The Dow is flirting with 40,000 currently, confirming that good news is good news and bad news is also good news for the stock market these days. That's because the bad news is also good news for the bond market. On balance, the news is that inflation is moderating and the economy is growing.

Yesterday's April CPI report confirmed that inflation remains on course to fall to the Fed's 2.0% target by the end of this year. The Atlanta Fed's GDPNow model is currently showing Q2 real GDP tracking at 3.6% (saar) with consumer spending up 3.4% despite yesterday's weak April retail sales report. Here are our quick takes on today's batch of economic numbers:

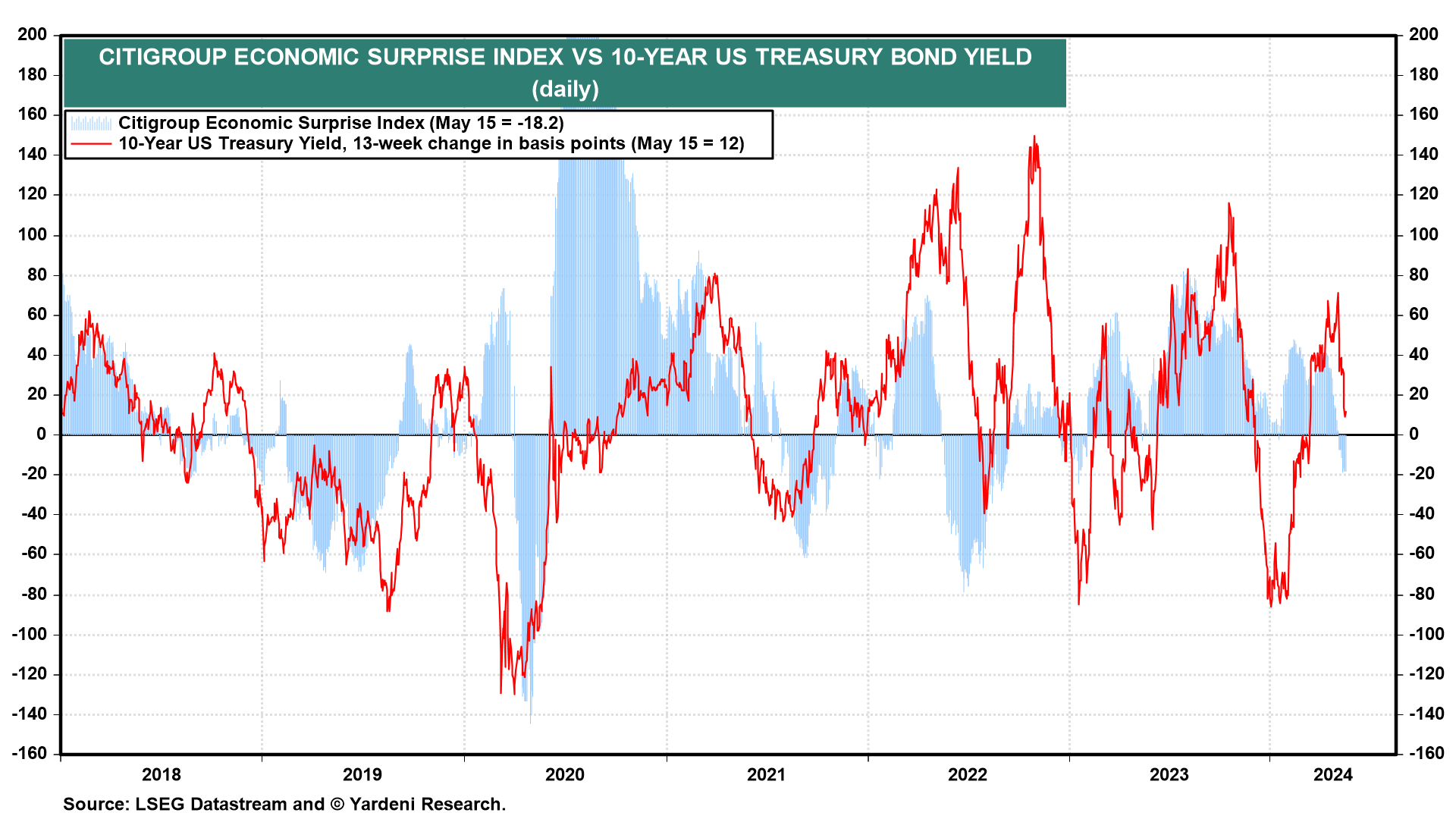

(1) The Citigroup Economic Surprise Index has been back down in negative territory since May 2--for the first time since early 2023 (chart). The latest string of weak-than-expected economic indicators sank the 10-year US Treasury bond yield from its recent peak of 4.71% on April 25 to 4.36% currently.

(2) Both the Philly and New York Fed manufacturing surveys weakened in May, suggesting that the ISM's national M-PMI remained below 50.0 this month (chart). The rolling recession in goods may be bottoming, but we don't see a rolling recovery in the data yet.

Leer la noticia completa

Regístrese ahora para leer la historia completa y acceder a todas las publicaciones de pago.

Suscríbase a