Investors are obviously relieved that the economy may be on a sustainable soft-landing path and might avoid a recession (again) in 2024. They are especially relieved that Fed Chair Jerome Powell recently implied that he and his colleagues are relieved about this too and are talking more dovish now:

(1) Waller. For example, two weeks ago, Fed Governor Christopher Waller, in a November 28 speech titled, "Something Appears to Be Giving," said that if inflation continues to cool "for several more months—I don’t know how long that might be—three months, four months, five months—that we feel confident that inflation is really down and on its way, you could then start lowering the policy rate just because inflation is lower." He added, "It has nothing to do with trying to save the economy or recession."

(2) Powell. In his December 13 presser, Powell said: "I have always felt, since the beginning, that there was a possibility, because of the unusual situation, that the economy could cool off in a way that enabled inflation to come down without the kind of large job losses that have often been associated with high inflation and tightening cycles. So far, that's what we're seeing."

That sounds like a soft landing, and was confirmed as the consensus outlook of the FOMC participants in their latest Summary of Economic Projections also released on December 13. It implied three cuts in the federal funds rate (FFR) of 25bps each in 2024.

So there have been meltup rallies in both bond and stock prices in recent weeks. The 10-year Treasury yield has plunged from 4.99% on October 19 to 3.95% this evening. TLT is up 19.7% over this period (chart).

The S&P 500/400/600 are up 14.6%, 19.1%, and 21.8% since October 27 through today's close (chart).

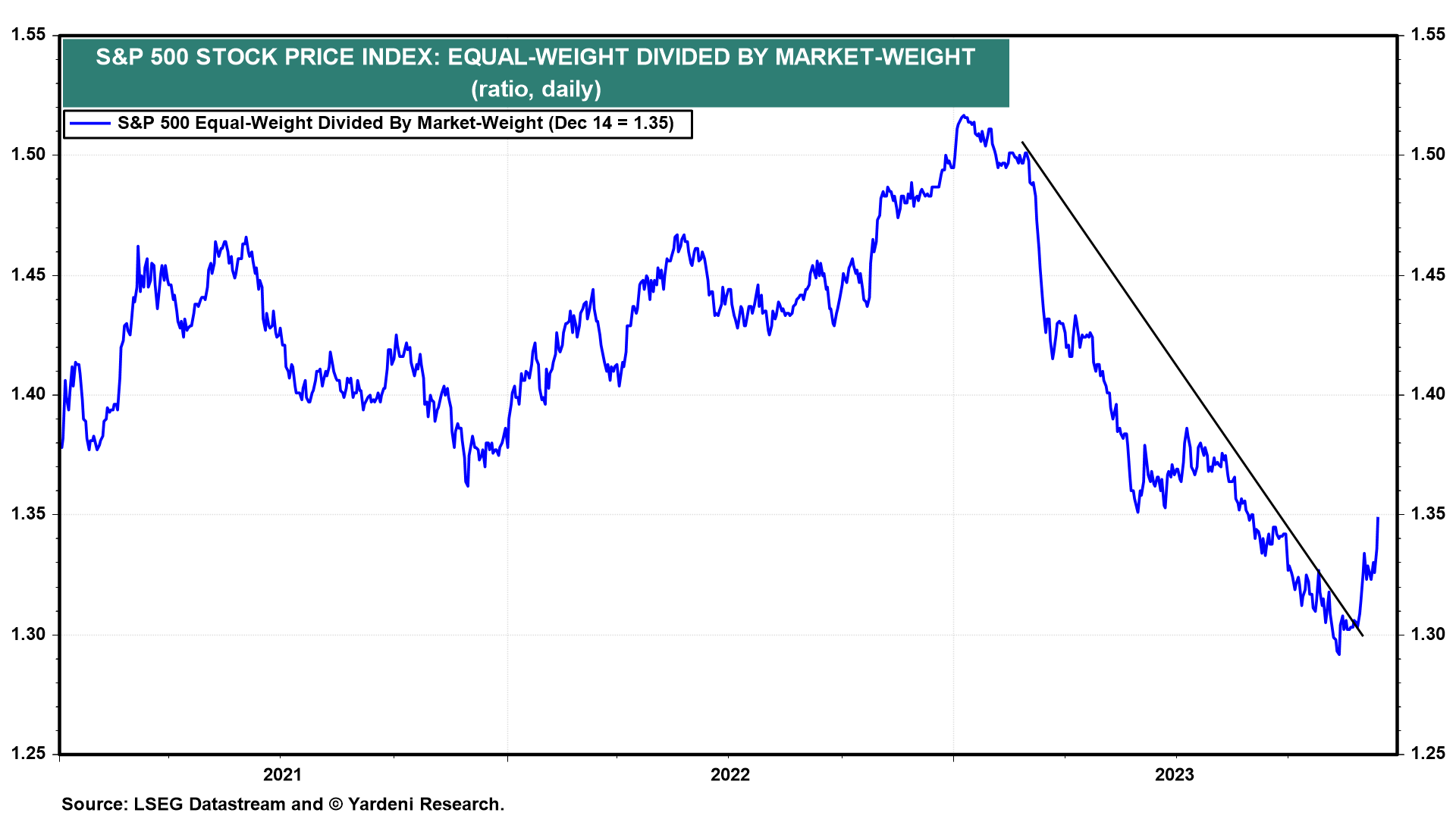

The meltup relief rally is especially notable in the S&P 500 equal-weight index, which has been outperforming the S&P 500 market-weight index since November 13 (chart). The stock market rally is broadening now that investors are increasingly convinced that the Fed is done raising the FFR and might lower it next year, reducing the odds of a recession because inflation is moderating without one. That's been our forecast for a while. Happy holidays!