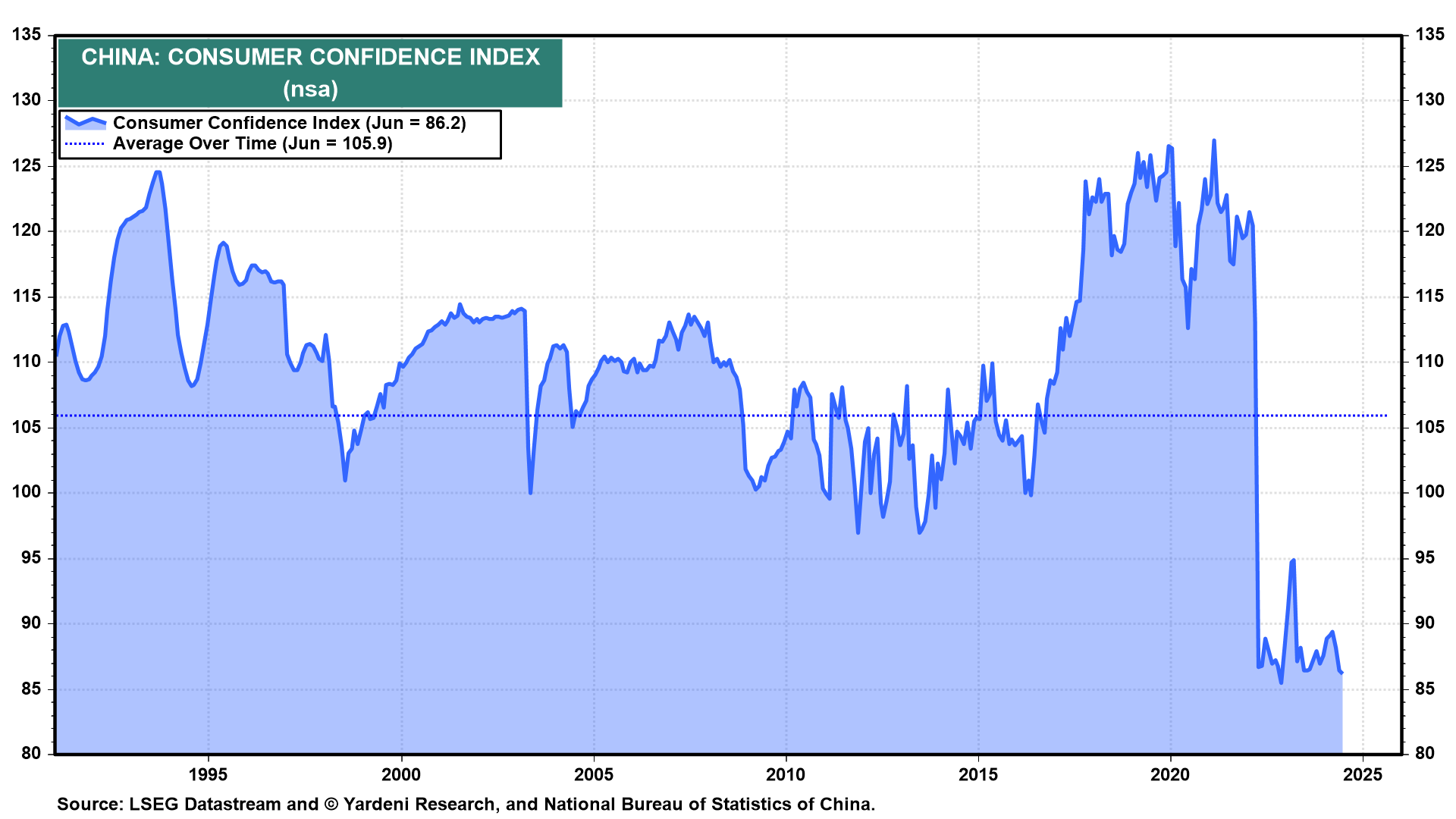

(1) Chinese consumers are depressed.

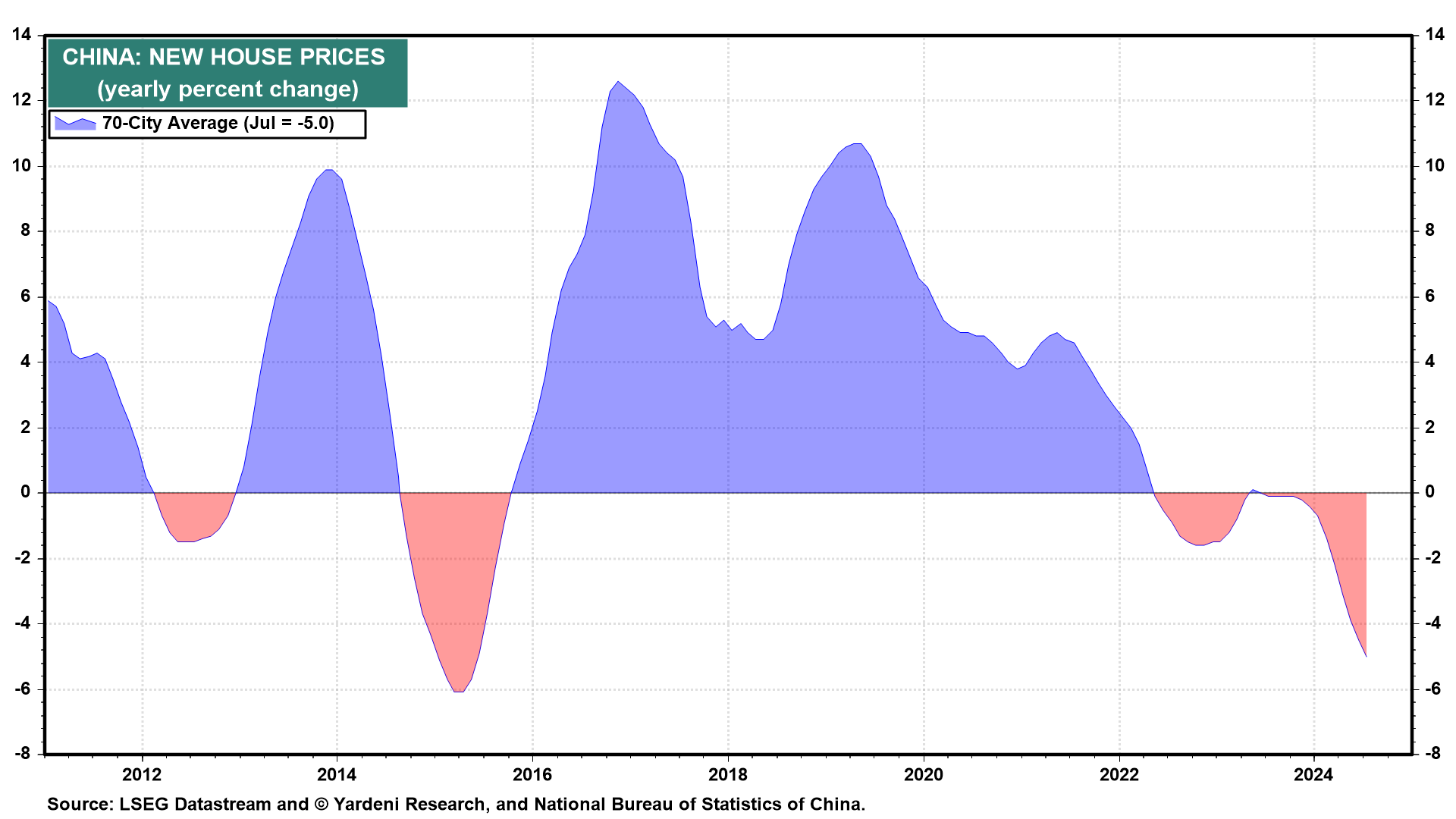

(2) Home prices are falling in China.

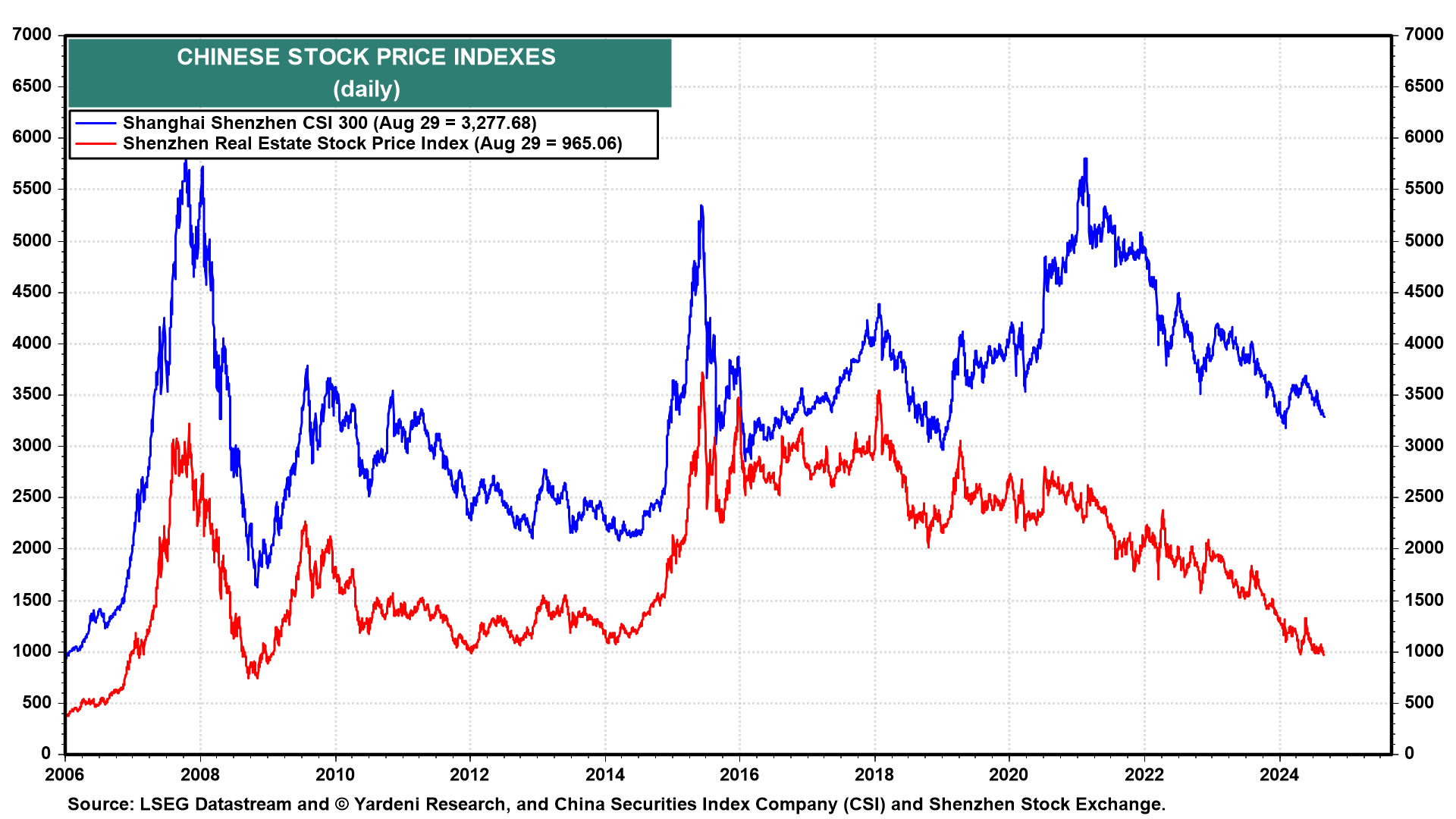

(3) Chinese stock prices are on downward trends led by real estate stocks.

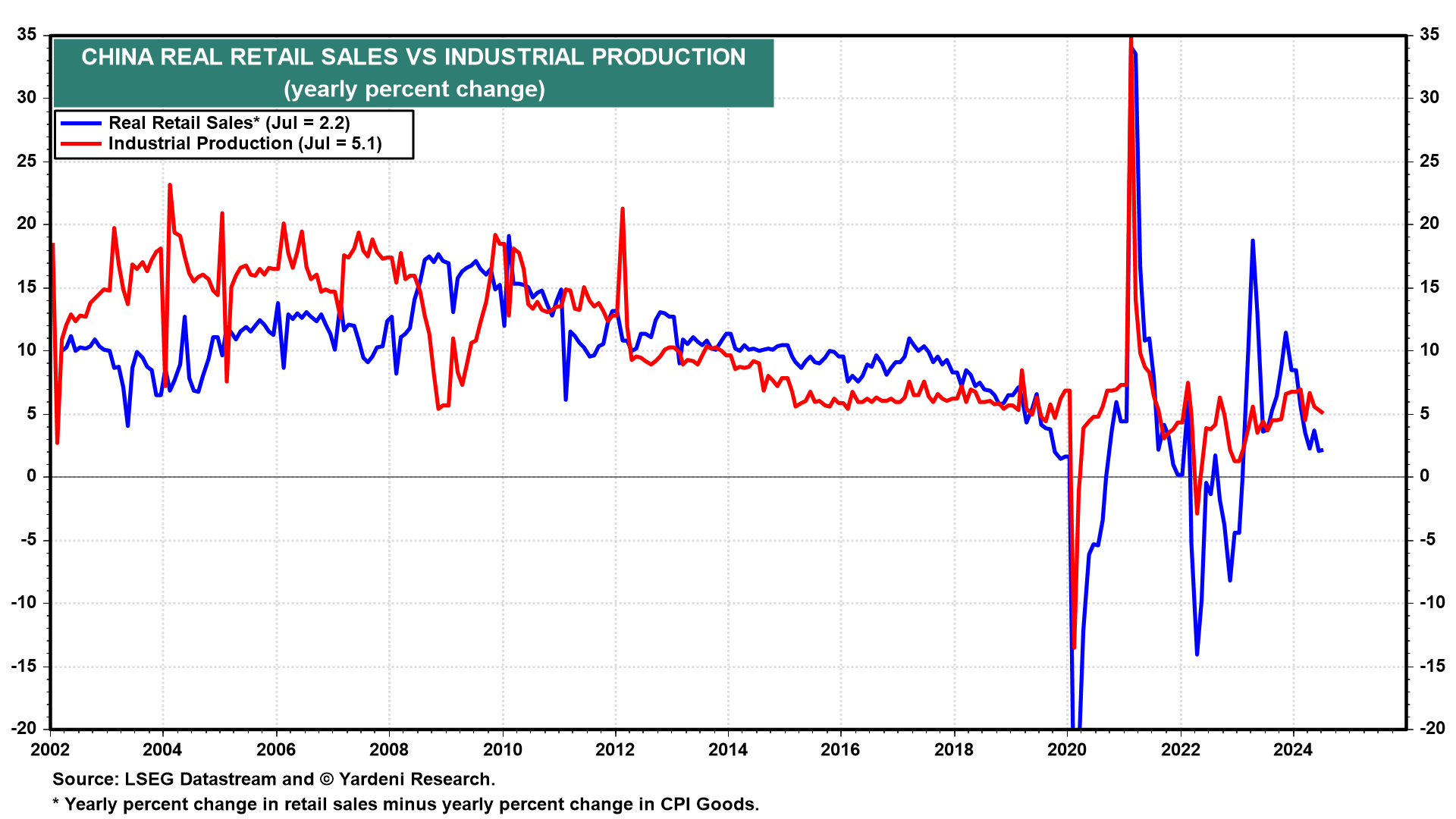

(4) China's real retail sales growth is weak and exceeds the growth of industrial production.

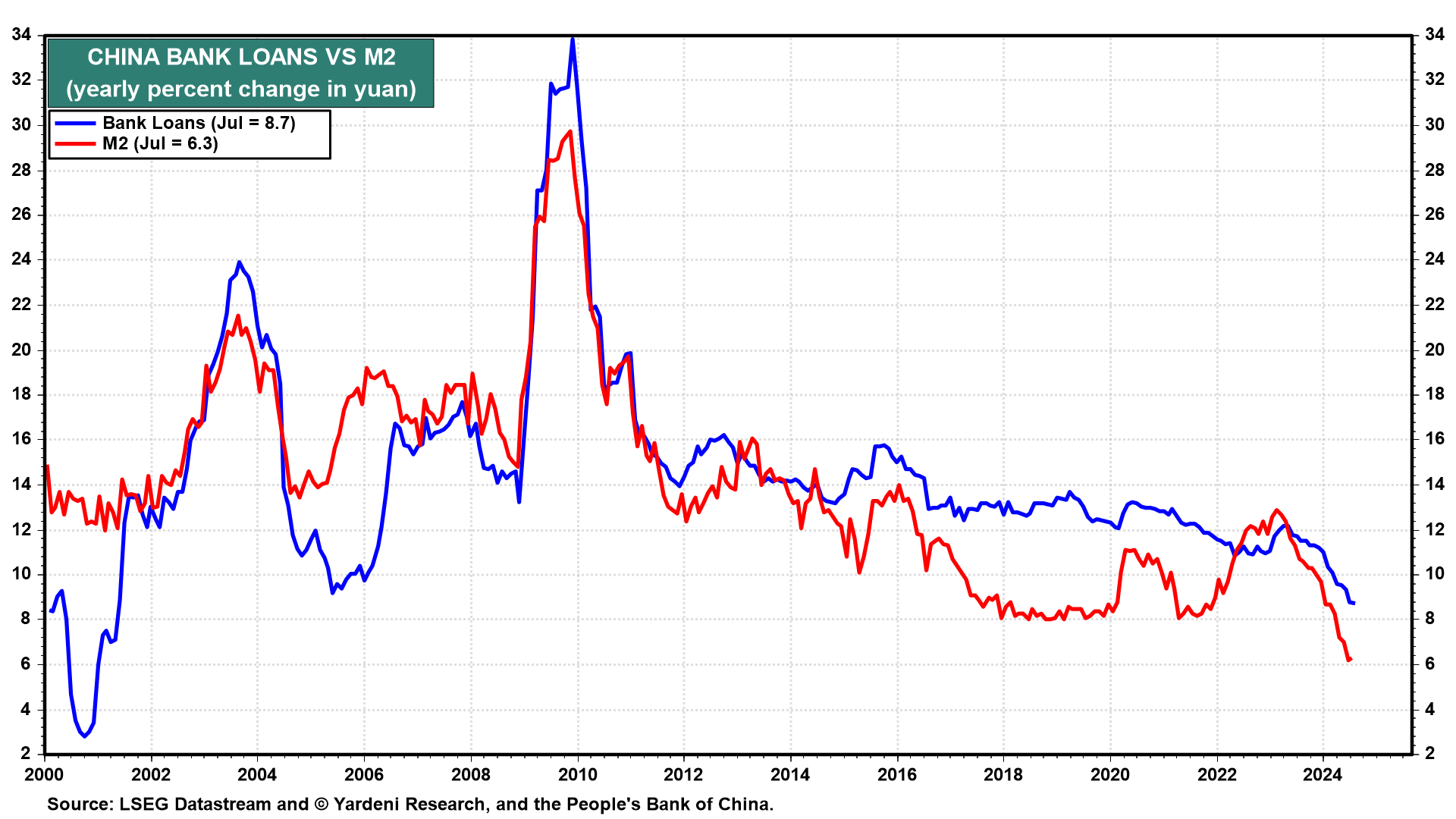

(5) The growth rates of Chinese bank loans and M2 are falling rapidly.

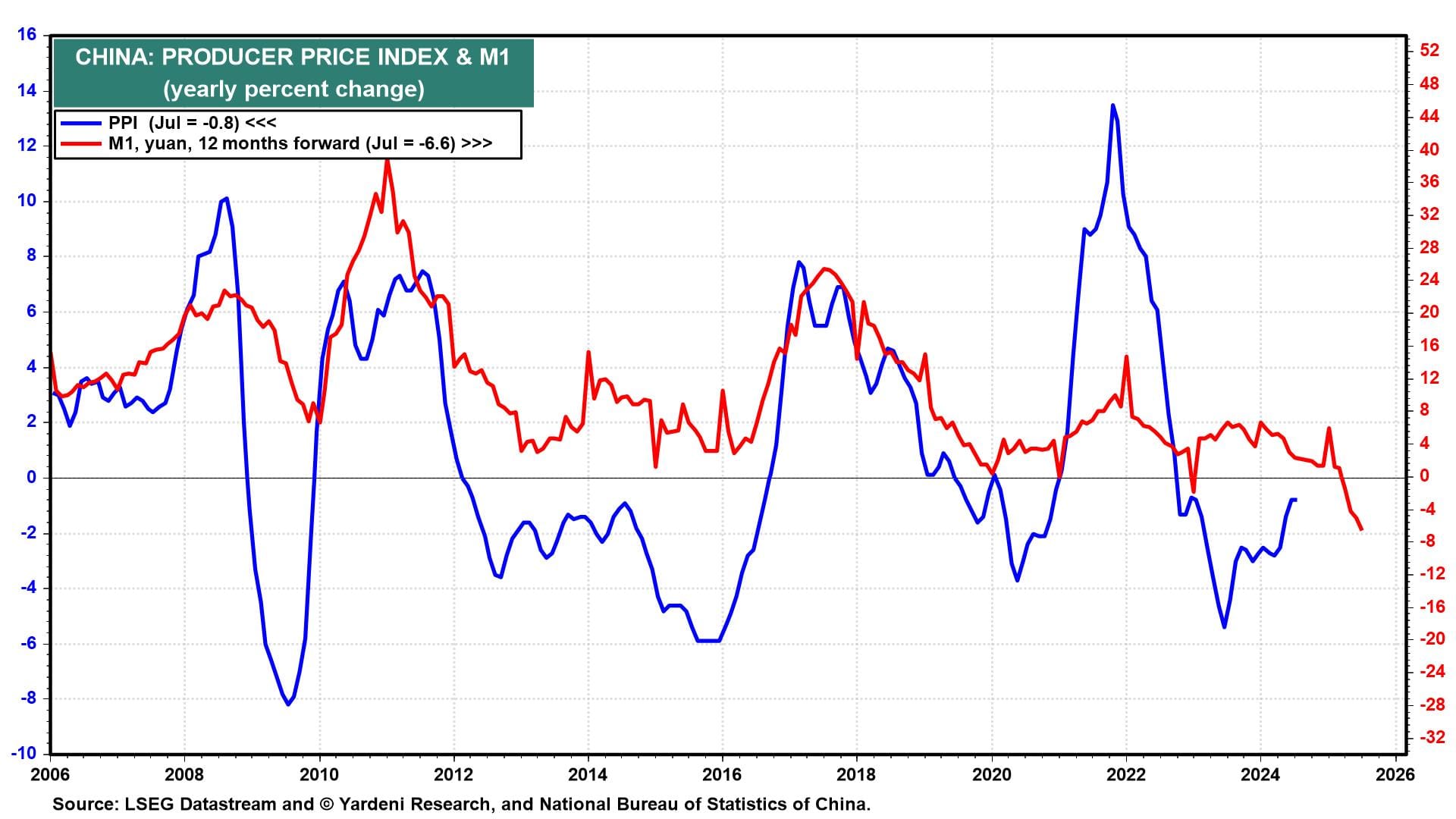

(6) Negative growth in M1 suggests that deflationary pressures on China's producer price index will persist over the coming 12 months.

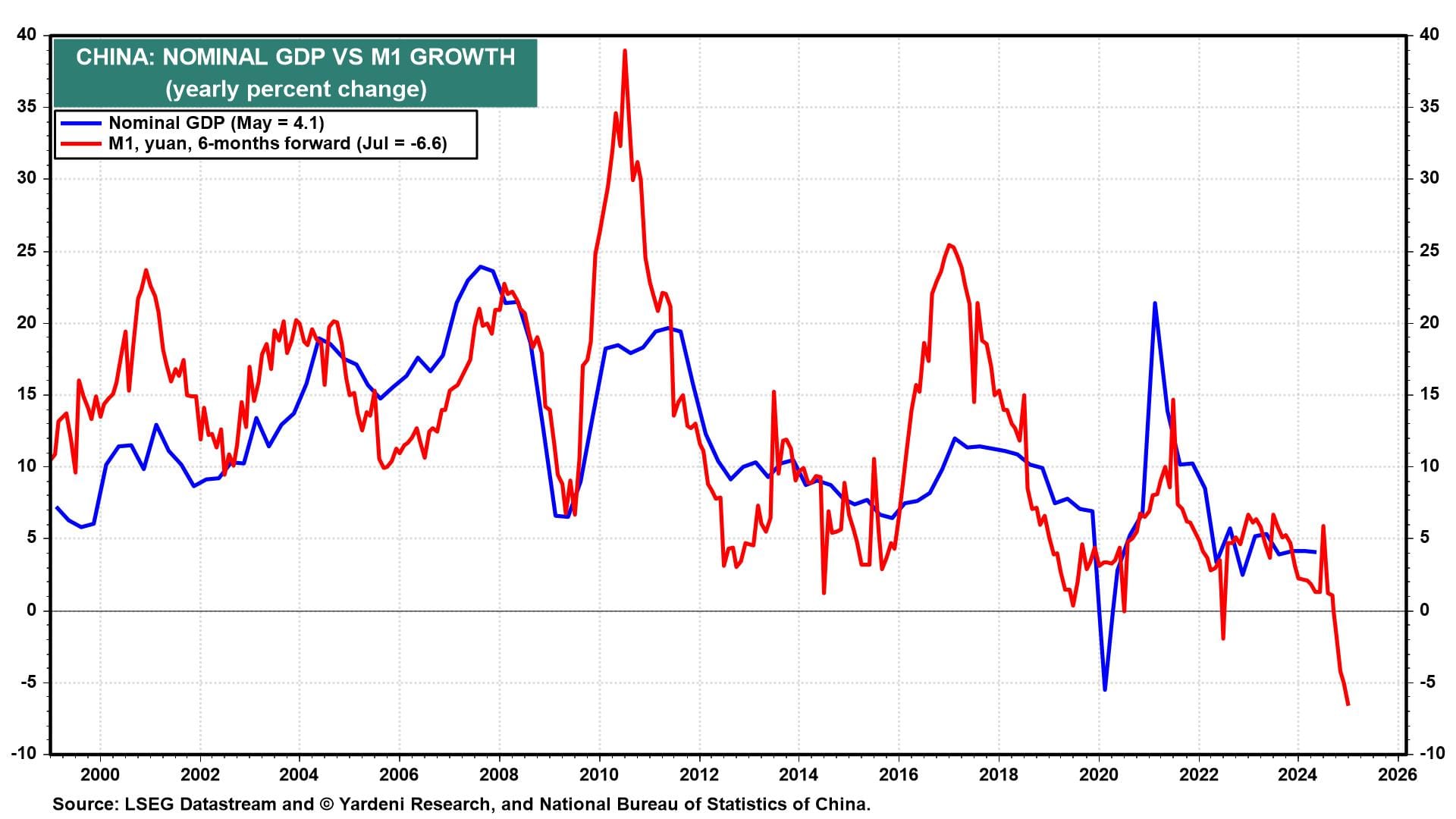

(7) According to M1, China's nominal GDP growth could fall to zero or turn negative over the next six months.

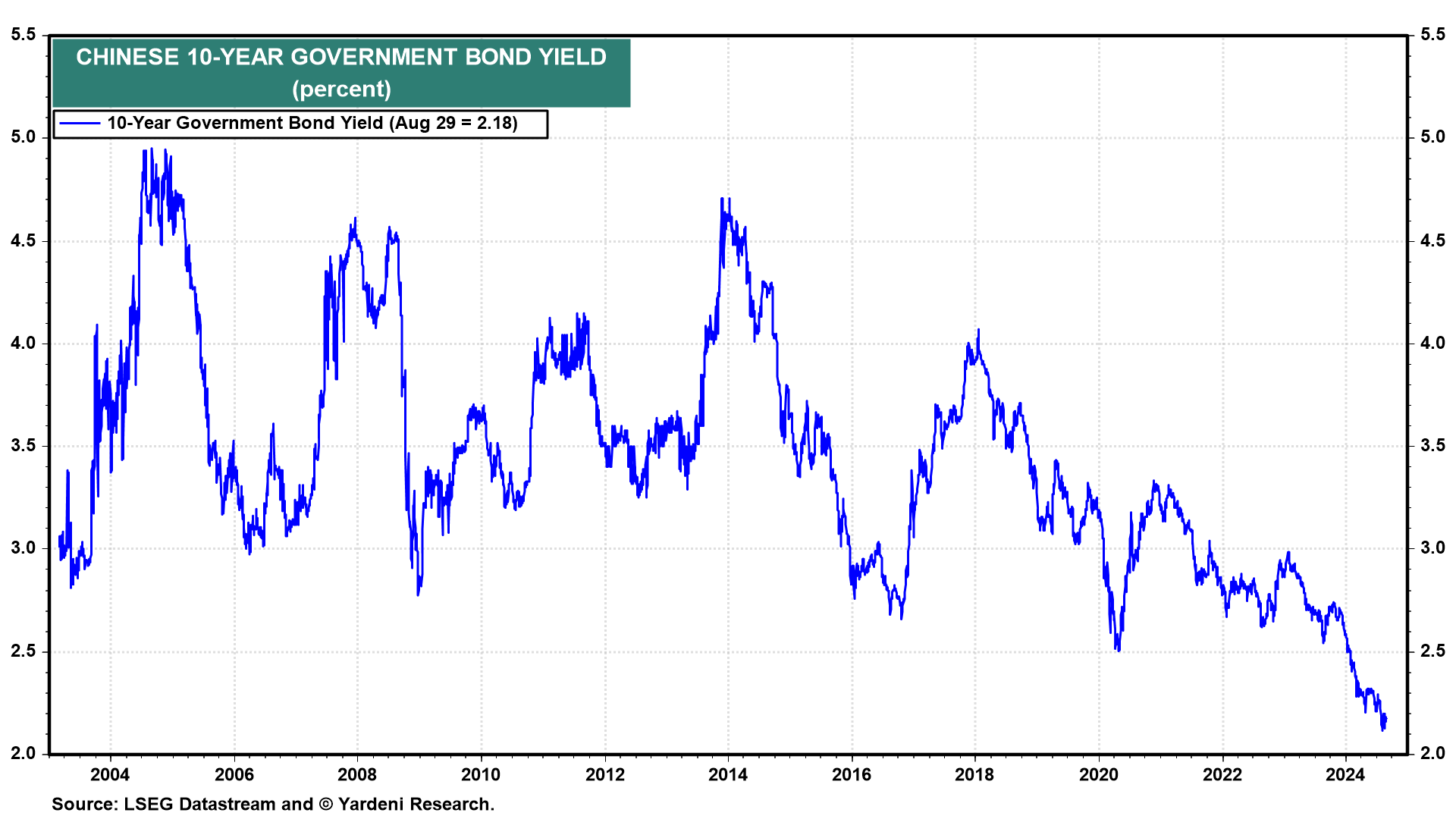

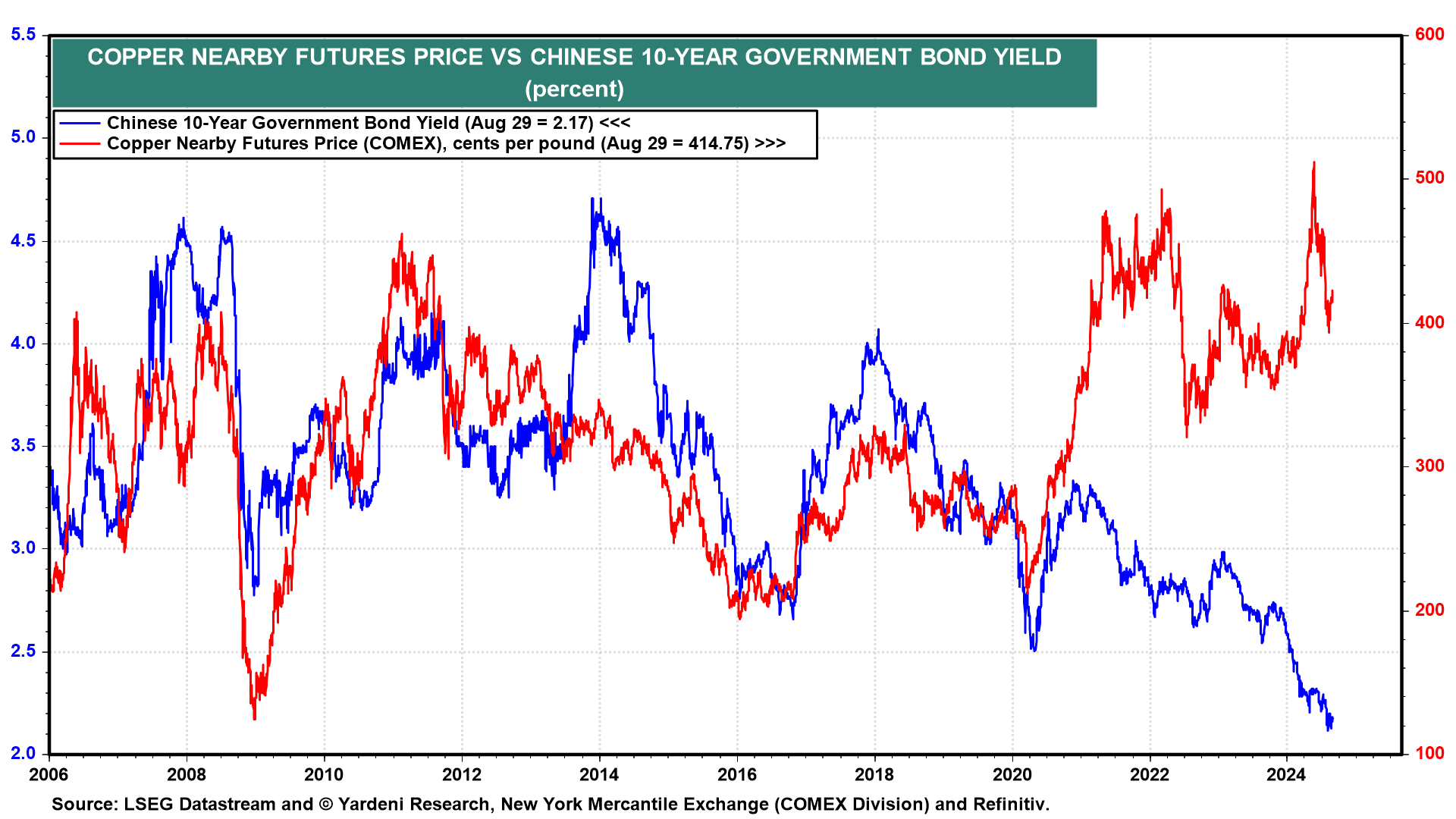

(8) The Chinese 10-year government bond yield has plunged since the start of last year from 3.00% to 2.18% currently.

(9) The weakness in China's economy is weighing on commodity prices, especially copper and crude oil prices.

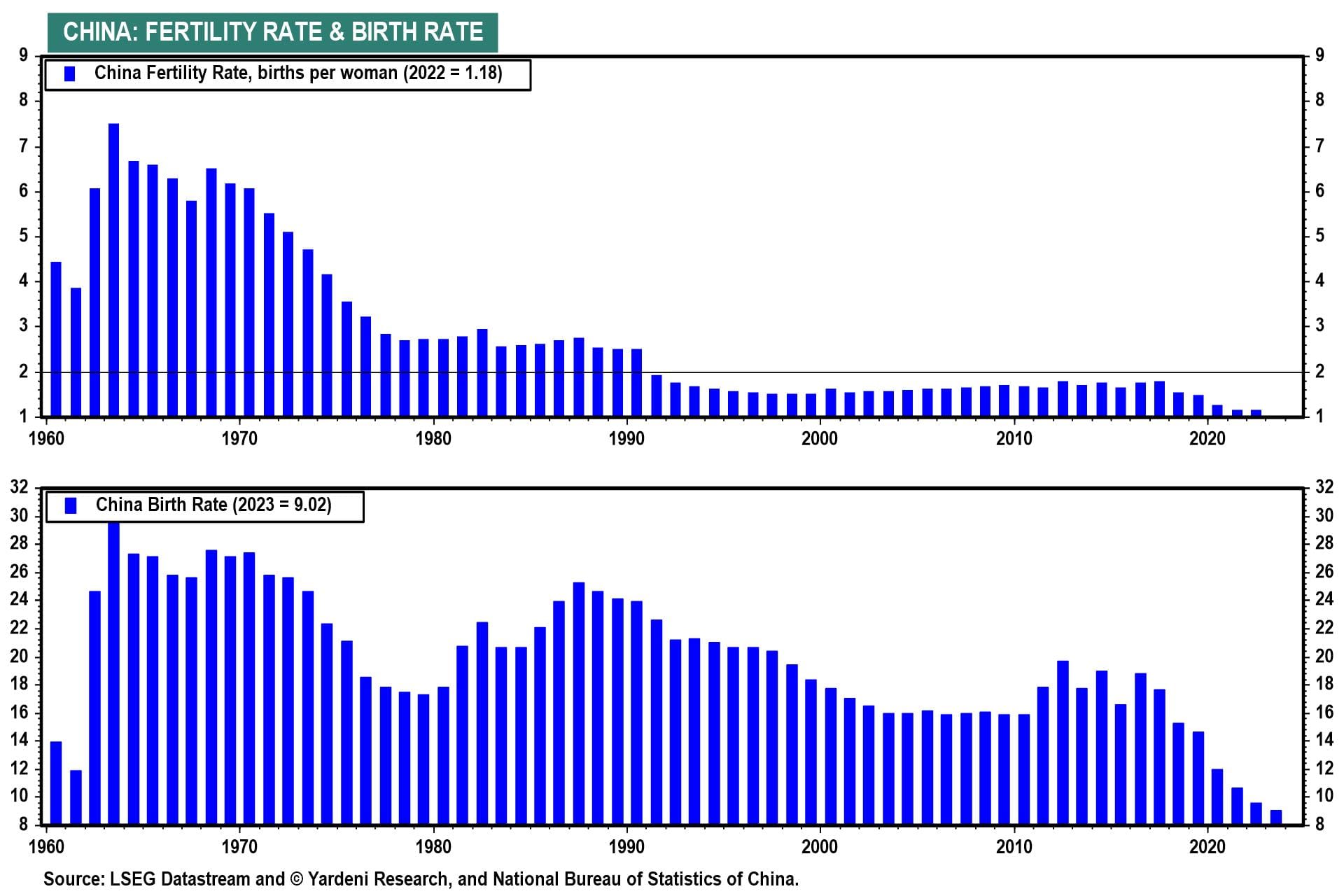

(10) A record-low fertility rate in China has depressed the number of births to a record low as well.