The bulls continue to gain ground in our tug-of-war with the bears. Consider the following:

(1) The S&P 500 is now up 23.3% since October 12 to 4425.84 through last Thursday. That was the highest level since April 20, 2022. It was only 7.7% below the January 3, 2022 record high.

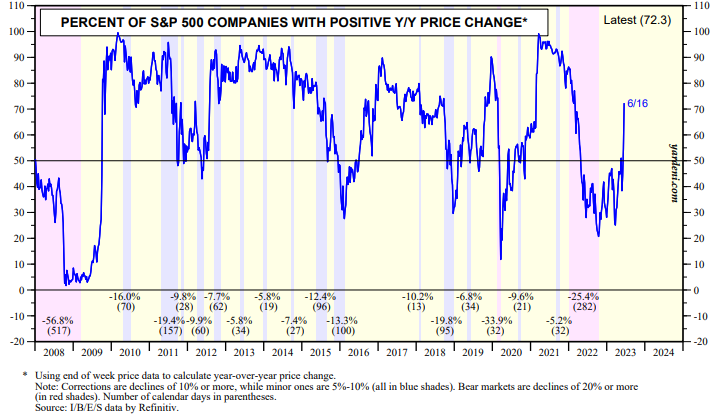

(2) Measures of breadth are improving. The percentage of S&P 500 companies with positive y/y share price changes rose to 72.3% on Friday (chart). The percentage of S&P 500 companies with positive three-month percent changes in forward earnings rose to 73.5% on Friday).

The breadth of the market narrowed significantly earlier this year because of the banking crisis in early March. The MegaCap-8 stocks (i.e., Alphabet, Amazon, Apple, Meta, Microsoft, Netflix, Nvidia, and Tesla) led a very narrow advance through May. Since the first week of 2023 through the June 16 week, their collective market cap rose 57.4%, while the S&P 492’s market cap rose 0.9%.

The market’s rally has broadened significantly so far in June: Consumer Discretionary (9.3%), Industrials (8.8), Materials (8.7), Information Technology (5.7), Financials (5.6), S&P 500 (5.5), Real Estate (4.0), Energy (5.3), Communication Services (3.0), Utilities (3.5), Health Care (3.4), and Consumer Staples (2.8) (chart).

Leer la noticia completa

Regístrese ahora para leer la historia completa y acceder a todas las publicaciones de pago.

Suscríbase a