Is the bond yield heading higher or lower? It should be heading higher given that it remains well below the rate of inflation. That’s unless investors believe that inflation is more likely to move lower than higher over the next few years if not in the immediate future.

In any event, two useful bond market indicators are currently bullish for bonds and offer some hope for stocks too:

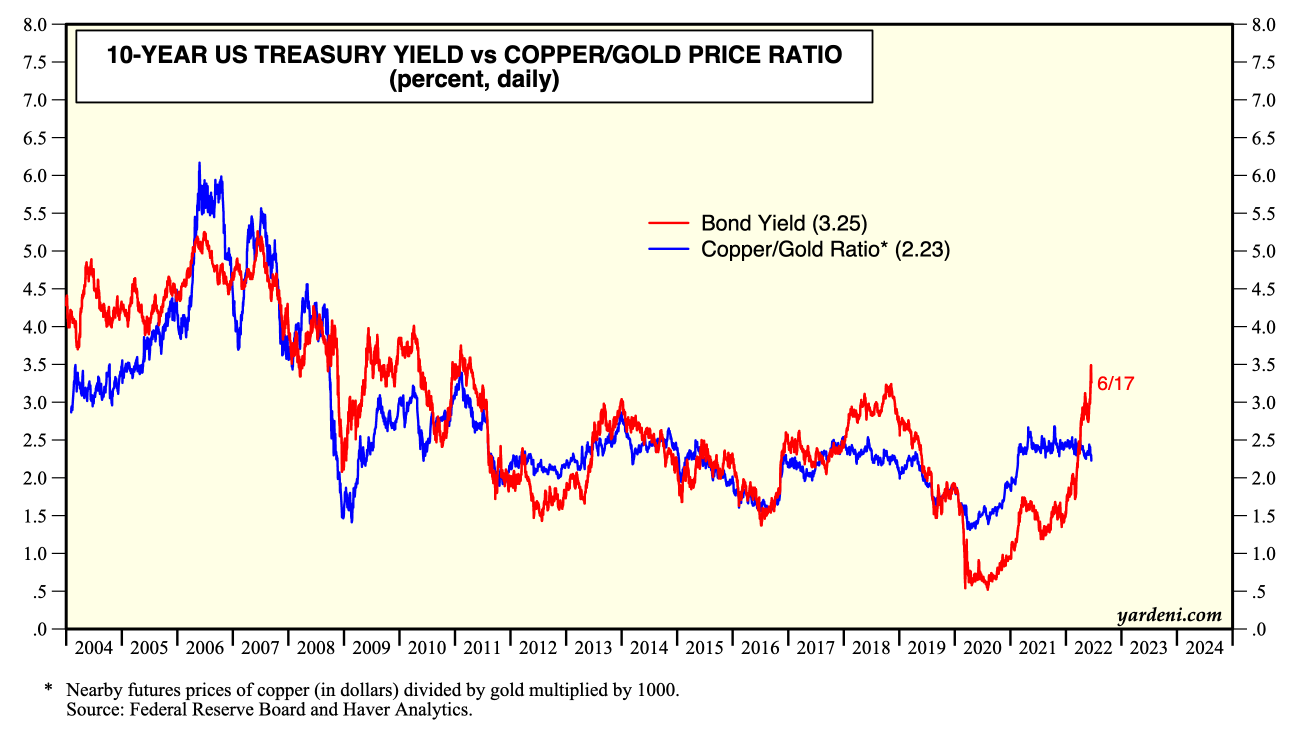

(1) The copper/gold price ratio has closely tracked the 10-year US Treasury bond yield since 2004. They diverged during 2020 and most of 2021, with the yield well below the ratio. But they converged rapidly from late 2021 through early 2022. They've diverged recently, with the yield rising about 100bps above the ratio, which edged down to 2.23% recently.

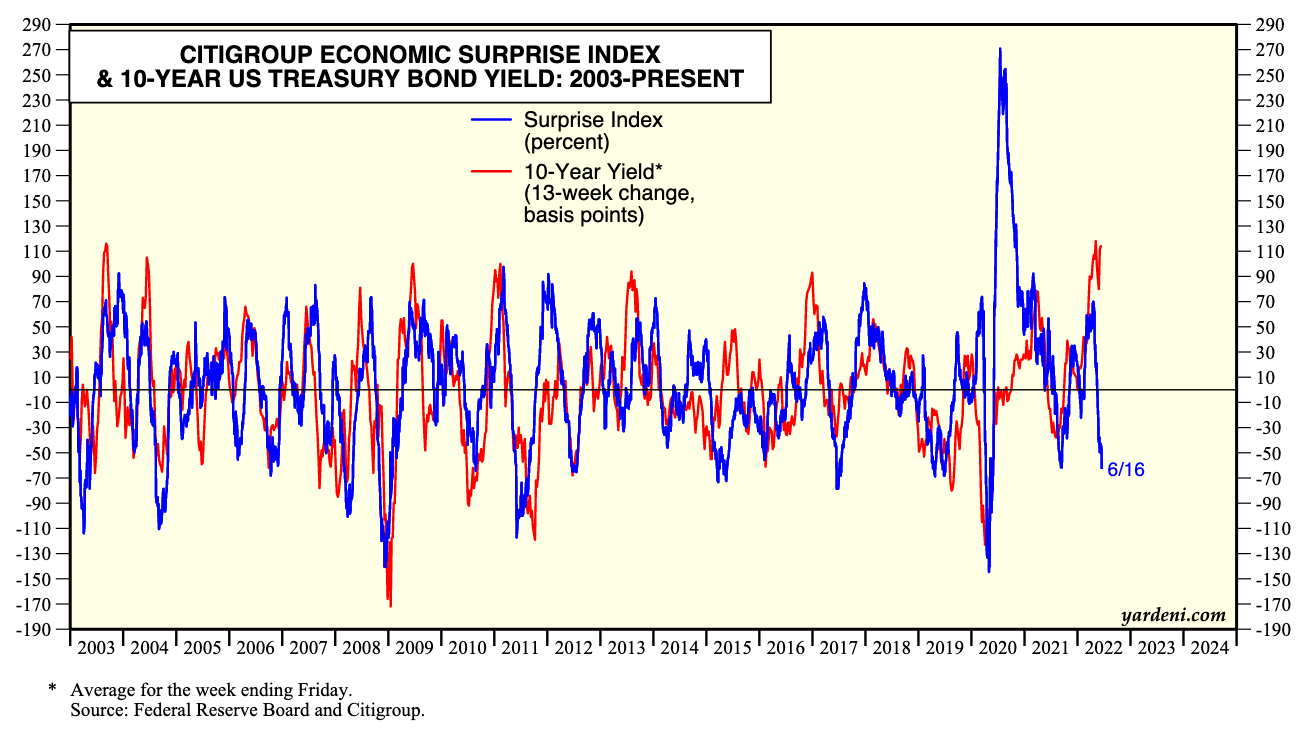

(2) The Citigroup Economic Surprise Index has been falling deeper into negative territory in recent weeks. The 13-week change in the bond yield tends to follow this index closely.

By the way, the forward P/E of the S&P 500 has been tracking the inverse of the 10-Year TIPS (inflation-protected) yield since 2014. The two indicators mentioned above suggest that slower economic growth is weighing on both the nominal and real bond yields. If so, that should ease some of the downward pressure on the P/E. Slower growth may not be good for earnings, but at least it might put a floor under the P/E.