The FDIC started to do its job immediately after it seized Silicon Valley Bank (SVB). The regulator transferred all SVB deposits and assets into a new “bridge bank” to protect depositors of the failed lender. On Monday morning, March 27, the FDIC announced that First Citizens BancShares will buy SVB’s deposits and loans, just over two weeks after the biggest US banking collapse since the global financial crisis.

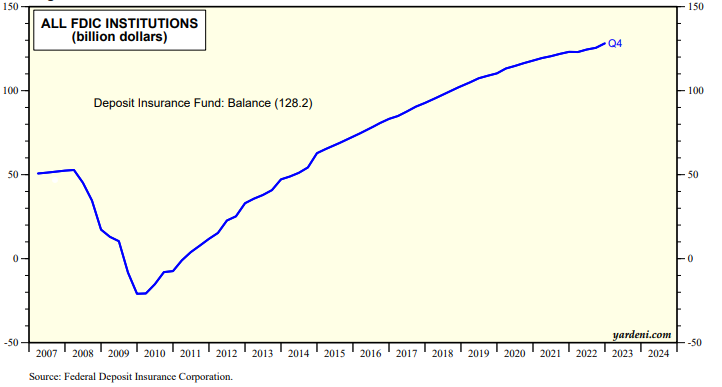

The FDIC estimated that SVB’s failure will cost its Deposit Insurance Fund (DIF) around $20 billion, with the exact amount to be determined once the receivership is terminated. The DIF had a balance of $128.2 billion at the end of last year (chart).

There could be more mergers and acquisitions among the regional banks. To avert disintermediation, they will have to raise their deposit rates, which will squeeze their profitability. That could force many of them to consolidate to lower their costs.

Leer la noticia completa

Regístrese ahora para leer la historia completa y acceder a todas las publicaciones de pago.

Suscríbase a