Are we heading toward a P/E-led bear market even though earnings continue to grow?

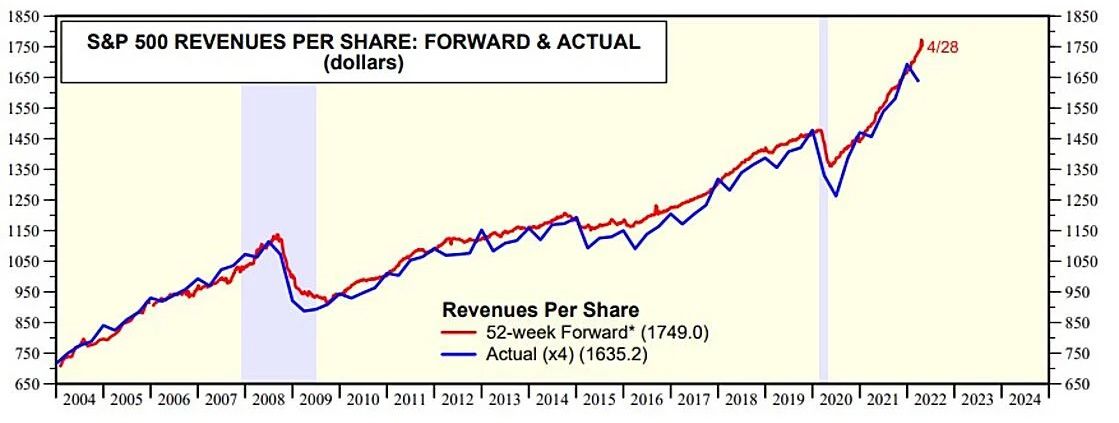

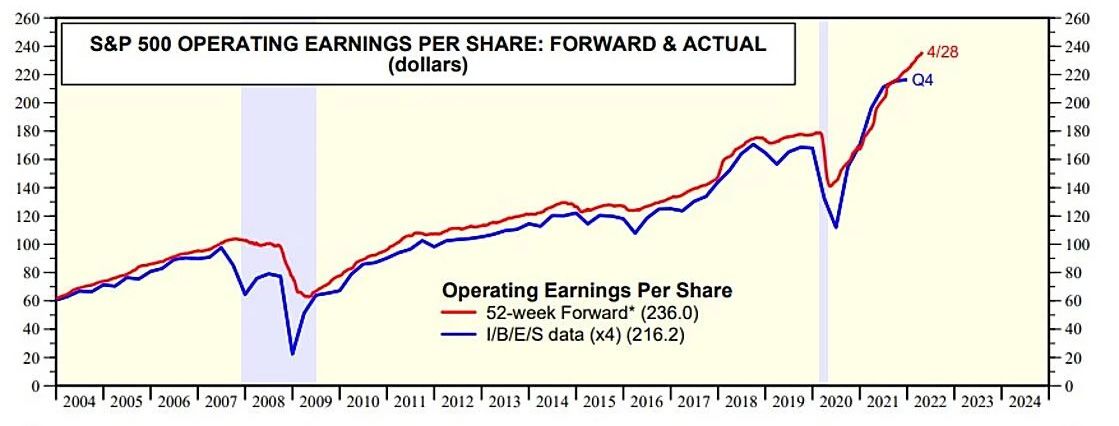

Investors have slashed the forward P/E of the S&P 500 since the start of this year, resulting in a 14.0% drop in the S&P 500 stock price index from its record high on January 3 through Friday’s close. Meanwhile, industry analysts collectively have been raising their 2022 and 2023 revenues and earnings estimates:

(1) S&P 500 forward revenues per share is up 5.1% ytd to yet another record high of $1,749.

(2) S&P 500 forward earnings per share is up 6.1% ytd through the April 28 week to a record $236.

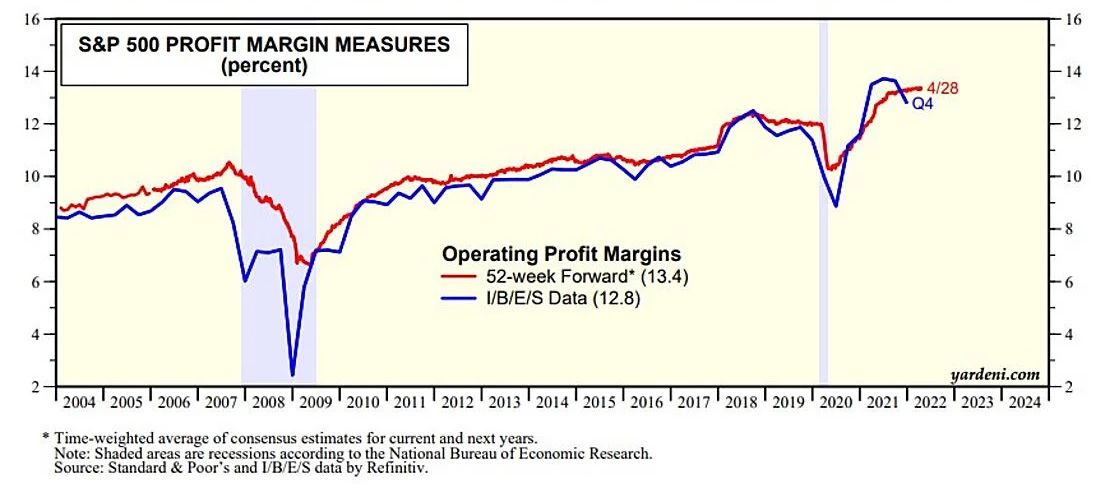

(3) The S&P 500 forward profit margin edged up to a record 13.4% during the April 28 week.

(4) Here are the ytd growth rates of forward earnings and forward revenues for the S&P 500 and its 11 sectors: S&P 500 (6.1%, 5.1%), Communication Services (-1.2, 3.2), Consumer Discretionary (5.6, 3.4), Consumer Staples (1.4, 3.4), Energy (45.8, 20.8), Financials (3.8, 3.2), Health Care (1.5, 2.6), Industrials (4.5, 4.2), Information Technology (7.0, 5.5), Materials (8.3, 7.6), Real Estate (7.6, 5.7), and Utilities (2.0, 6.2).

(5) Industry analysts didn’t get the recession memo. Their estimates imply that most companies are passing their rising costs through to their selling prices. So margins are holding up well, as both revenues and earnings are keeping pace with inflation.

(6) Might there be a P/E-led bear market with the S&P 500 down more than 20% while earnings estimates continue to rise to record highs? The market has been on that path since the start of the year as rising inflation (and yields) have depressed the P/E investors are willing to pay while also boosting analysts’ earnings estimates! In this scenario, the bear market shouldn’t last very long since earnings will drive stock prices back up once a bottom has been made in the P/E.

Note: “Forward P/E” is price/earnings ratio using forward earnings as the denominator. “Forward earnings” and “forward revenues” are the time-weighted averages of industry analysts’ consensus per-share estimates for this year and next. The time weighting removes past periods from the estimates, making a useful proxy for expected results over the next 52 weeks. We calculate forward margins from forward earnings and revenues.