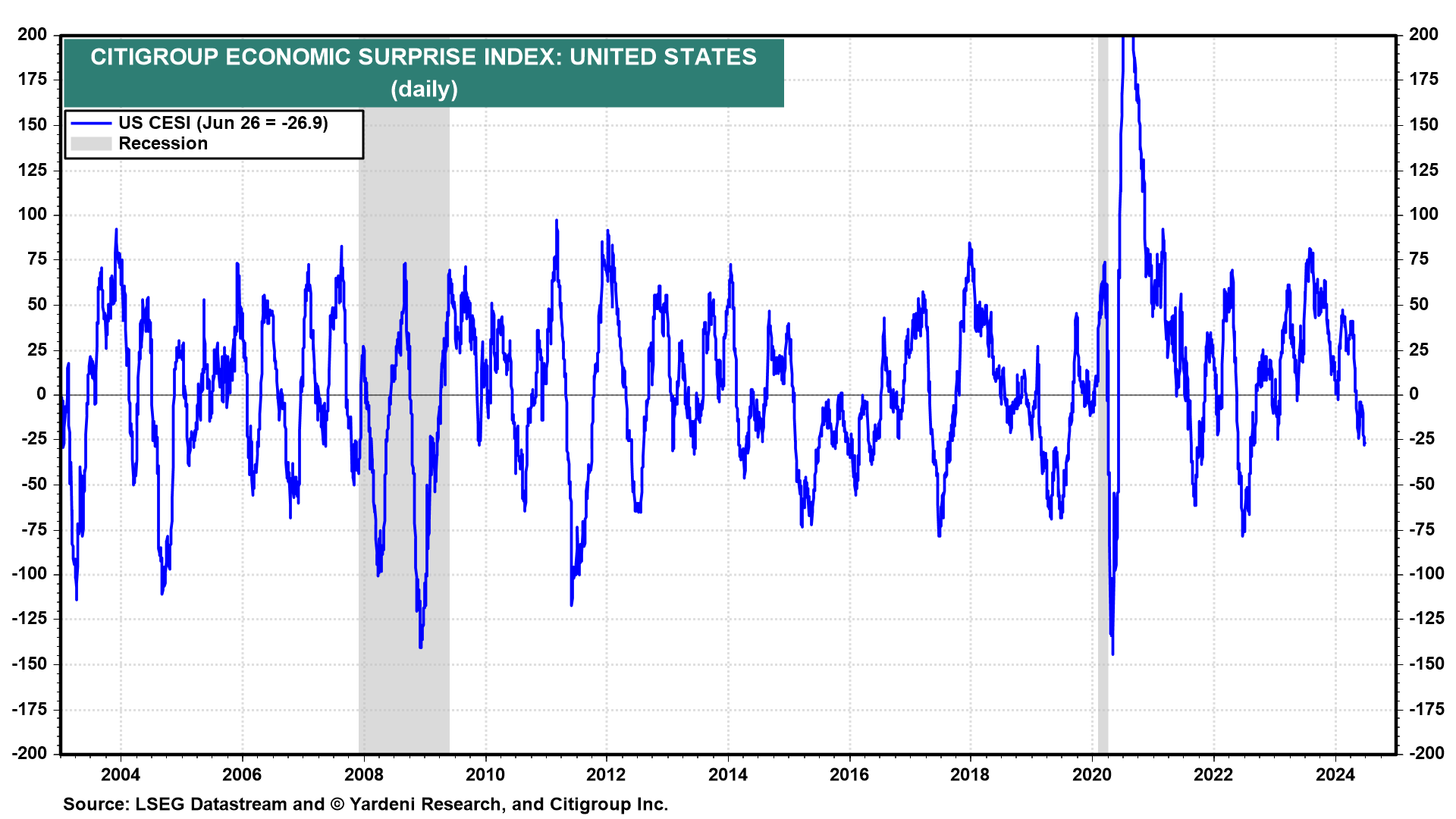

The economy has experienced neither a hard landing nor a soft landing since the Fed started tightening monetary policy in March 2022. It has experienced a few rolling recessions in industries like housing and retailing, which spurred soft patches in overall economic growth. The economy may be going through another soft patch, as evidenced by the Citigroup Economic Surprise Index, which has been modestly negative since May 3 (chart).

After today's soft batch of economic indicators, the Atlanta Fed’s GDPNow tracking model revised Q2’s real GDP estimate down from 3.0% (saar) to 2.7%. That's still relatively strong. Neither the bond nor stock market reacted much to today's numbers.

Let’s have a look at today’s indicators, which might have brought some (fleeting) joy to the diehard hard-landers:

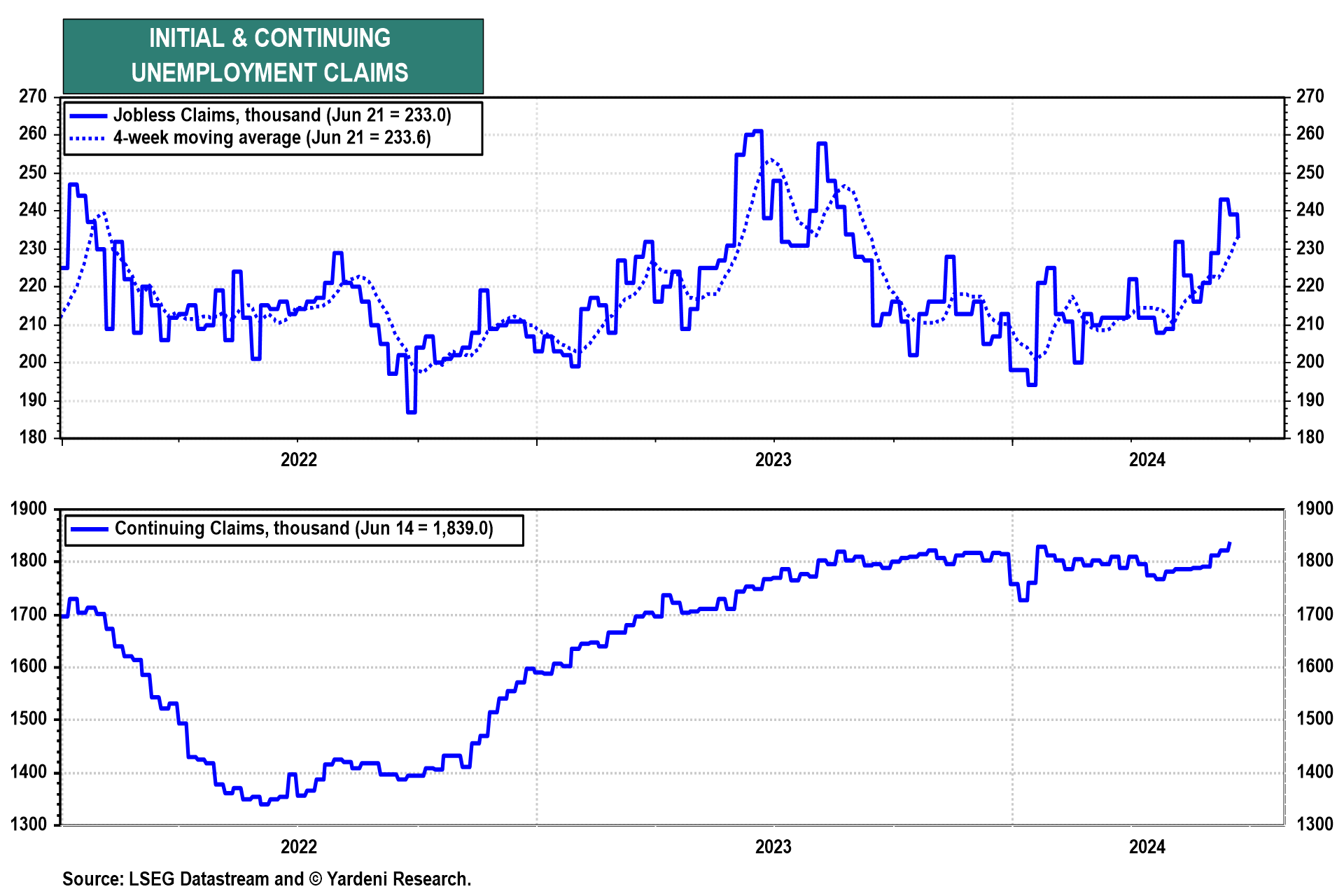

(1) Unemployment claims. Weekly jobless claims fell 6,000 to 233,000 (sa) in the week ended June 22, remaining at historically low levels (chart). A bit of labor market weakness could be gleaned from continuing claims, which rose 18,000 to 1.839 million—the highest since November 2021—in the week ended June 15.

However, as Reuters noted today, the jump in continuing claims was driven by a rule change last year in Minnesota that allows non-teaching educational staff to file for unemployment during the summer months. Minnesota was the largest contributor to continuing claims for the week, rising by 8,834 (nsa).

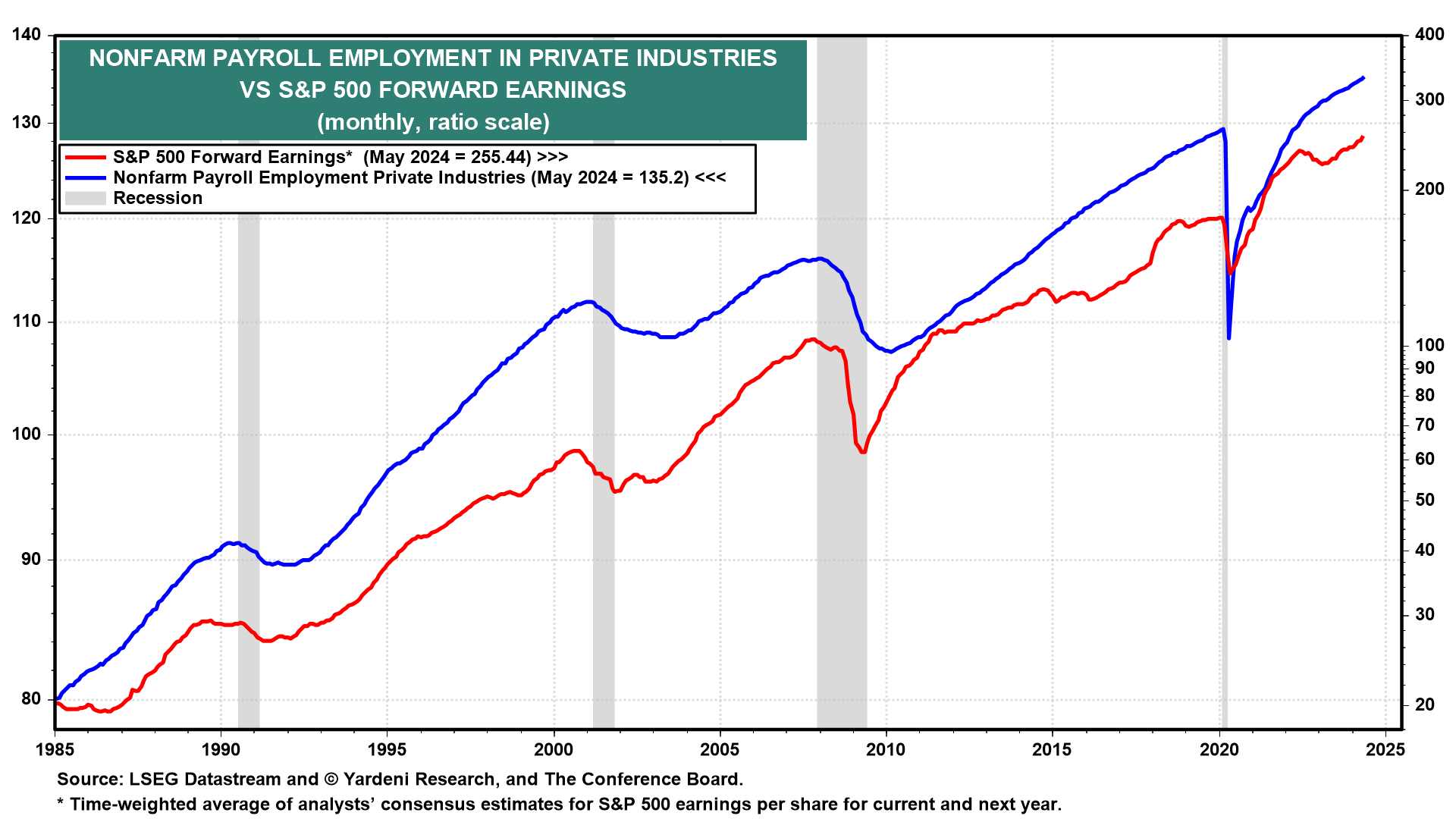

Everyone seems to be on the lookout for signs of weakness in the labor market, including several Fed officials. One important reason why we aren’t concerned is that private payroll employment is driven by profits, and S&P 500 forward earnings continues to rise to record highs (chart). Profitable companies tend to expand their payrolls!

Leer la noticia completa

Regístrese ahora para leer la historia completa y acceder a todas las publicaciones de pago.

Suscríbase a