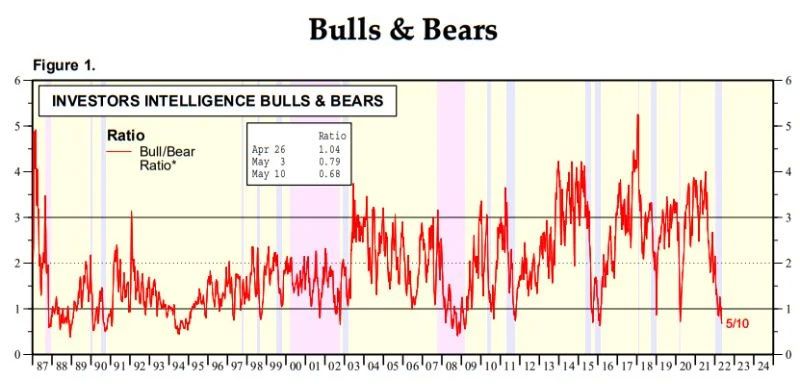

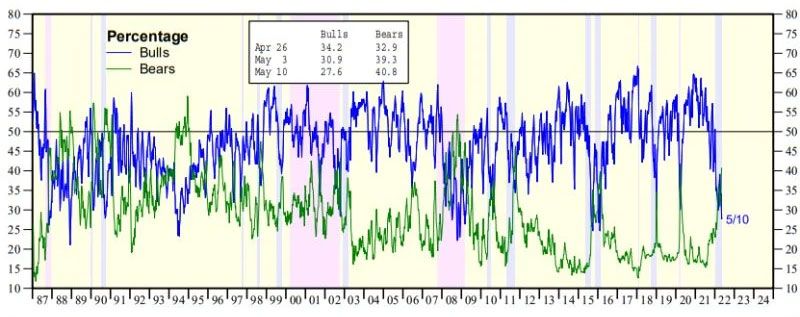

The Investors Intelligence Bull/Bear Ratio (BBR) fell further below 1.00, to 0.68, during the May 10 week.

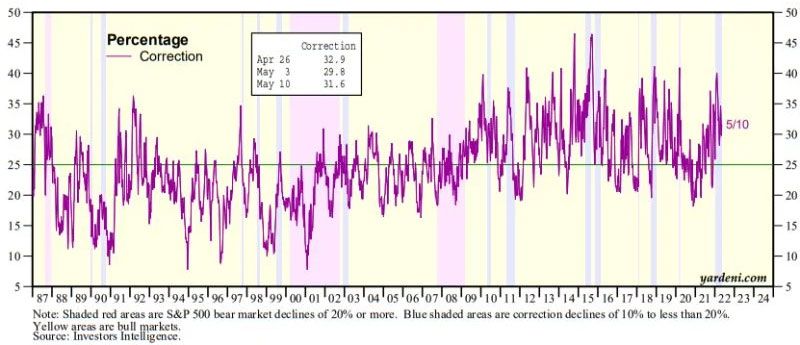

In the past, “transitory” BBR readings around 1.00 or lower marked great buying opportunities attributable to short-term market corrections. More “persistent” readings around 1.00 or lower tended to coincide with longer-term bear markets, which also presented great buying opportunities but with a prolonged amount of pain.

We remain in the correction camp, but feeling the pain.