Bank stocks popped today after Reuters reported that the Fed is considering relaxing a regulation, i.e., the GSIB Surcharge. It requires big banks to hold additional capital due to the systemic risk they pose to the global financial system. Tweaking the GSIB surcharge would free up big banks to lend more.

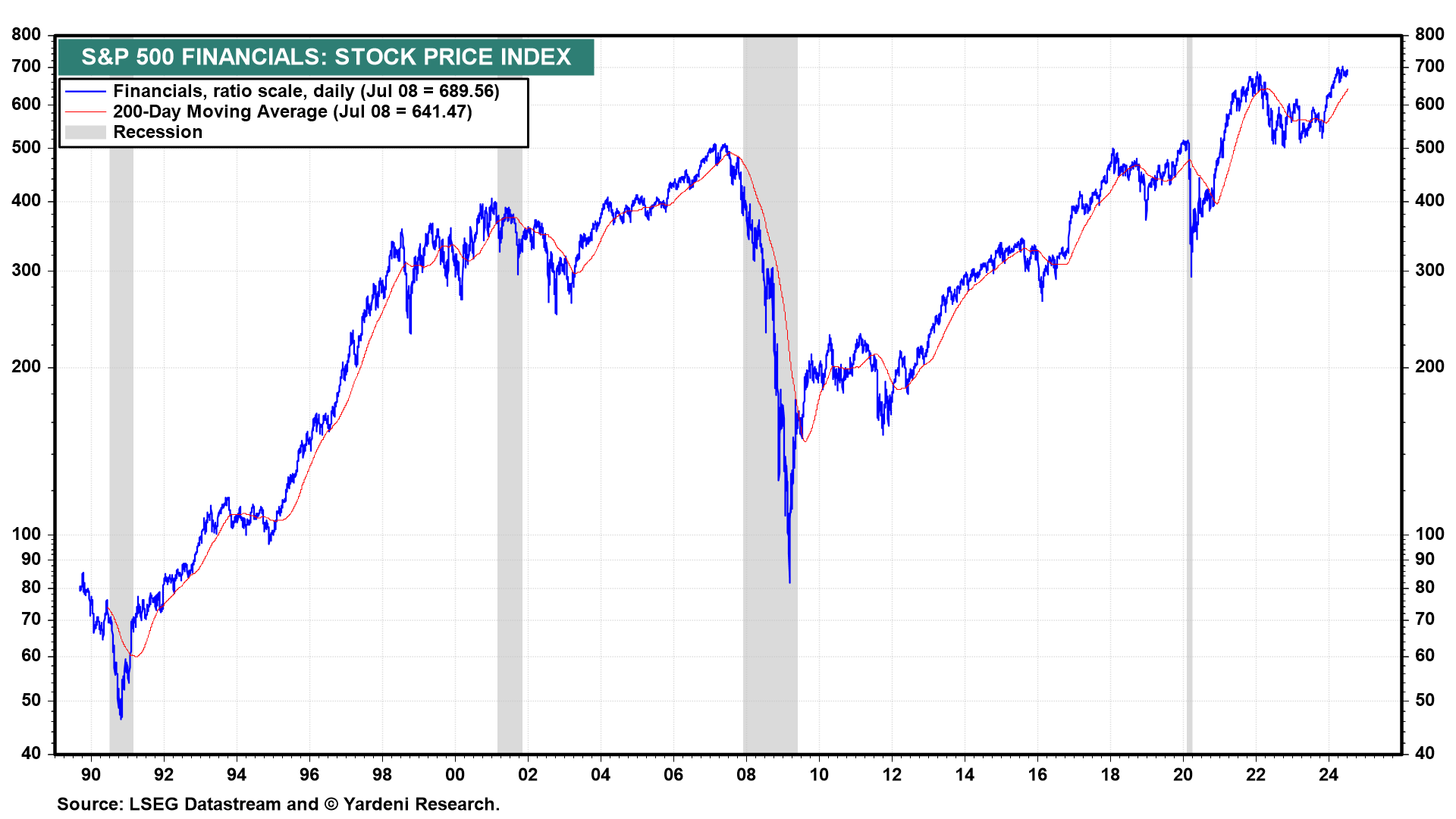

The S&P 500 Financials stock price index had already been doing well. It is up 37.9% since the start of the bull market and 10.8% ytd (chart). The sector may be on the verge of breaking out to new highs led by the banks. Such broadening would be a very healthy development for the bull market.

Bank stocks haven't moved much since the Q1 earnings reporting season. JPMorgan, Citigroup, and Wells Fargo will report their Q2 results on Friday. Ahead of then, let's review the latest weekly bank data, as well as touch on today's labor market stats in the NFIB survey of small business owners:

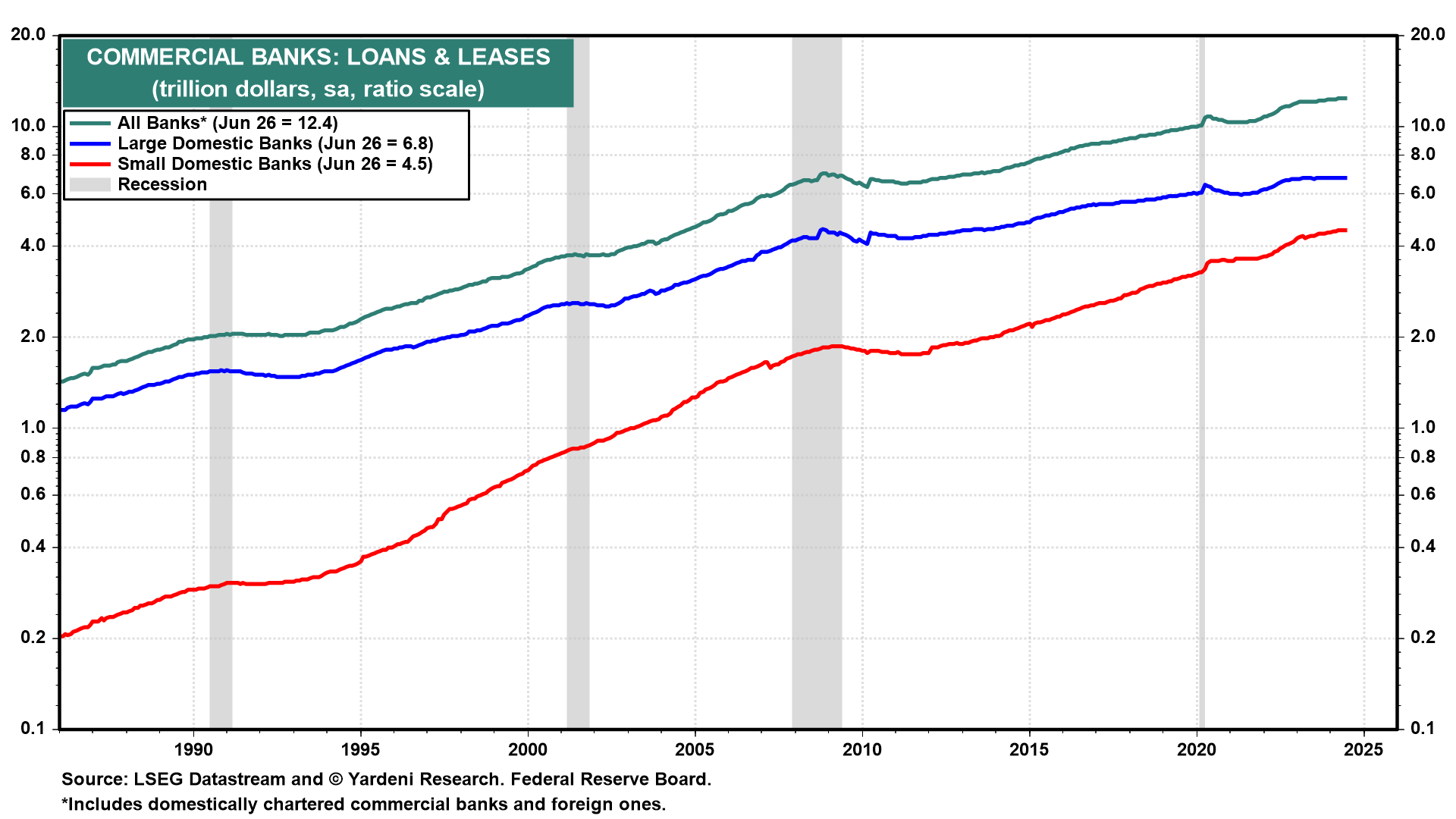

(1) Loans at all banks. There hasn't been much growth in loans & leases at the banks since early last year (chart). They've been flat at the large banks over this period.

The weakest loan category over the past couple of years has been commercial & industrial (C&I) loans, which has been relatively flat (chart). This series is highly correlated with business inventories, which has also been flat as a result of the growth recession in the goods-producing sector of the economy. C&I loans may be starting to turn up again. Interestingly, the commercial real estate (CRE) loans category is only recently starting to look toppy.

Leer la noticia completa

Regístrese ahora para leer la historia completa y acceder a todas las publicaciones de pago.

Suscríbase a