Bears started coming out of hibernation early this year. Now they are roaming all over the stock market. Here are the latest bearish sentiment readings, which are bullish from a contrarian perspective:

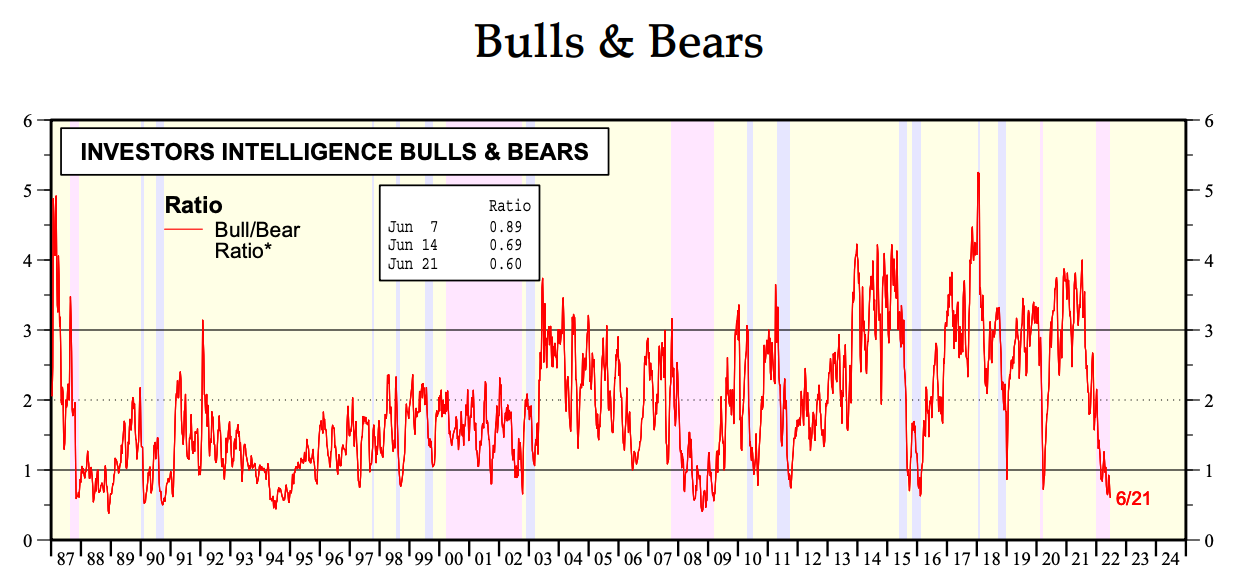

(1) The Bull/Bear Ratio (BBR) was below 1.00 for the eighth consecutive week this week. It slipped for the third week to 0.60 this week—the lowest reading since early March 2009, which was when the last bear market bottomed during the Great Financial Crisis! The BBR has been bouncing around 1.00 since late February.

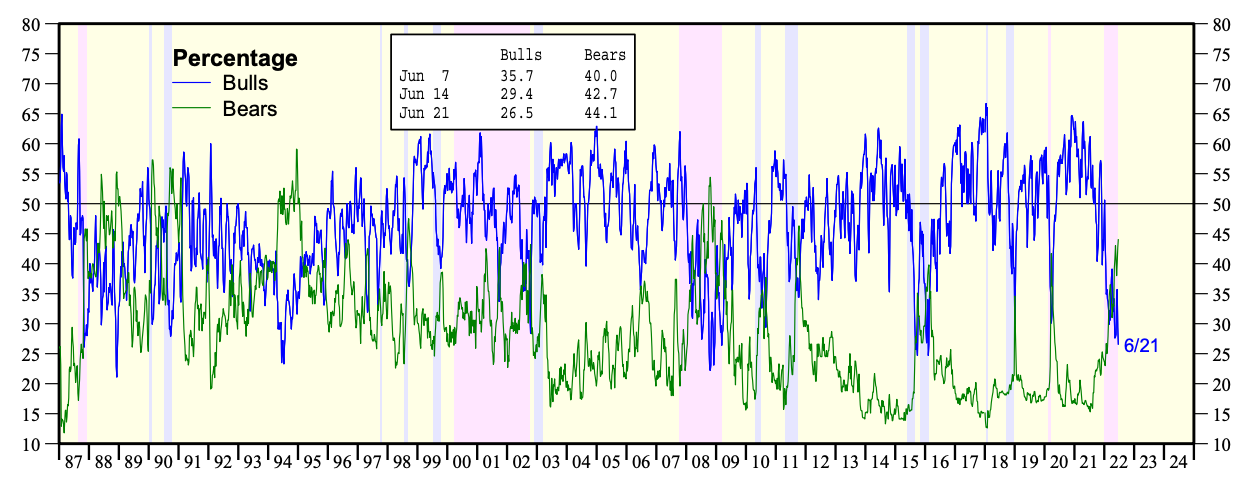

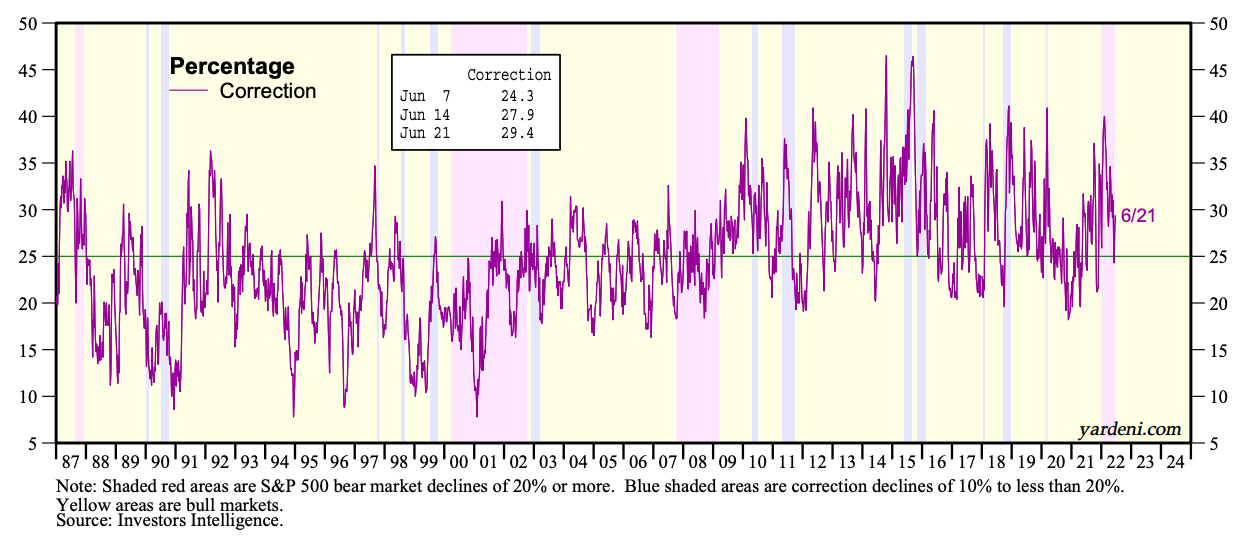

(2) Bullish sentiment sank for the second week to 26.5% this week, the lowest since early 2016. Bearish sentiment increased for the third week to 44.1%, the highest since early October 2011. The correction count climbed for the second week to 29.4% this week.

(3) The AAII Sentiment Survey dated June 16 showed that the percentage of individual investors expecting stock prices to fall over the next six months is above 50% for the fifth time in eight weeks. The latest survey also shows short-term optimism about stocks falling below 20%. The bull-bear spread is –38.9% and is unusually low for the 20th time in 23 weeks.

(4) The stock market could be setting a bear trap. With sentiment so bearish, the bears might have to scramble to cover their shorts if June’s CPI (to be released on July 13) is better than expected because retailers have had to lower their prices of excess durable goods inventories. Most importantly, let’s watch for possible peaks in food and energy commodities as the global economy slows and their high prices boost supplies of these commodities.

(5) By the way, the S&P 500 bottomed on March 6, 2009 at 666. Last Thursday, it bottomed at 3666. Might that have been the bottom for the current bull market? That would be a devilish development for the bears. Let’s see if the Da Vinci Code playbook works this time again.