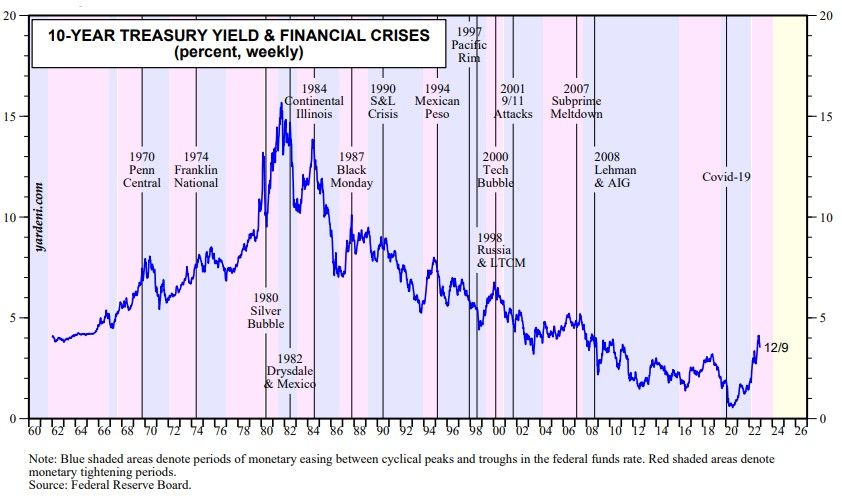

The 10-year US Treasury bond yield rose from a recent low of 3.425% on December 7 to 3.849% today, the highest since early November. We still believe it peaked at 4.248% on October 12. The spread between the 10-year and 2-year US Treasuries remained inverted at 50bps today. An inverted yield curve tends to coincide with the end of monetary policy tightening cycles and peaks in the bond yield (chart).

In the past, inverted yield curves anticipated financial crises that turned into credit crunches and recessions. This time, we think it is signaling that inflation will continue to moderate without necessarily triggering a credit crunch or a recession.

Leer la noticia completa

Regístrese ahora para leer la historia completa y acceder a todas las publicaciones de pago.

Suscríbase a