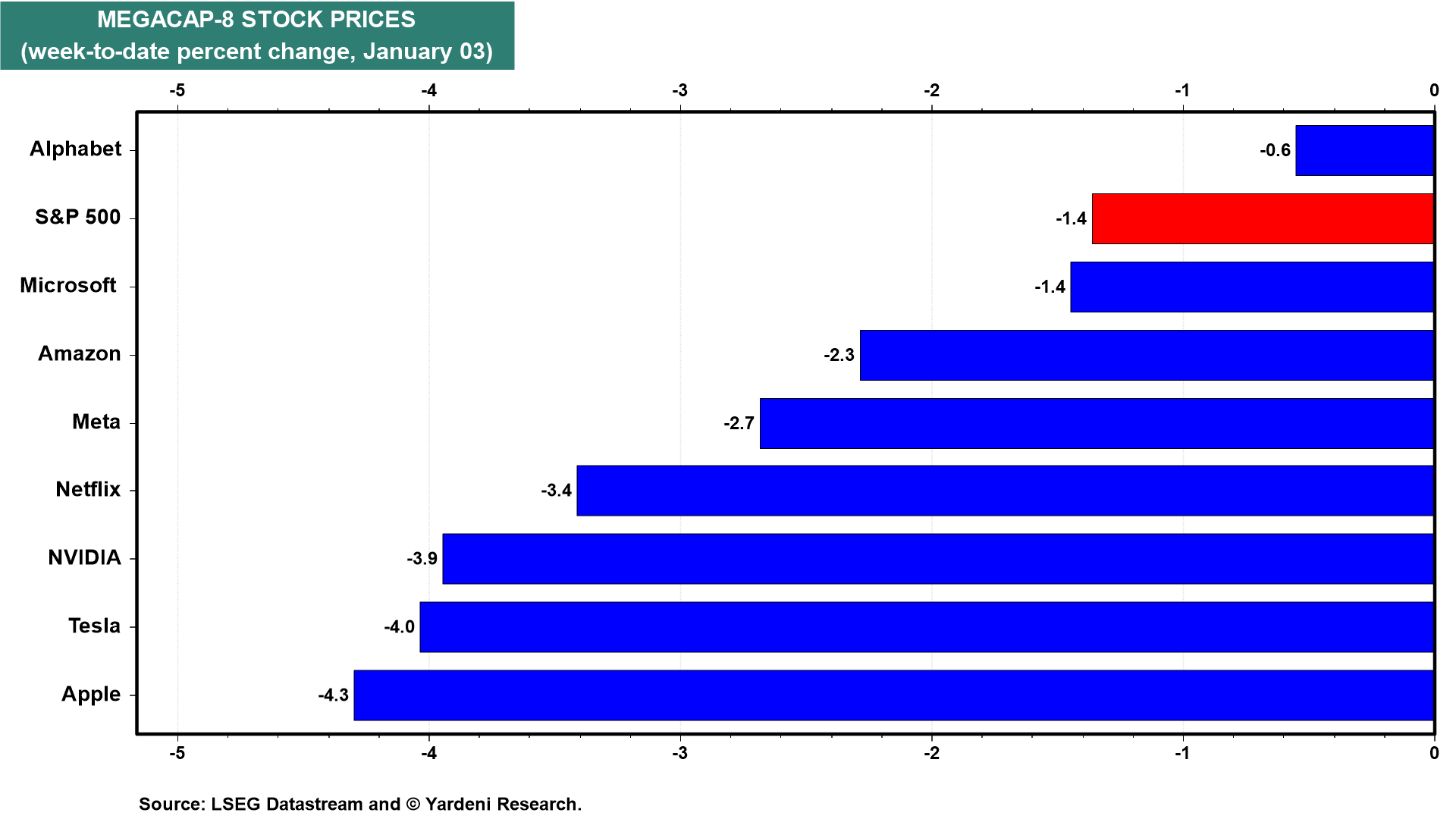

The MegaCap-8 stocks led the S&P 500 down during the first two days of trading in 2024 (chart). The moves came after Barclays downgraded Apple on Tuesday and lowered its price target for shares of the company on fears of slowing iPhone 15 sales in China. We warned you about companies with exposure to the weak Chinese economy on December 26 in our QT titled "Prepare For A Recession & Debt Crisis In 2024" (in China).

Today, the minutes of December's FOMC meeting confirmed that Fed officials are thinking about cutting the federal funds rate this year. But whether they do so and by how much will be data dependent: “In discussing the policy outlook, participants viewed the policy rate as likely at or near its peak for this tightening cycle, though they noted that the actual policy path will depend on how the economy evolves.” In other words, they are not rushing to cut rates. The market has been in the sooner-rather-than-later camp with five 25bps cuts this year. We remain in the fewer-and-later camp with 2-3 cuts this year.

The latest batch of data confirms that the labor market is strong with plenty of job openings (chart).

Leer la noticia completa

Regístrese ahora para leer la historia completa y acceder a todas las publicaciones de pago.

Suscríbase a