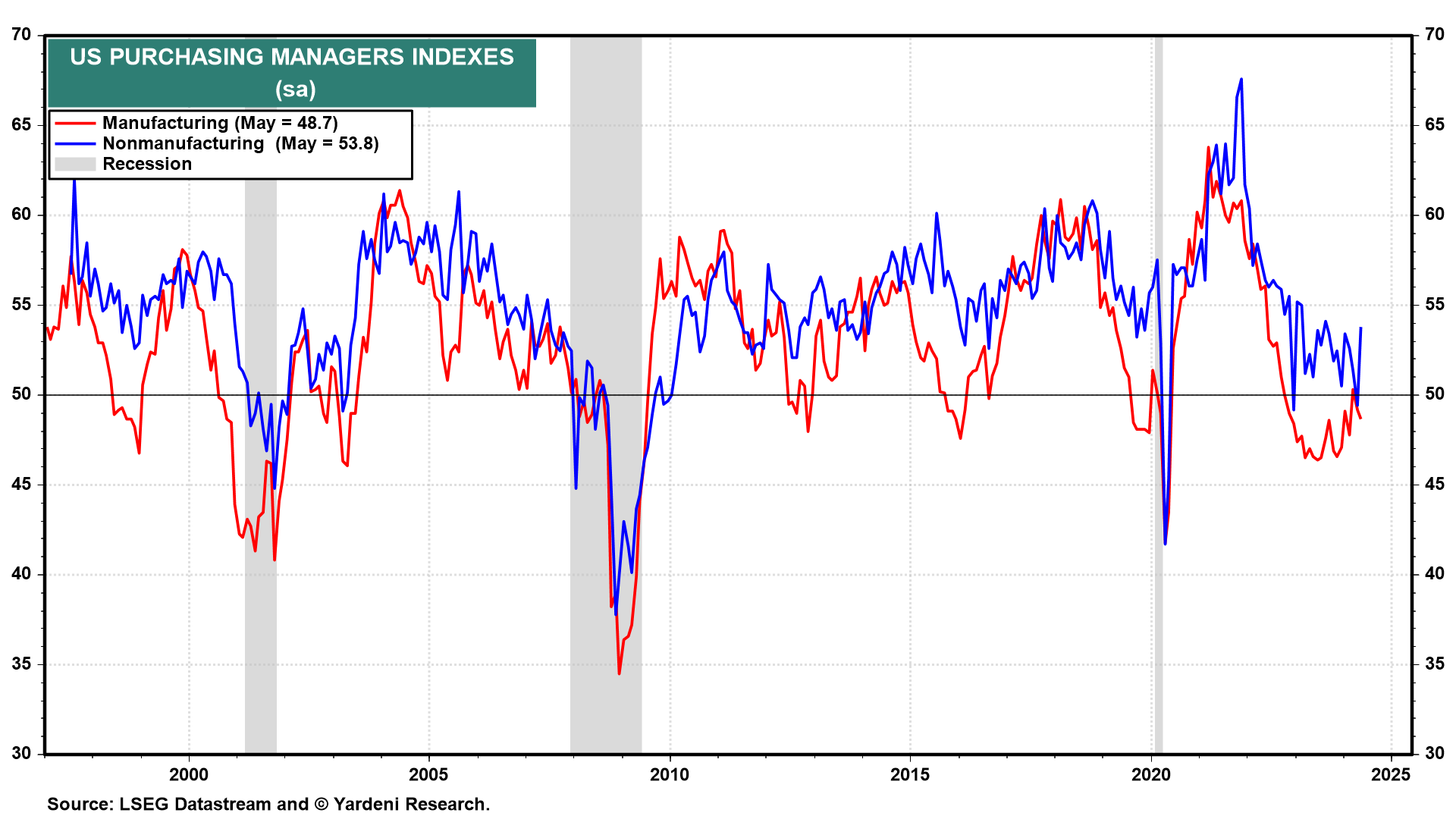

(1) NM-PMI vs M-PMI. The ISM nonmanufacturing purchasing managers index jumped in May to 53.8, retracing a brief dip below 50.0 (chart). The production component soared to 61.2 from 50.9 and the prices-paid index declined to 58.1 (from 59.2). May's data reversed the stagflationary blip in April.

The M-PMI was less hot, as the goods sector remains in a growth recession. This confirms our view that the US economy is transitioning from an industrial one to a digital one, dominated by services and technology providers. Fewer US companies produce goods and fewer workers are employed by them. This helps to explain why manufacturing-related indicators (such as the M-PMI and LEI) erroneously signaled a recession over the past couple of years.

Leer la noticia completa

Regístrese ahora para leer la historia completa y acceder a todas las publicaciones de pago.

Suscríbase a