We may or may not know tonight who will be the next president, but we should know which party will win a majority in the Senate and the House. It appears that Republicans are likely to do so. In this case, a Harris administration would be gridlocked, while a Trump administration would have more power to implement his policies, including higher tariffs (raising inflation risks) and lower taxes (ballooning the federal deficits). That could push the 10-year yield up to 4.75%-5.00%, which should attract lots of buyers.

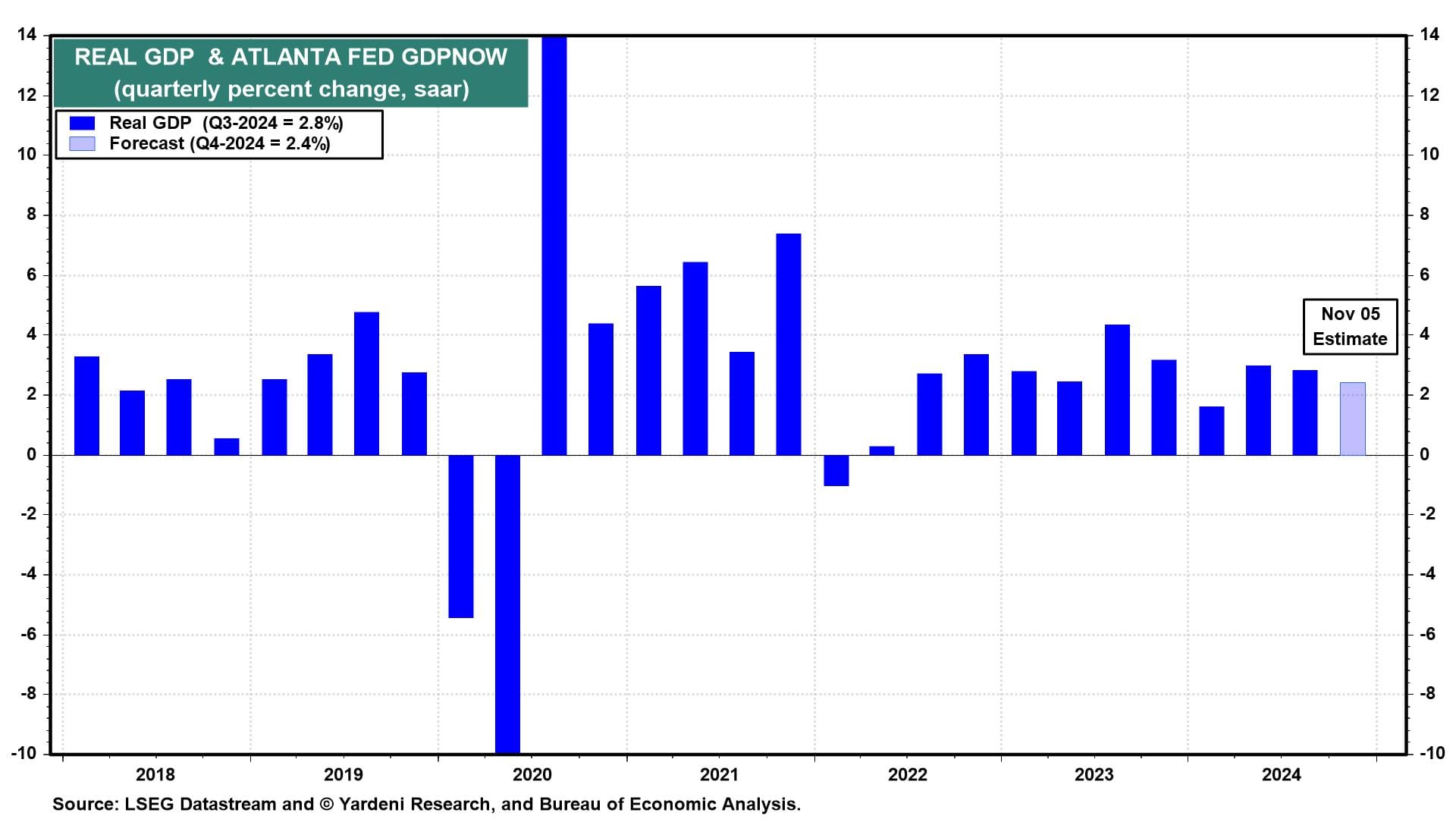

Meanwhile, the Fed is widely expected to cut the federal funds rate (FFR) by 25bps on Thursday. If we were on the Federal Open Market Committee (FOMC), we would strongly dissent in favor of a pause. By most measures, including today's nonmanufacturing PMI report, the economy has been roaring even before the Fed's September 18 meeting when the FFR was cut by 50bps (chart).

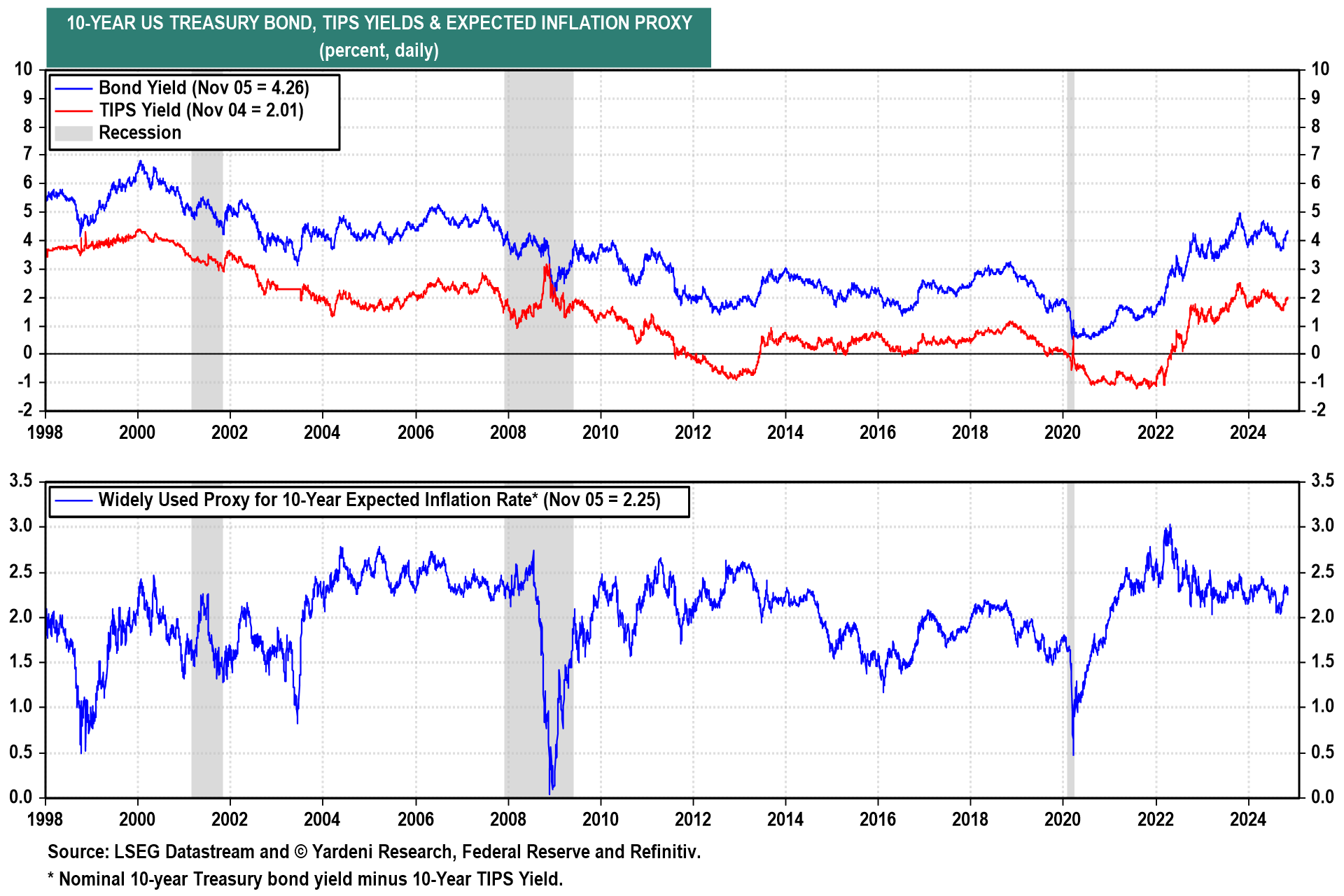

When the Fed cut by 50bps rather than 25bps on September 18, we immediately concluded that was too much, too soon. The Bond Vigilantes have agreed with our assessment, raising their expectations for long-term inflation and taking the 10-year US Treasury yield from 3.65% on September 16 to 4.44% this evening (chart).

Only one FOMC member dissented from the September 18 decision, favoring a 25bps cut. There are likely to be more dissenters at this week's FOMC meeting. They may prefer not to fight the Bond Vigilantes for now given the strength of the economy and vote in favor of no cut on Thursday. Without commenting on political matters, they might fear that the US elections will result in persistent and large federal budget deficits despite strong economic growth.

Let's review the latest economic data Fed officials will be discussing at their meeting:

Leer la noticia completa

Regístrese ahora para leer la historia completa y acceder a todas las publicaciones de pago.

Suscríbase a