Some macroeconomic storm clouds are brewing. Markets are fleeing for shelter in Treasuries, leaving behind almost everything else, including their prized LargeCap tech stocks and recently acquired SMidCaps. Here's the market action as of midday:

- The Nasdaq officially entered a correction, down more than 10% from its record high reached roughly a month ago.

- The CBOE Volatility Index (VIX) popped to 29, which hasn’t been seen since mini regional banking panic in March 2023.

- The 2-year US Treasury is down roughly 25 basis points to 3.9%. Investors are worried the Fed is behind the curve on cutting interest rates, risking a policy error. Odds of a 50 basis point cut to the federal funds rate (FFR) versus a 25 bps cut are now 2:1 in September.

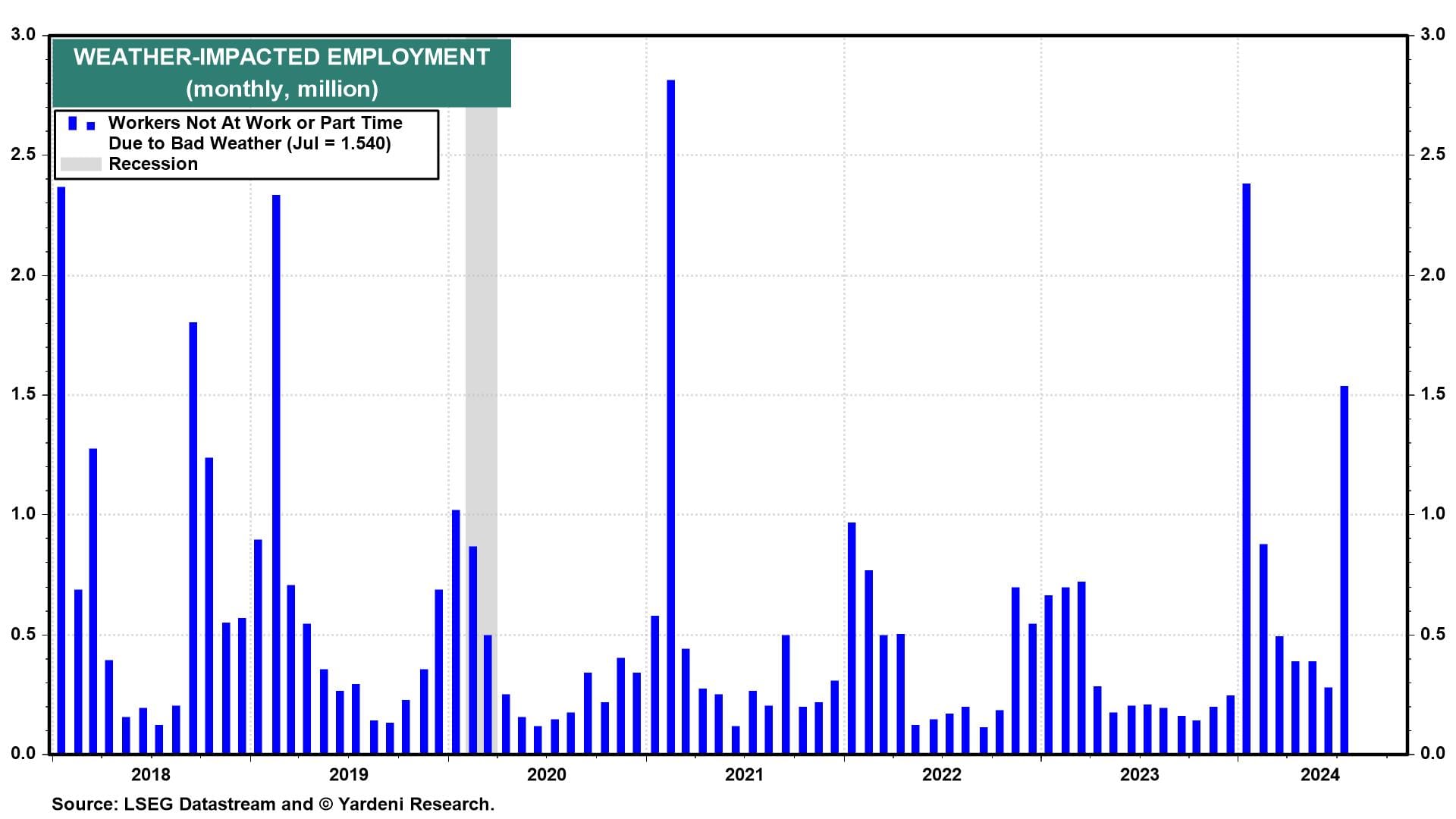

We hate to spoil the party for the diehard hard-landers, but we won't be joining them after today's July employment report. We blame much of the weakness on the weather. Yes, we know, the Bureau of Labor Statistics (BLS) noted that Hurricane Beryl had no impact on the report. Yet, the BLS household employment survey showed that 1.54 million workers were either not working or only part time due to weather, far above the historical average (chart).

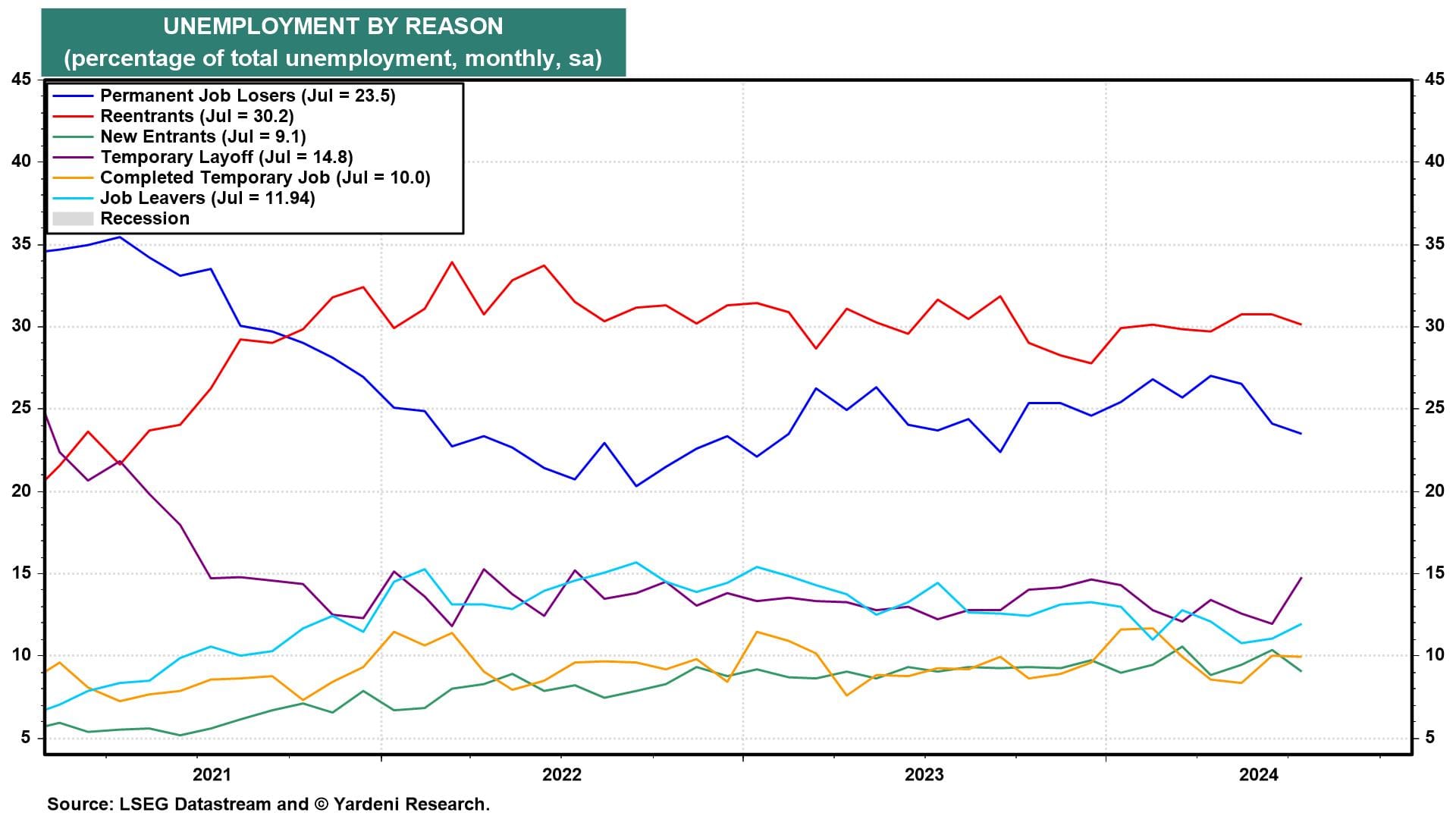

Workers on temporary layoff jumped to 14.8% of total unemployment, a two-year high. Permanent job losers actually declined for the third-straight month in July (chart).

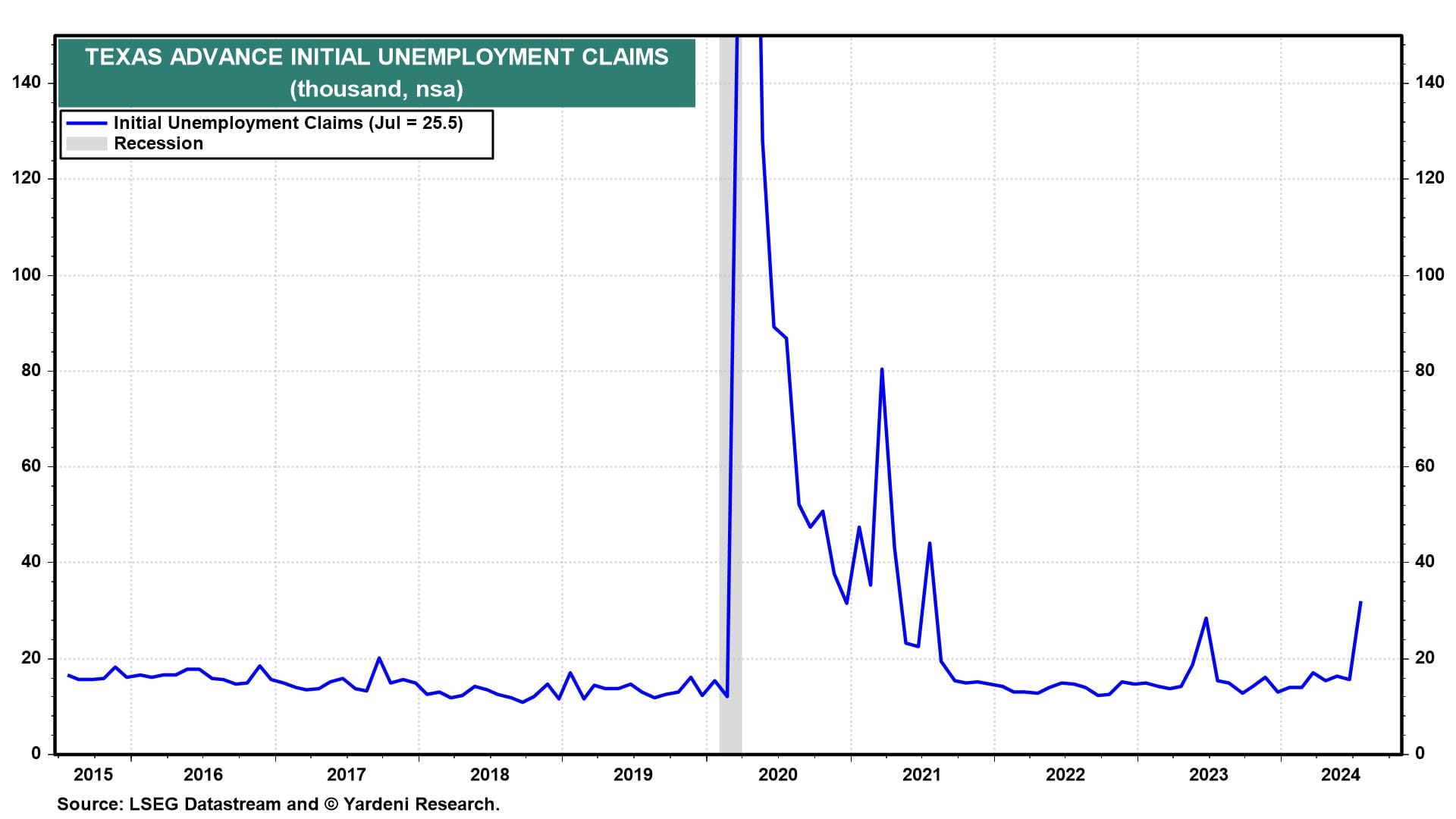

Many of these temporary layoffs showed up in the initial unemployment claims in Texas (chart). We expect both series to revert lower in August.

Finally, the party for the recession cheering squad started yesterday when July’s M-PMI came in at 46.8, much lower than expected. It was led by a sharp drop in the M-PMI’s employment component. Yet, today’s report showed that manufacturing employment edged higher. Go figure!

Other sources of market volatility included a report that the DoJ opened an antitrust probe into Nvidia to investigate complaints of abusing AI market dominance (record profits are abusive, apparently). The yen also strengthened to 146.5 vs the dollar, hurting leveraged investors who have been short the yen in carry trades (chart).