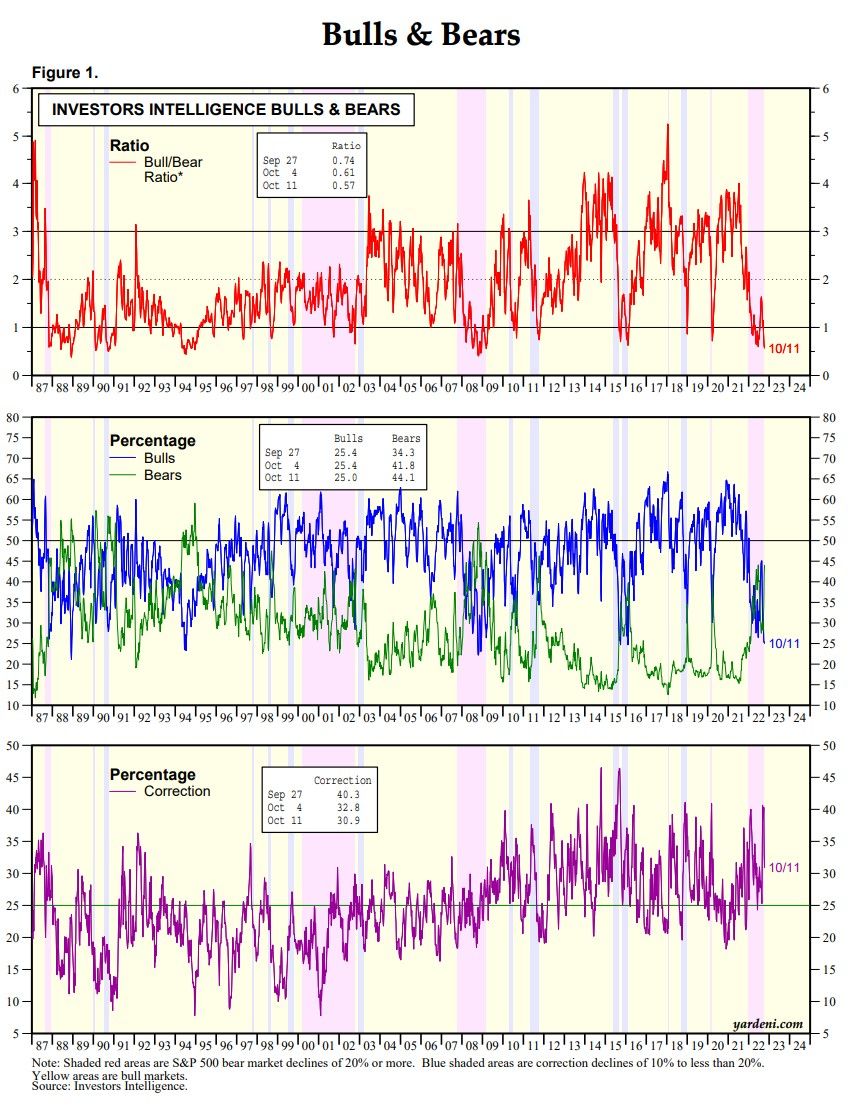

So far, widespread bearishness hasn't worked as a contrary bullish signal. Readings below 1.0 in the Bull-Bear Ratio (BBR) have often marked the bottoms of corrections (charts below). But during bear markets, such readings can persist. In the current bear market, contrarians have been up against the old adage: "Don't fight the Fed."

The BBR sank further below 1.00 this week, dropping for the fourth consecutive week to 0.57 (the lowest since March 2009):

(1) Bullish sentiment slipped to 25.0% (the lowest since early 2016) this week after holding steady at 25.4% last week; it was at 45.1% seven weeks ago.

(2) Bearish sentiment exceeded bullish sentiment for the fourth week, moving higher for the fourth week by 15.9ppts (to 44.1% from 28.2%), equaling the mid-June peak reading. It was the largest group for the second straight week, unseating the correction count—which had the top spot the prior four weeks.

(3) Correction sentiment dropped for the second week to 30.9% this week, after climbing from 38.6% to 40.3% the prior week.