During the first two trading days of September, stock prices, oil prices, and bond yields fell sharply; the Department of Justice (DOJ) subpoenaed Nvidia in its antitrust probe; Bank of Japan (BOJ) Governor Kazuo Ueda reaffirmed his hawkish monetary policy stance; US job openings were lower-than-expected; and, the US Treasury yield curve pancaked. Furthermore, the Fed's Beige Book reported that nine out of 12 Federal Reserve regional districts had flat or declining economic activity in August. In addition, Atlanta Fed President Raphael Bostic said that he is ready to start lowering interest rates. The Atlanta Fed's GDPNow model showed that real GDP is up 2.1% (saar) so far in Q3. Consider the following:

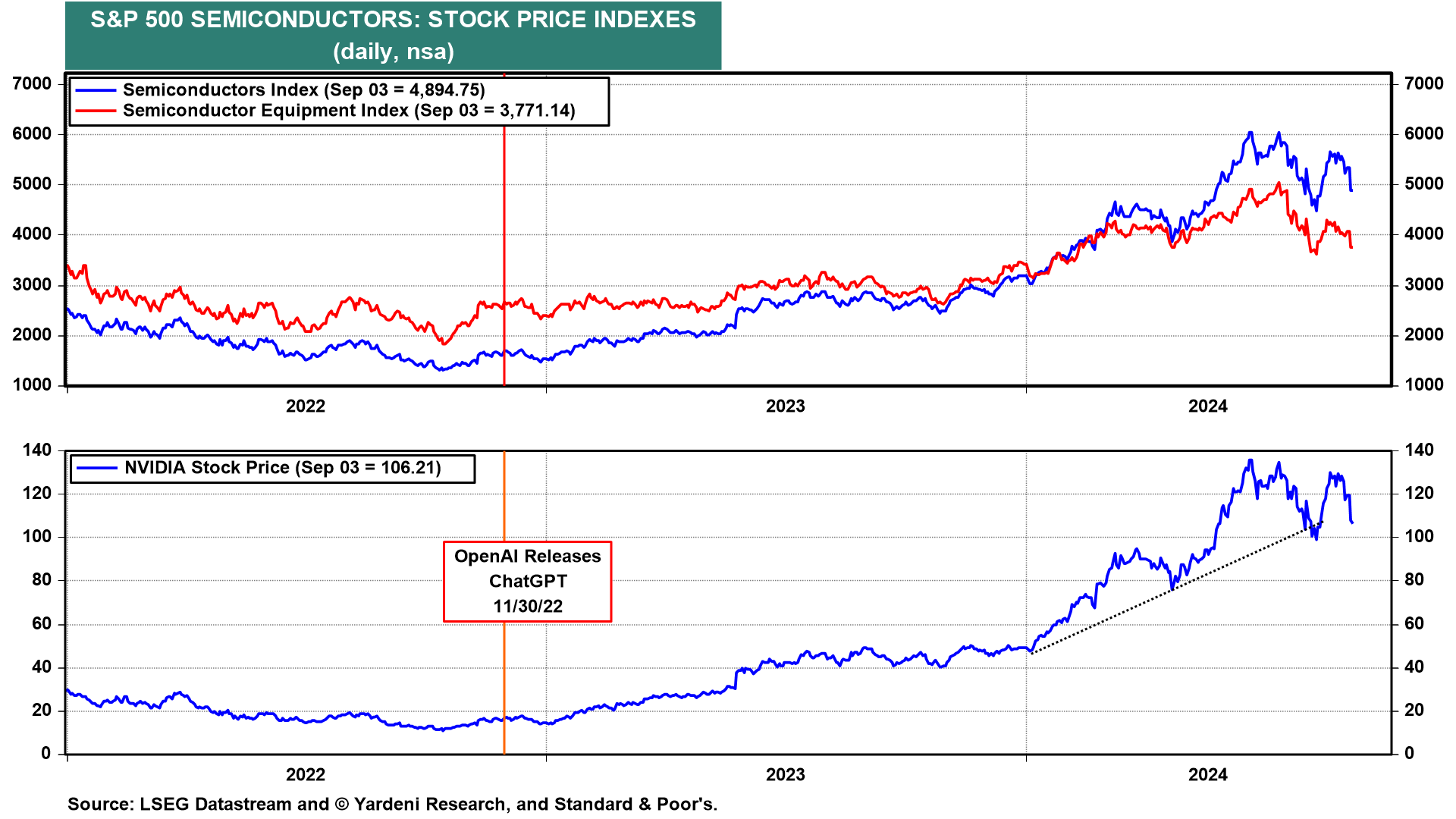

(1) Nvidia. We suspect that the DOJ's subpoena leaked over the long weekend. Nvidia fell 11% on Tuesday despite the news breaking after the market closed. Nvidia's freefall caused other semiconductor stocks to drop (chart).

Leer la noticia completa

Regístrese ahora para leer la historia completa y acceder a todas las publicaciones de pago.

Suscríbase a