Yesterday, we suggested that the stock market selloff since the July 16 record high in the S&P 500 might not last very long. So we were pleased by today's broad rally in the S&P 500 (1.1%), Nasdaq (1.6%), Russell 2000 (1.7%), and the MAGS (2.4%). We expect that a solid print in Q2's real GDP on Thursday and a subdued June PCED inflation reading on Friday will keep the rally going.

The bears warn that stretched equity valuations will prevent the party from going on much longer. We've acknowledged that the current stock market rally is reminiscent of the valuation-led market meltup of the 1990s. But, we've also noted that the current bull market has more support from earnings.

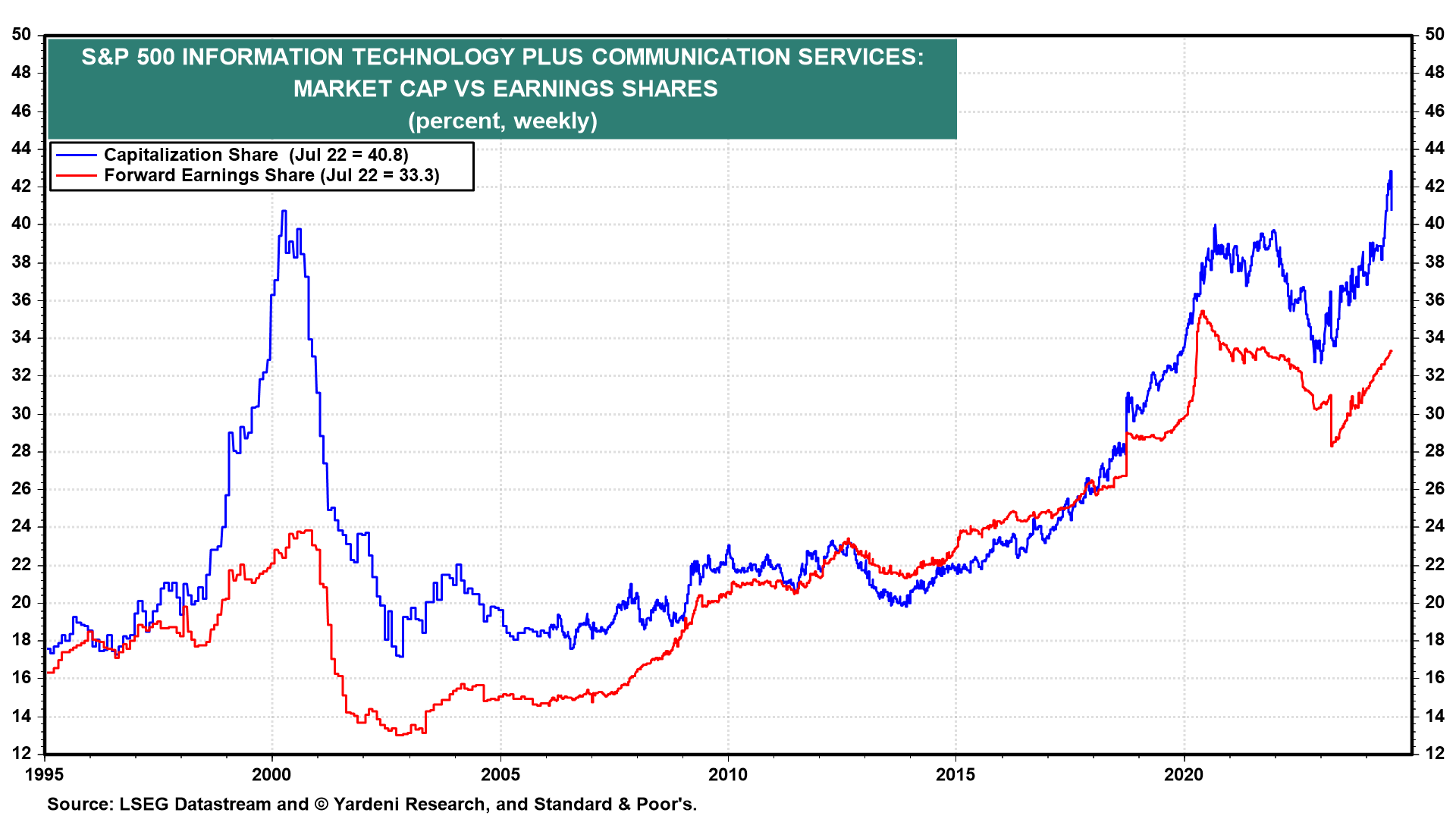

For example, while the combined market cap of the S&P 500 Information Technology and Communication Services sectors comprise 41% of the S&P 500, matching the 2000 peak, the two sectors currently represent a third of the S&P 500's forward earnings, versus less than a quarter in 2000 (chart).

Let's review the latest earnings data which we expect will increasingly drive the bull market:

Leer la noticia completa

Regístrese ahora para leer la historia completa y acceder a todas las publicaciones de pago.

Suscríbase a